Not All Agents Are Created Equal

In today’s fast-paced world where answers are just a Google search away, there are some who may question the benefits of hiring a real estate professional when selling a house. The reality is, the addition of more information can lead to more confusion. A real estate agent can be your essential guide, but truth be told, not all agents are created equal. Finding the right agent for you and your family should be your top priority when you’re ready to sell your house.

The right agent is the person who can truly walk you through the whole process, look out for your best interest, and seamlessly lead you through all the steps along the way. In today’s complex market, the way we execute real estate transactions is changing constantly, especially as more elements can be done virtually. Making sure you have the best advice on your side is more important than ever.

So, how do you choose the perfect agent?

It starts with trust. You must trust the advice this person is going to give you, and you’ll want to begin by making sure you’re connected to a true professional. An agent can’t give you perfect advice because it’s impossible to know exactly what’s going to happen at every turn – especially in this unique market. A true professional agent can, however, give you the best advice possible based on the information and situation at hand, helping you make the necessary adjustments and best decisions along the way. The right agent – the professional – will get you the best offer available. That’s exactly what you want and deserve.

What do you need to trust your agent to do?

1. Navigate the Process

There are over 230 possible steps that take place during a successful real estate transaction. Don’t you want someone who has been there before, someone who knows what these actions are, to ensure you have a positive selling experience?

2. Negotiate on Your Behalf

Today, hiring a trusted and talented negotiator could save you thousands, perhaps tens of thousands of dollars. Each step – from the buyer submitting an original offer, to the possible renegotiation of that offer after a home inspection, to the potential cancelation of the deal based on a troubled appraisal – you need someone who can keep the deal together until it closes.

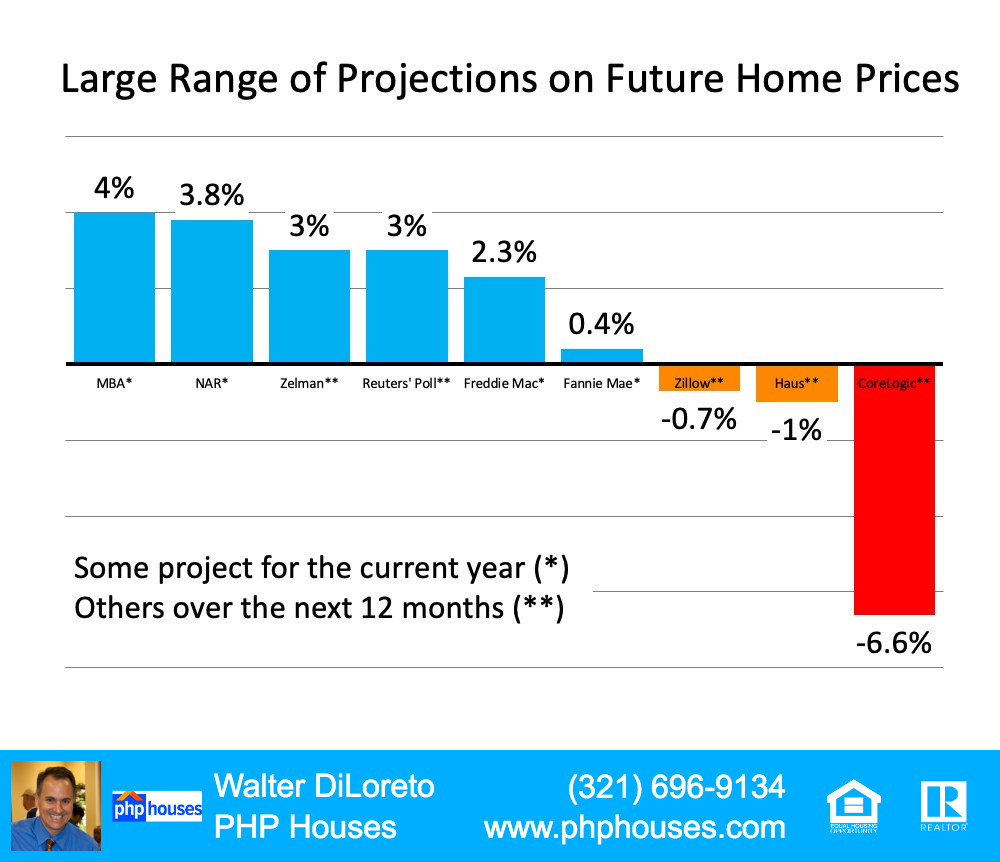

3. Price Your House Competitively

There’s so much information in the news and on the Internet about home sales, prices, and mortgage rates. How do you know what’s going on in our local area? Who do you turn to in order to competitively and correctly price your home at the beginning of the selling process?

Dave Ramsey, known as the financial guru, advises:

“When getting help with money, whether it’s insurance, real estate or investments, you should always look for someone with the heart of a teacher, not the heart of a salesman.”

Hiring a trusted professional who has a finger on the pulse of the market and is eager to help you learn will make your experience an informed and educated one. You need someone who’s going to tell you the truth, not just what they think you want to hear.

Bottom Line

Today’s real estate market is highly competitive. Having a trusted professional who’s been there before to guide you through the process is a simple step that will give you a huge advantage when you’re ready to sell your house. Let’s make it happen together.

Contact us:

PHP Houses

142 W Lakeview Ave

Unit 1030

Lake Mary, FL 32746

Ph: (407) 519-0719

Fax: (407) 205-1951

email: info@phphouses.com

Let’s Connect:

Facebook

Linkedin

Twitter

Instagram

THE INFORMATION PRESENTED IN THIS ARTICLE IS FOR EDUCATIONAL PURPOSES ONLY AND SHOULD NOT BE CONSIDERED LEGAL, FINANCIAL, OR AS ANY OTHER TYPE OF ADVICE.