Why Pre-Approval Is a Game Changer for Homebuyers

If you’re planning to buy a home this year, you might have heard that pre-approval is a necessary step to take before starting out on your journey. But why is that? And is it still important in today’s shifting market?

The truth is, getting a pre-approval letter from your lender is critical, and when it comes to your home search, it can be a game changer in so many ways.

To better understand why, it’s important to know what pre-approval is. Freddie Mac defines the process like this:

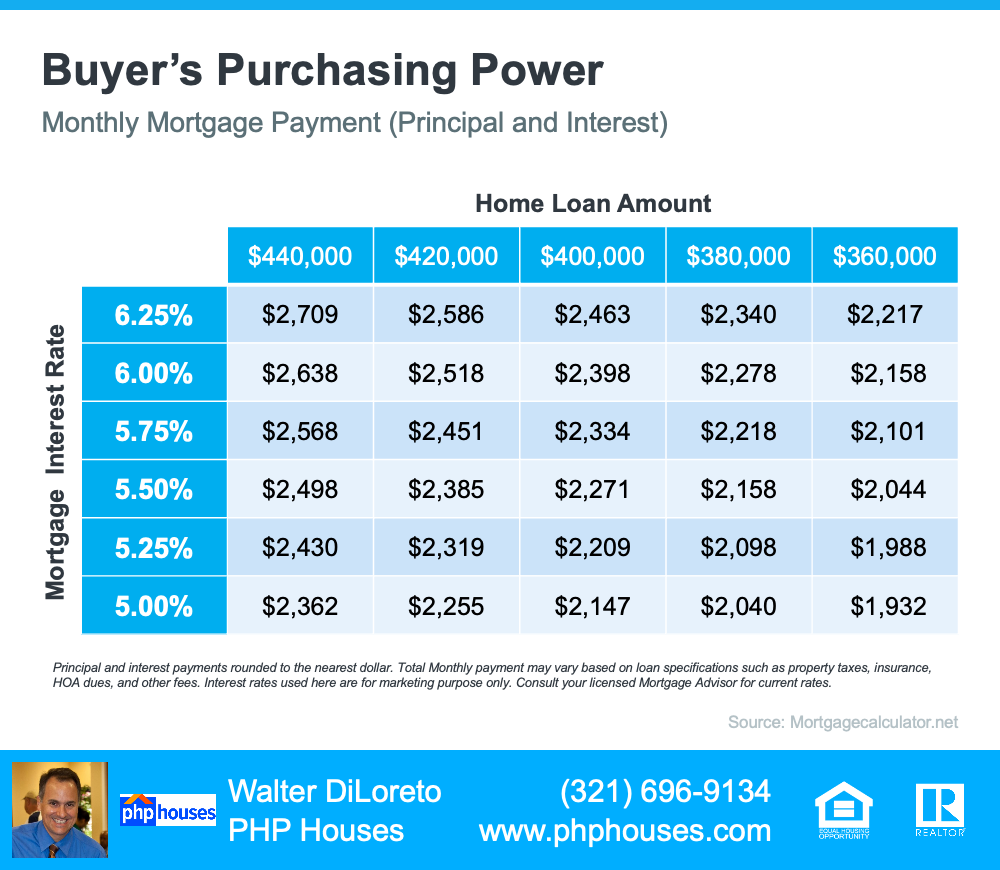

“A pre-approval is an indication from your lender that they are willing to lend you a certain amount of money to buy your future home. The lender you work with will provide you with a pre-approval letter, which is an official document that states the maximum amount they are willing to lend you, . . .”

Put simply, pre-approval from a lender helps you understand your true price range and how much money you can borrow for your loan. That can make it easier when you set out to search for homes. And since you’ll know what you’re approved for, it’ll also help once it’s time to submit an offer on the home of your dreams.

Another added benefit is that pre-approval lets the seller know you’re qualified to buy their house. Paul Centopani, Editor for the Mortgage Reports, explains:

“. . . most sellers won’t even consider an offer unless the buyer is pre-approved at the right price point. Sellers and their agents want to know you’re ready and able to finance your offer amount. So you’ll want to have your preapproval teed up as soon as you’re serious about bidding on a home you like.”

Every advantage you can gain as a buyer is crucial in a market that’s constantly changing. You’re going to need guidance to navigate these waters, so it’s important to have a team of professionals, such as a real estate advisor and trusted lender, on your side. They’ll help make sure you’re ready to put your best foot forward.

Bottom Line

Getting pre-approved for a mortgage helps you better understand what you can borrow and shows sellers you’re serious about purchasing their home. Let’s connect so you have the tools you need to succeed as a homebuyer in today’s shifting market.

Contact us:

PHP Houses

142 W Lakeview Ave

Unit 1030

Lake Mary, FL 32746

Ph: (407) 519-0719

Fax: (407) 205-1951

email: info@phphouses.com

Let’s Connect:

Facebook

Linkedin

Twitter

Instagram

The information contained, and the opinions expressed, in this article are not intended to be construed as investment advice. The author does not guarantee or warrant the accuracy or completeness of the information or opinions contained herein. Nothing herein should be construed as investment advice. You should always conduct your own research and due diligence and obtain professional advice before making any investment decision. The author will not be liable for any loss or damage caused by your reliance on the information or opinions contained herein.