Miniature house model with illuminated light in the hand

There are many benefits to working with a real estate professional when selling your house. During challenging times like the one we face today, it becomes even more important to have an expert help guide you through the process. If you’re considering selling on your own, known in the industry as a For Sale By Owner or FSBO, please consider the following:

1. Your Safety Is a Priority

During this pandemic, your family’s safety comes first. When you FSBO, it is incredibly difficult to control entry into your home. A real estate professional will have the proper protocols in place to protect not only your belongings, but your family’s health and well-being too. From regulating the number of people in your home at one time to ensuring proper sanitization during and after a showing, and even facilitating virtual tours for buyers, agents are equipped to follow the latest industry standards recommended by the National Association of Realtors (NAR) to help protect you and your family.

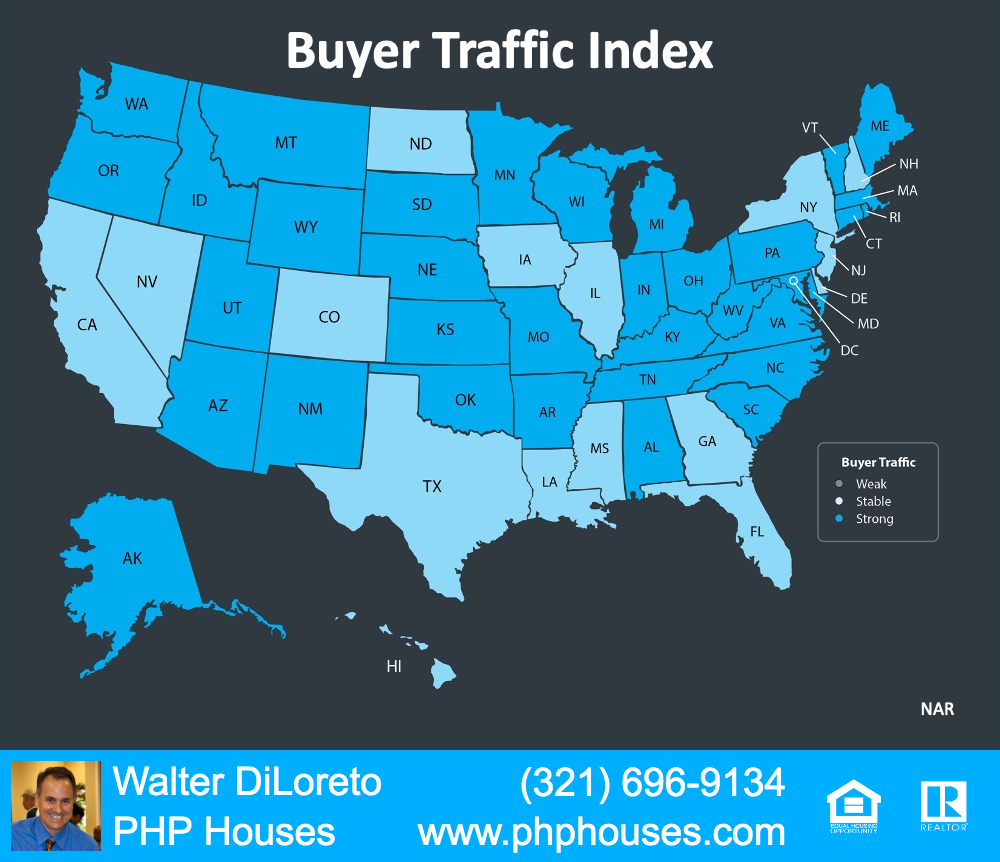

2. A Powerful Online Strategy Is a Must to Attract a Buyer

Recent studies have shown that, even before COVID-19, the first step 44% of all buyers took when looking for a home was to search online. Throughout the process, that number jumped to 93%. Today, those numbers have grown exponentially. Most real estate agents have developed a strong Internet and social media strategy to promote the sale of your house. Have you?

3. There Are Too Many Negotiations

Here are just a few of the people you’ll need to negotiate with if you decide to FSBO:

- The buyer, who wants the best deal possible

- The buyer’s agent, who solely represents the best interest of the buyer

- The inspection companies, which work for the buyer and will almost always find challenges with the house

- The appraiser, if there is a question of value

As part of their training, agents are taught how to negotiate every aspect of the real estate transaction and how to mediate the emotions felt by buyers looking to make what is probably the largest purchase of their lives.

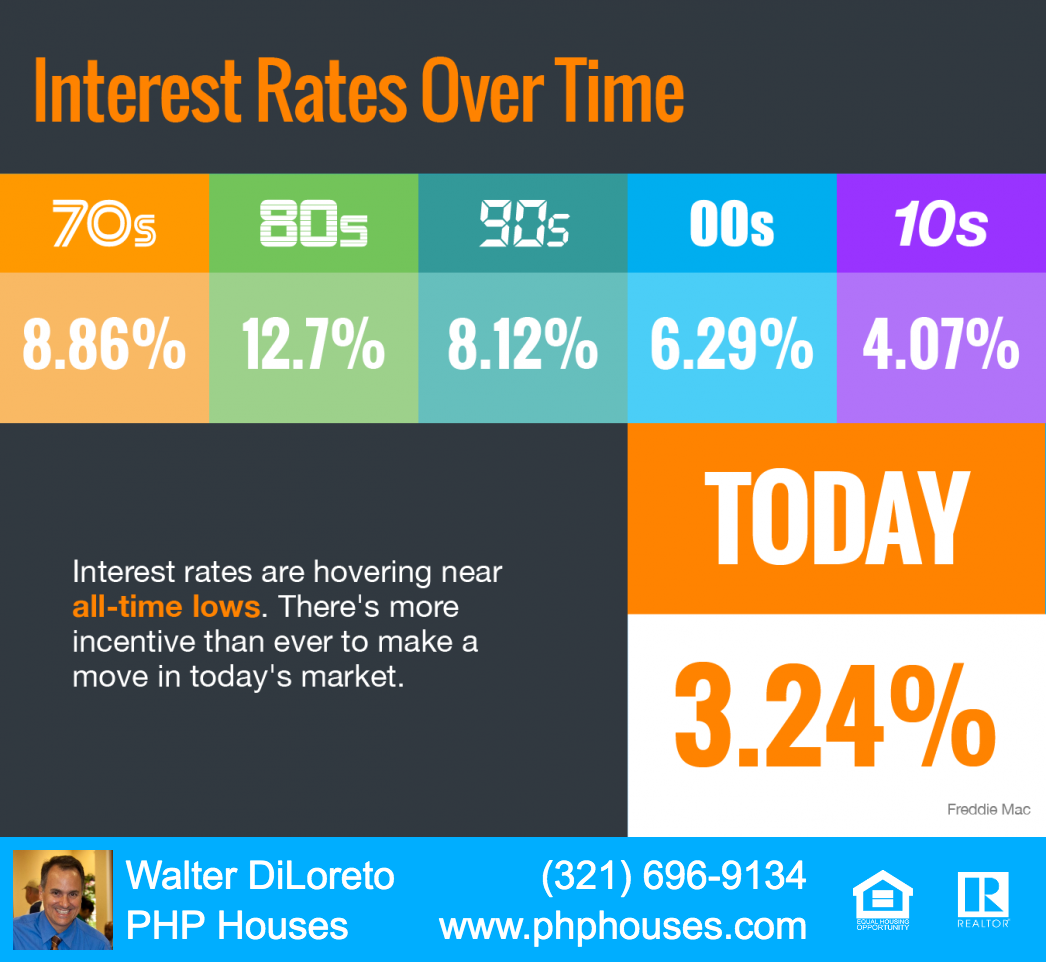

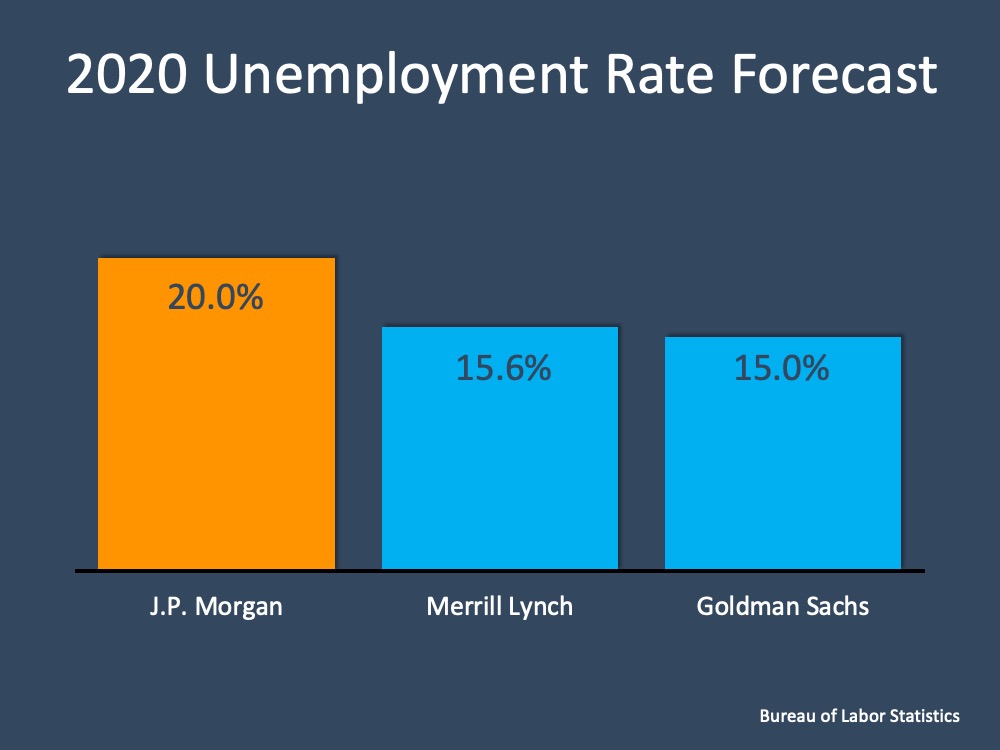

4. You Won’t Know if Your Purchaser Is Qualified for a Mortgage

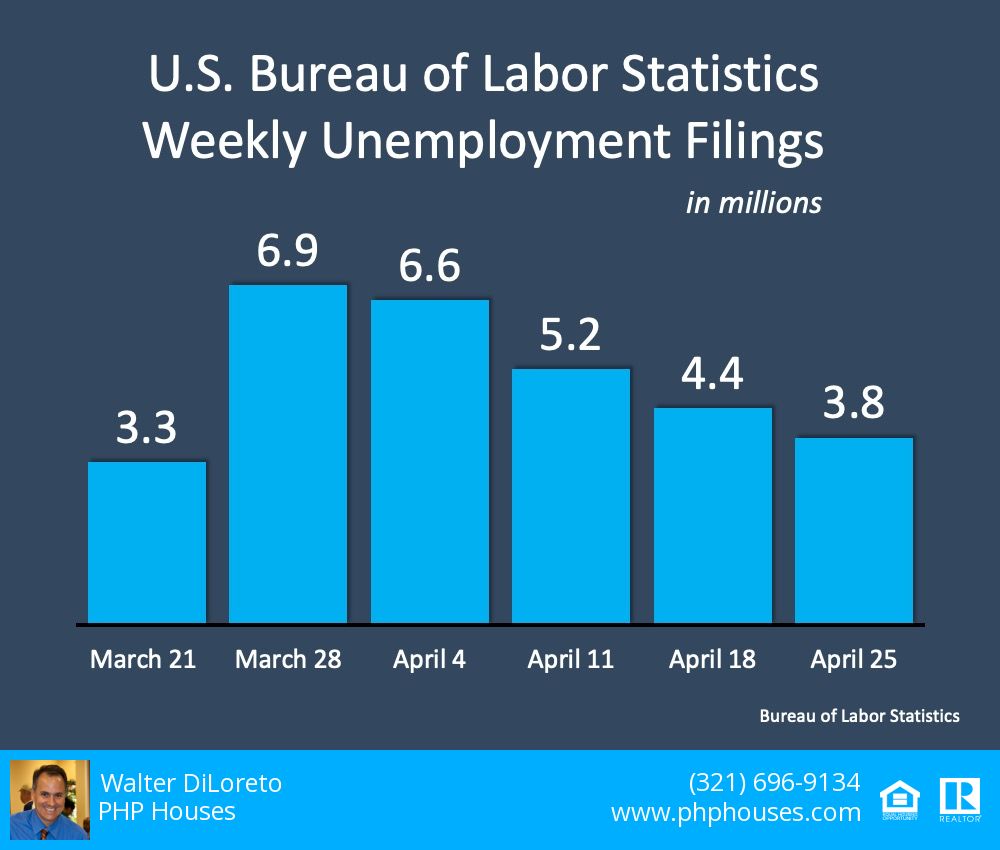

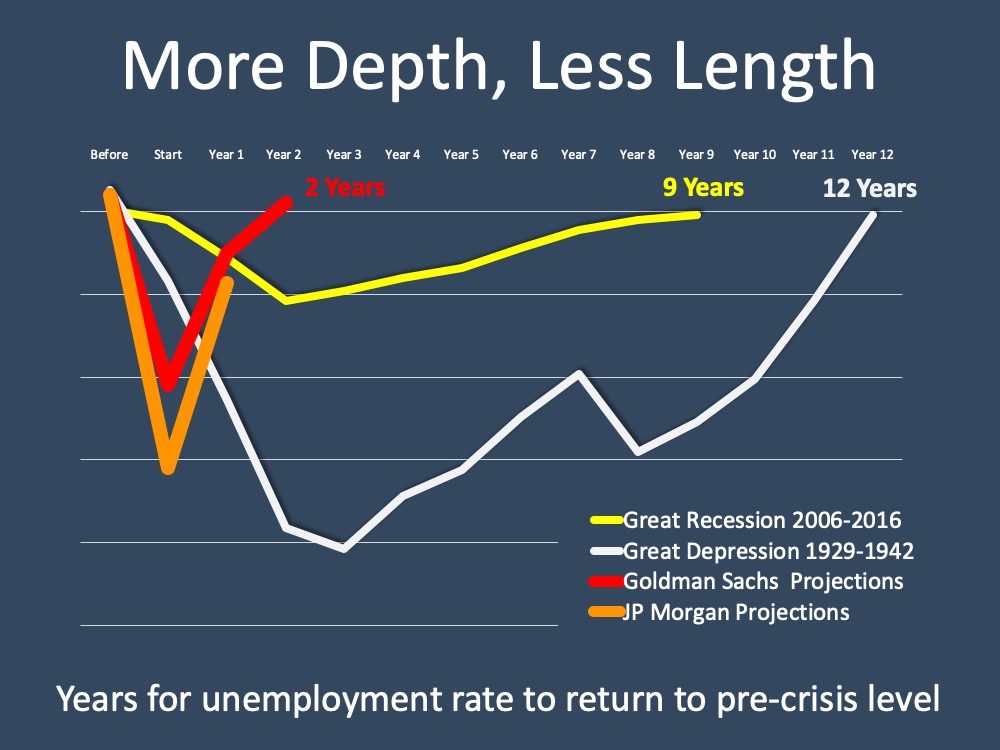

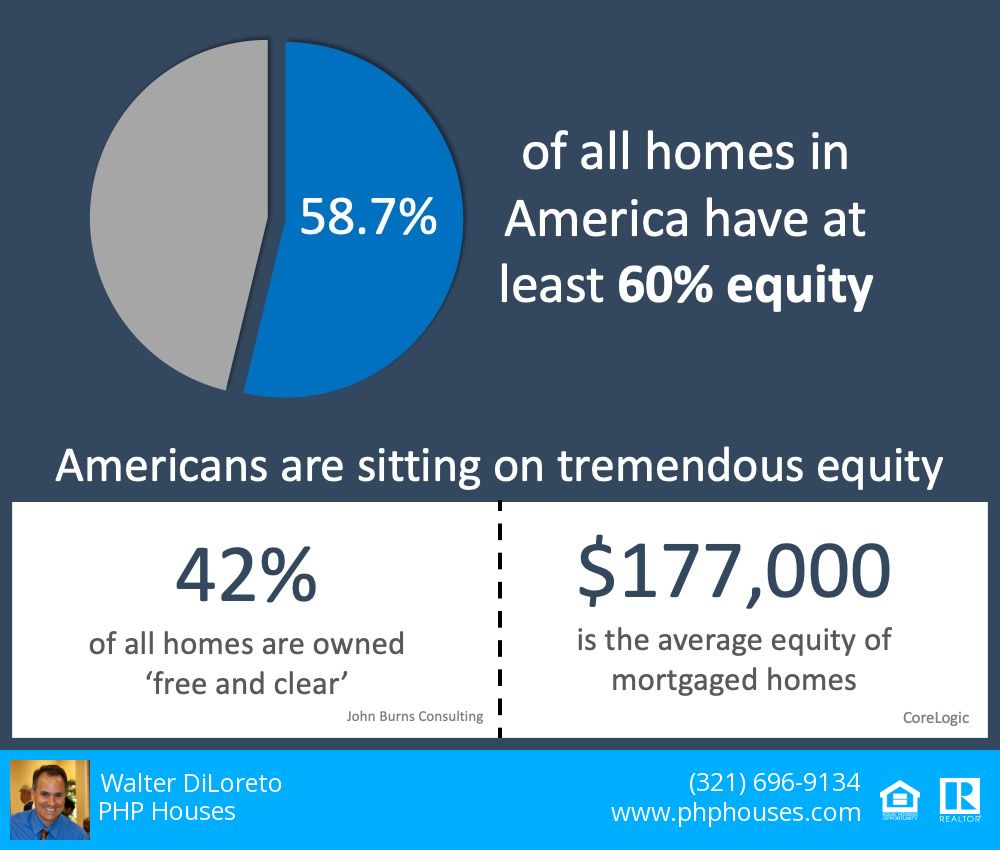

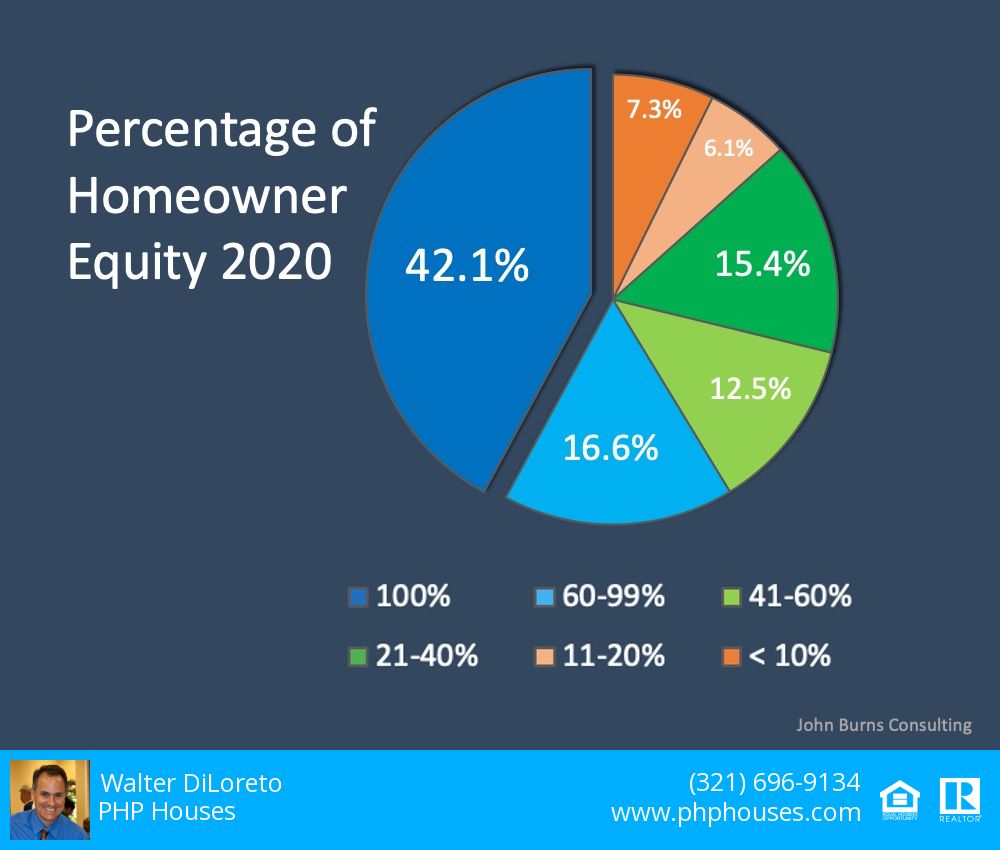

Having a buyer who wants to purchase your house is the first step. Making sure they can afford to buy it is just as important. As a FSBO, it’s almost impossible to be involved in the mortgage process of your buyer. A real estate professional is trained to ask the appropriate questions and, in most cases, will be intimately aware of the progress that’s being made toward a purchaser’s mortgage commitment. Further complicating the situation is how the current mortgage market is rapidly evolving because of the number of families out of work and in mortgage forbearance. A loan program that was there yesterday could be gone tomorrow. You need someone who is working with lenders every day to guarantee your buyer makes it to the closing table.

5. FSBOing Has Become More Difficult from a Legal Standpoint

The documentation involved in the selling process has increased dramatically as more and more disclosures and regulations have become mandatory. In an increasingly litigious society, the agent acts as a third-party to help the seller avoid legal jeopardy. This is one of the major reasons why the percentage of people FSBOing has dropped from 19% to 8% over the last 20+ years.

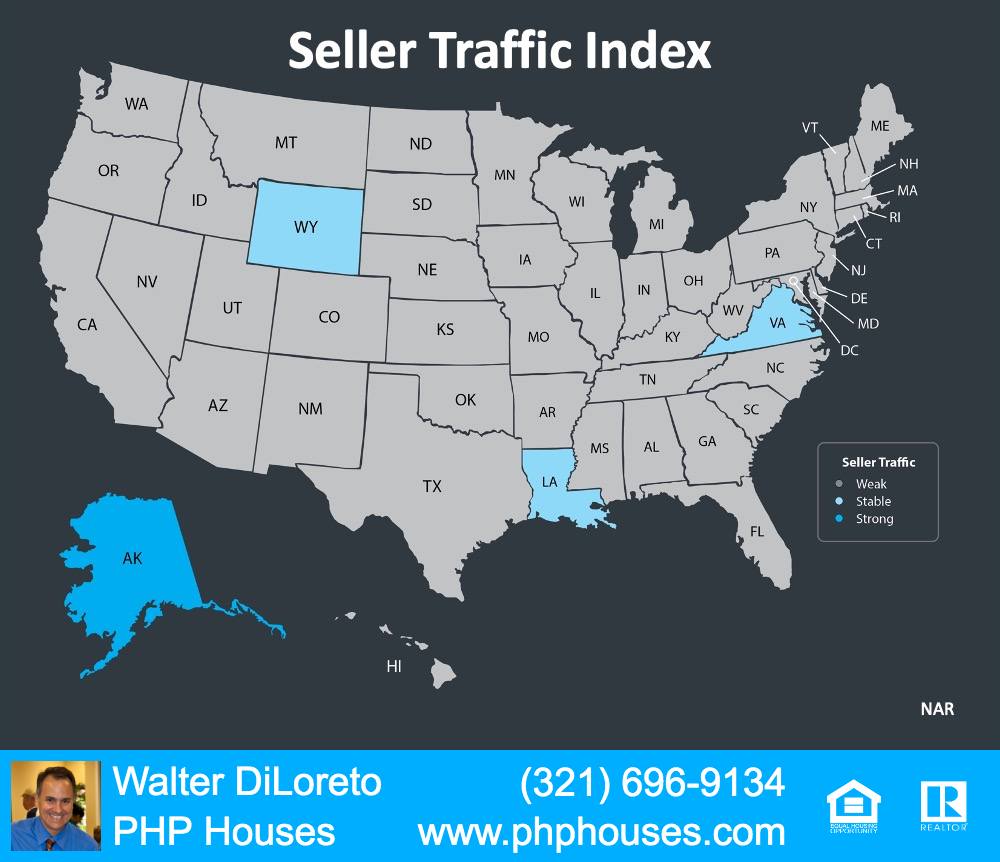

6. You Net More Money When Using an Agent

Many homeowners believe they’ll save the real estate commission by selling on their own. Realize that the main reason buyers look at FSBOs is because they also believe they can save the real estate agent’s commission. The seller and buyer can’t both save the commission. A study by Collateral Analytics revealed that FSBOs don’t actually save anything by forgoing the help of an agent. In some cases, the seller may even net less money from the sale. The study found the difference in price between a FSBO and an agent-listed home was an average of 6%. One of the main reasons for the price difference is effective exposure:

“Properties listed with a broker that is a member of the local MLS will be listed online with all other participating broker websites, marketing the home to a much larger buyer population. And those MLS properties generally offer compensation to agents who represent buyers, incentivizing them to show and sell the property and again potentially enlarging the buyer pool.”

The more buyers that view a home, the greater the chance a bidding war will take place.

Bottom Line

Listing on your own leaves you to manage the entire transaction yourself. Why do that when you can hire an agent and still net the same amount of money? Before you decide to take on the challenge of selling your house alone, let’s connect to discuss your options.

Contact us:

PHP Houses

142 W Lakeview Ave

Unit 1030

Lake Mary, FL 32746

Ph: (407) 519-0719

Fax: (407) 205-1951

email: info@phphouses.com

Let’s Connect:

Facebook

Linkedin

Twitter

Instagram

THE INFORMATION PRESENTED IN THIS ARTICLE IS FOR EDUCATIONAL PURPOSES ONLY AND SHOULD NOT BE CONSIDERED LEGAL, FINANCIAL, OR AS ANY OTHER TYPE OF ADVICE.