If you’re thinking about moving, selling your house this fall might be the way to go. Here are four highlights in the housing market that may make your decision to sell this fall an easy one.

1. Buyers Are Actively in the Market

ShowingTime, a leading real estate showing software and market stat service provider, just reported that buyer traffic jumped 60.7% compared to this time last year. That’s a huge increase.

It’s clear that buyers are ready, willing, and able to purchase – and they’re in the market right now. In many regions of the country, multiple buyers are entering bidding wars to compete for the home they want. Take advantage of the buyer activity currently in the market so you can sell your house in the most favorable terms.

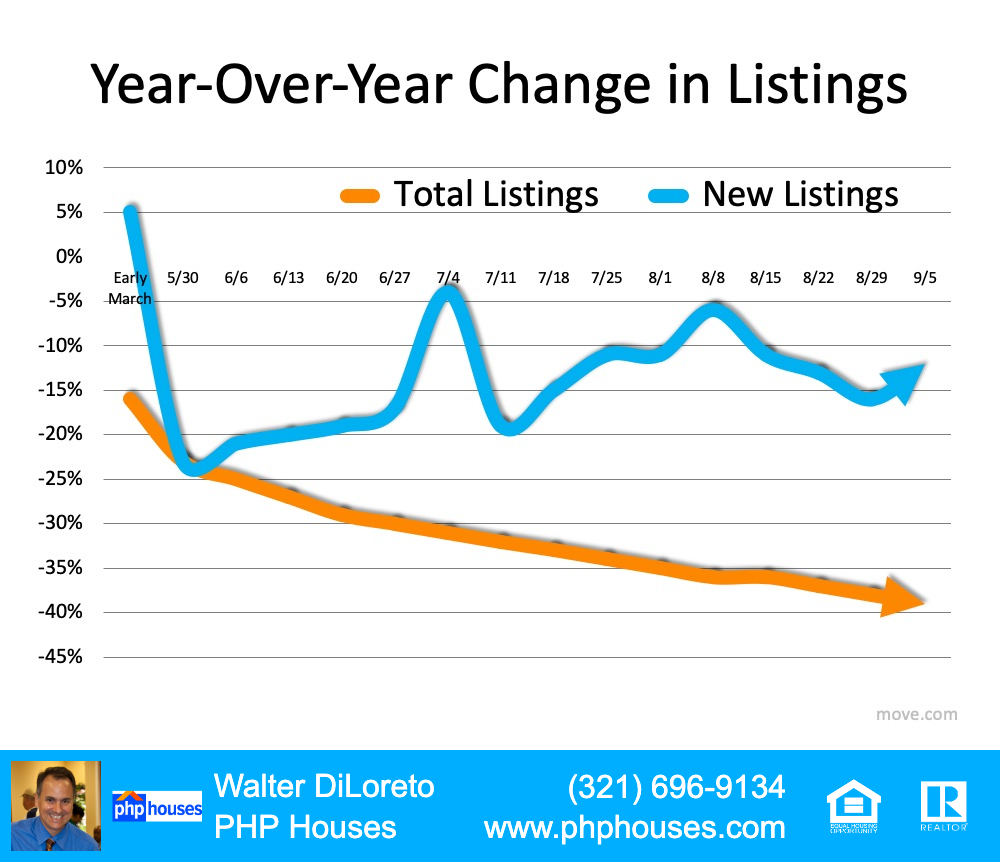

2. There Are Not Enough Homes for Sale

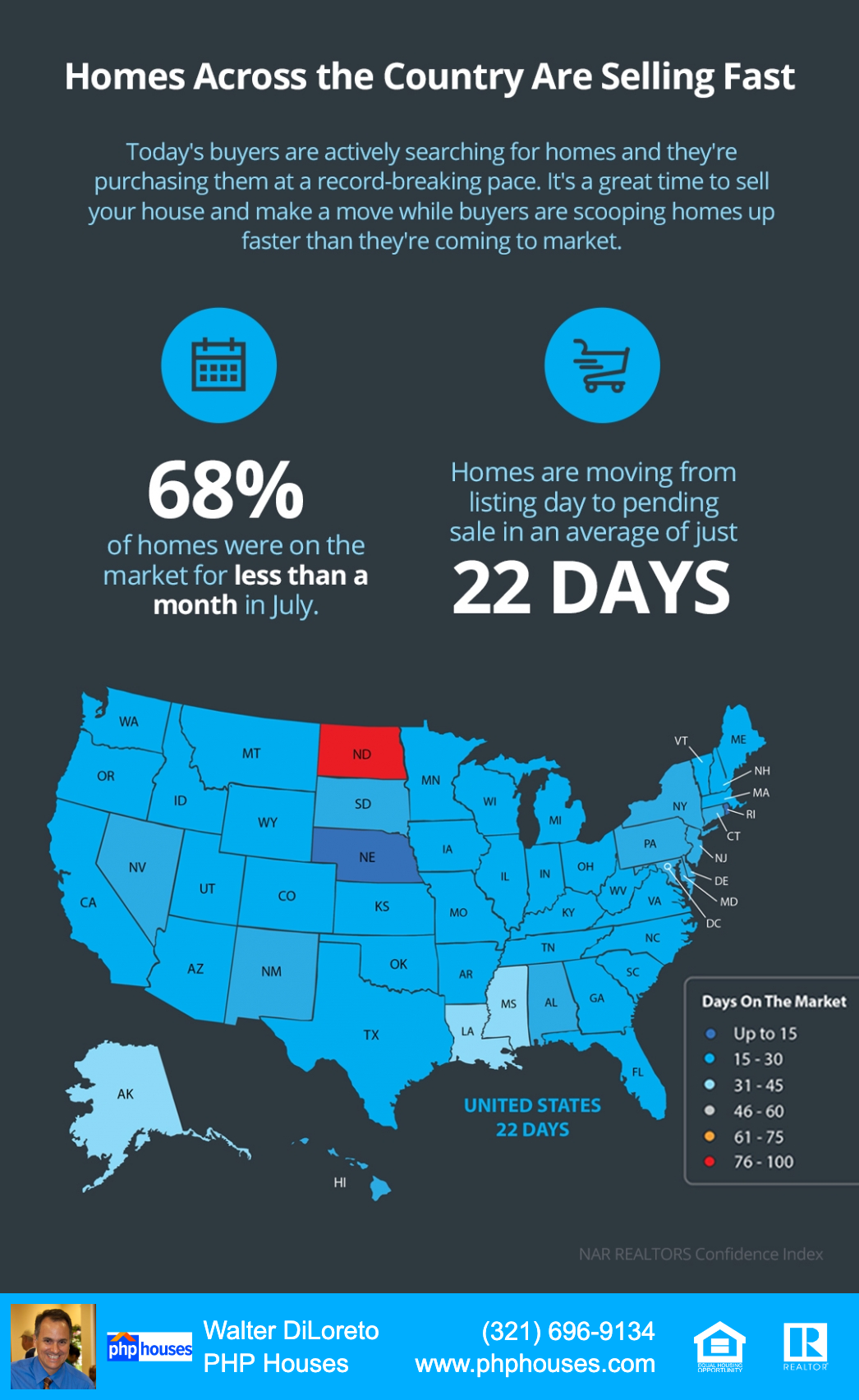

In the latest Existing Home Sales Report, the National Association of Realtors (NAR) announced that there were only 1.49 million units available for sale. That number was down 18.6% from one year ago. This means in the majority of the country, there aren’t enough homes for sale to satisfy the number of buyers.

Due to the health crisis, many homeowners were reluctant to list their homes earlier this year. That will change as the economy continues to recover. The choices buyers have will increase going into the new year. Don’t wait until additional sellers come to market before you decide to make a move.

3. The Process Is Going Quickly

Today’s ultra-competitive environment has forced buyers to do all they can to stand out from the crowd, including getting pre-approved for their mortgage financing. This makes the entire selling process much faster and simpler, as buyers know exactly what they can afford before shopping for a home. According to the latest Origination Insights Report from Ellie Mae, the time needed to close a loan is just 49 days.

4. There May Never Be a More Important Time to Move

You’ve likely spent much of the last six months in your current home. Perhaps you now realize how small it is, and you need more space. If you’re working from home, your children are doing virtual school, or you just need more space, your current floor plan may not work for your family’s changing needs.

Homebuilders are beginning to build houses again, so you can choose the exact floor plan to match what your family needs, and you can make sure the outdoor space is what you want too.

Bottom Line

The housing market is prime for sellers right now, so let’s connect to get the process started this fall. If the timing is right for you and your family, the market is calling your name.

Contact us:

PHP Houses

142 W Lakeview Ave

Unit 1030

Lake Mary, FL 32746

Ph: (407) 519-0719

Fax: (407) 205-1951

email: info@phphouses.com

Let’s Connect:

Facebook

Linkedin

Twitter

Instagram