Struggling To Find a Home To Buy? New Construction May Be an Option.

Struggling To Find a Home To Buy? New Construction May Be an Option.

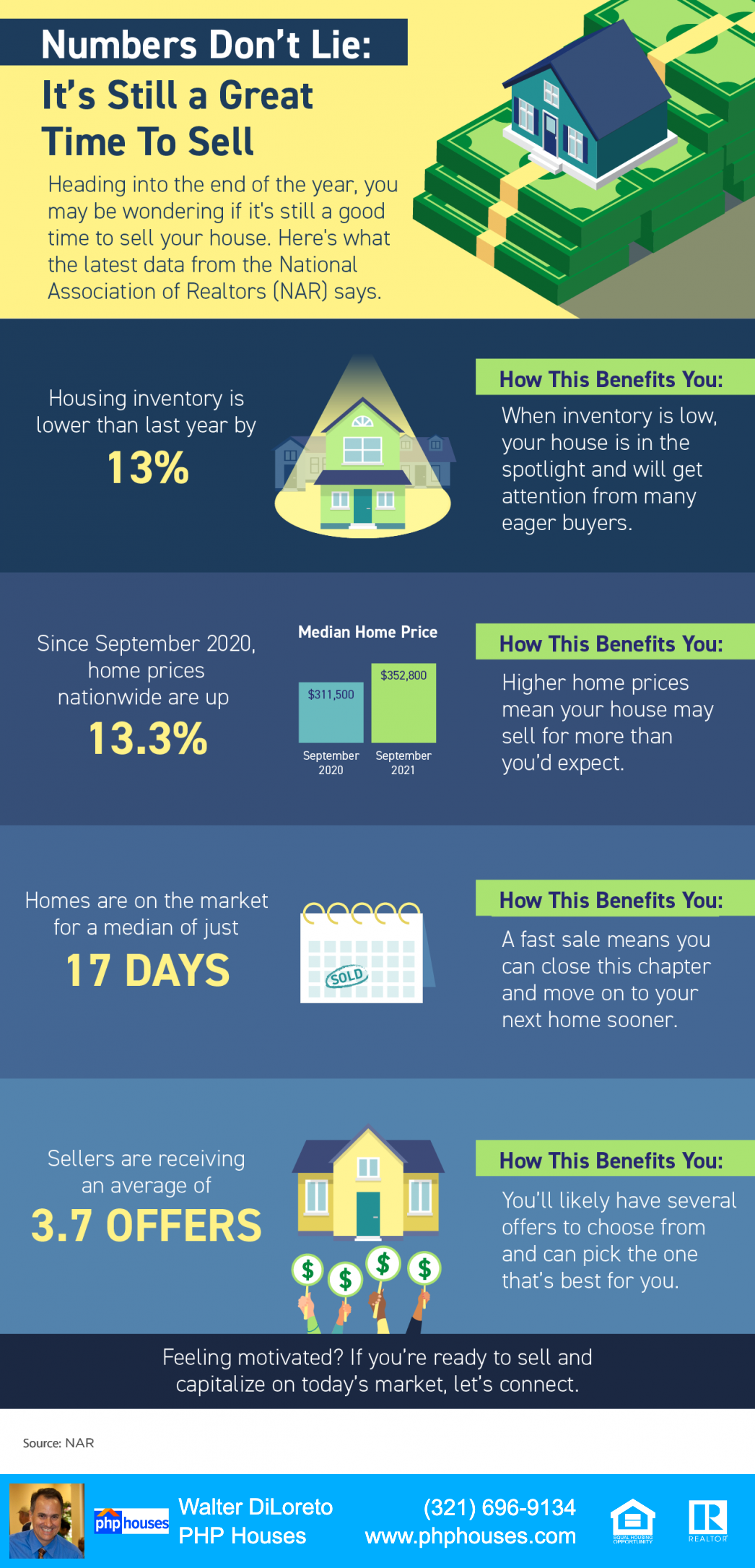

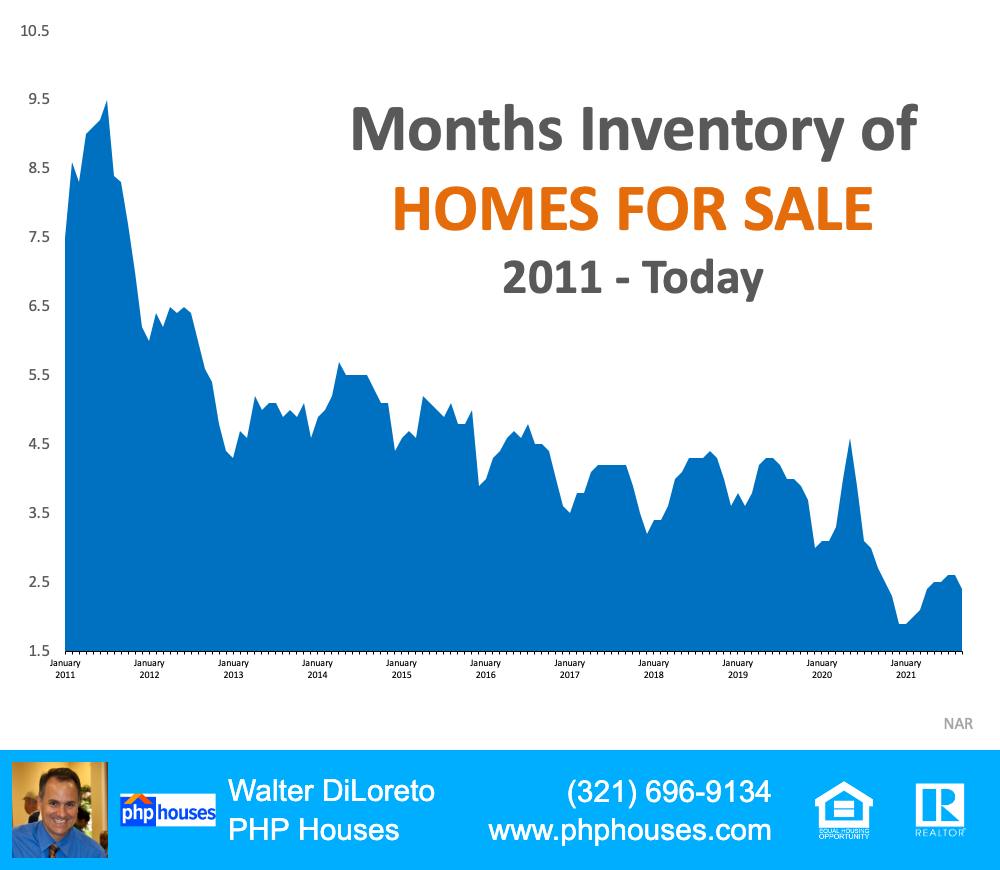

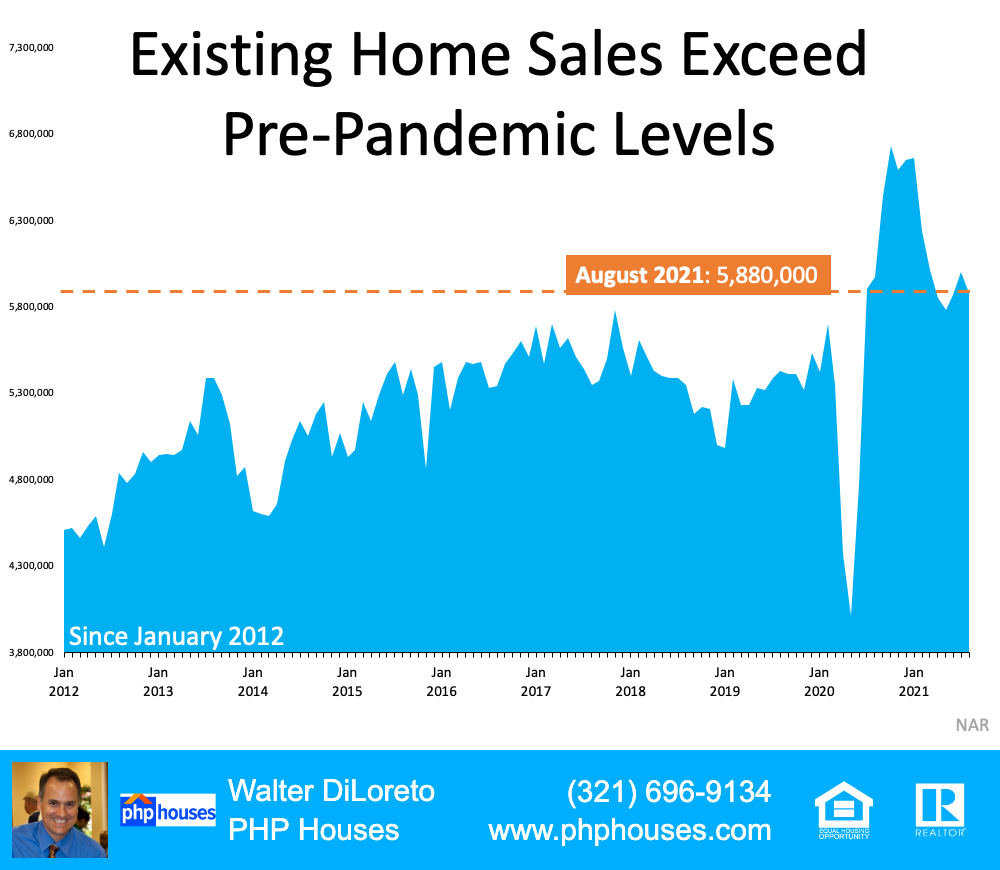

There’s no question that the financial benefits of selling a house are outstanding today. Now is truly a great time to list if you’re ready to make a change. But if you do sell your house right now, you may be wondering where you’ll go when you move.

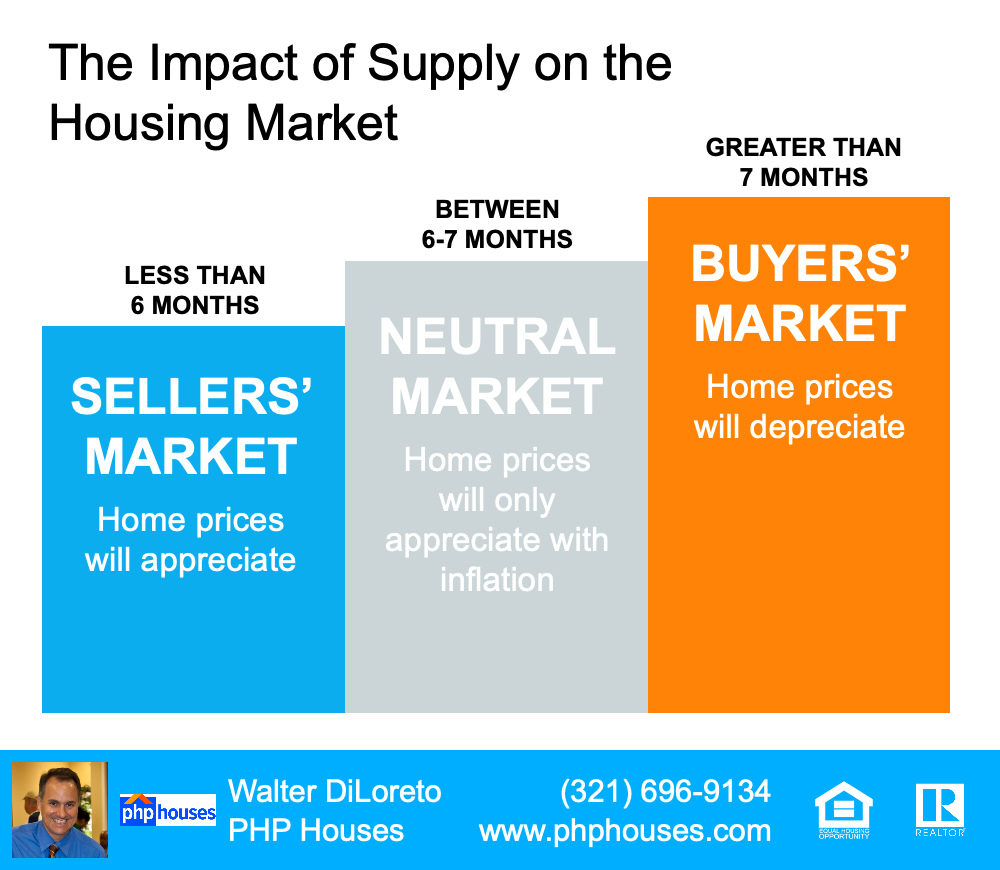

With so few homes available to buy right now, you might be considering building a new home as one of your options. But you may be unsure if that’s the way to go. Let’s compare the benefits of a newly built home versus moving into an existing one, and why working with a real estate agent throughout the process is mission-critical to your success no matter what you decide.

The Pros of Newly Built Homes

First, let’s look at the benefits of purchasing a newly constructed home. With a brand-new home, you’ll be able to:

1. Create your perfect home.

If you build a home from the ground up, you’ll have the option to select the custom features you want, including appliances, finishes, landscaping, layout, and more.

2. Cash-in on energy efficiency.

When building a home, you can choose energy-efficient options to help lower your utility costs, protect the environment, and reduce your carbon footprint.

3. Minimize the need for repairs.

Many builders offer a warranty, so you’ll have peace of mind on unlikely repairs. Plus, you won’t have as many little projects to tackle. QuickenLoans puts it like this:

“Buying a new construction vs. existing home typically means you’ll have fewer repairs to do. It can be a huge relief to know that it’s unlikely you’ll have to repair the roof or replace the furnace.”

4. Have brand new everything.

Another perk of a new home is that nothing in the house is used. It’s all brand new and uniquely yours from day one.

The Pros of Existing Homes

Now, let’s compare that to the perks that come with buying an existing home. With a pre-existing home, you can:

1. Explore a wider variety of home styles and floorplans.

With decades of homes to choose from, you’ll have a broader range of floorplans and designs available.

2. Join an established neighborhood.

Existing homes give you the option to get to know the neighborhood, community, or traffic patterns before you commit.

3. Enjoy mature trees and landscaping.

Established neighborhoods also have more developed landscaping and trees, which can give you additional privacy and curb appeal. As Investopedia says, if you buy an existing home:

“Odds are, too, that the home will have mature landscaping, so you won’t have to worry about starting a lawn, planting shrubs, and waiting for trees to grow.”

4. Appreciate that lived-in charm.

The character of older homes is hard to reproduce. If you value timeless craftsmanship or design elements, you may prefer an existing home. According to Houseopedia:

“Charm is priceless. Existing homes, especially those built in the 1950’s or before, often offer architectural elements, historic charm and a quality of craftsmanship not available in new homes.”

The choice is yours. When you start your search for the perfect home, remember that you can go either route – you just need to decide which features and benefits are most important to you. Working with the guidance of your trusted real estate advisor will help you make the most informed and educated decision, so you can move into the home of your dreams.

Bottom Line

If you have questions about the options in your area, let’s discuss what’s available and what’s right for you, so you’re ready to make your next move with confidence.

Contact us:

PHP Houses

142 W Lakeview Ave

Unit 1030

Lake Mary, FL 32746

Ph: (407) 519-0719

Fax: (407) 205-1951

email: info@phphouses.com

Let’s Connect:

Facebook

Linkedin

Twitter

Instagram