By Bill Gassett

Buying a home before selling an existing property you own is one of those real estate topics that I know gets debated quite a bit at the kitchen table all across America. It often happens unexpectedly.

You might be browsing the online housing ads, or you may just be driving in a neighborhood you like when you see it – a house you want, and for a great price to boot.

Unfortunately, you are still making payments on your current home.

You haven’t put it on the market yet, or you have, but it has yet to sell. Either way, you are in a tight position. Buying another home before selling your current property is a risky proposition for anyone without serious income. It is possible, but for most people, it is not recommended.

The question then becomes is buying a home before selling yours a smart move? Buying a house before selling your existing home is something only you can decide, but there are some things worth considering.

Benefits of Buying Before Selling

Even though most buyers are in no position to buy before selling their existing property, there are still a few benefits worth mentioning. There is a reason why you considered the idea in the first place, so it might be beneficial to review what you would have to gain.

You’re probably considering buying first because you found a property that is exactly what you want or one that is such a great deal that you feel like you cannot pass it up.

The reason could be more space is needed but just hadn’t gotten around to be a serious home buyer yet.

These are all legitimate reasons to want to buy a home, and opportunities like this can pop up, even if you have yet to sell your current home.

Everyone intends to get a great deal, and everyone has a dream home whether they have thoroughly thought through the idea yet or not.

When you come upon a house that fits one or both of these criteria, it can trigger some emotions and desires. You can picture yourself perfectly living in this new place, or you can see how much money you will net once you do sell your home.

You can also look forward to a smooth transition once you sell your home because you will have already purchased your new one.

If you have the finances, you may even see the potential benefits of carrying both houses – the old one with renters paying the mortgage while you enjoy your new home.

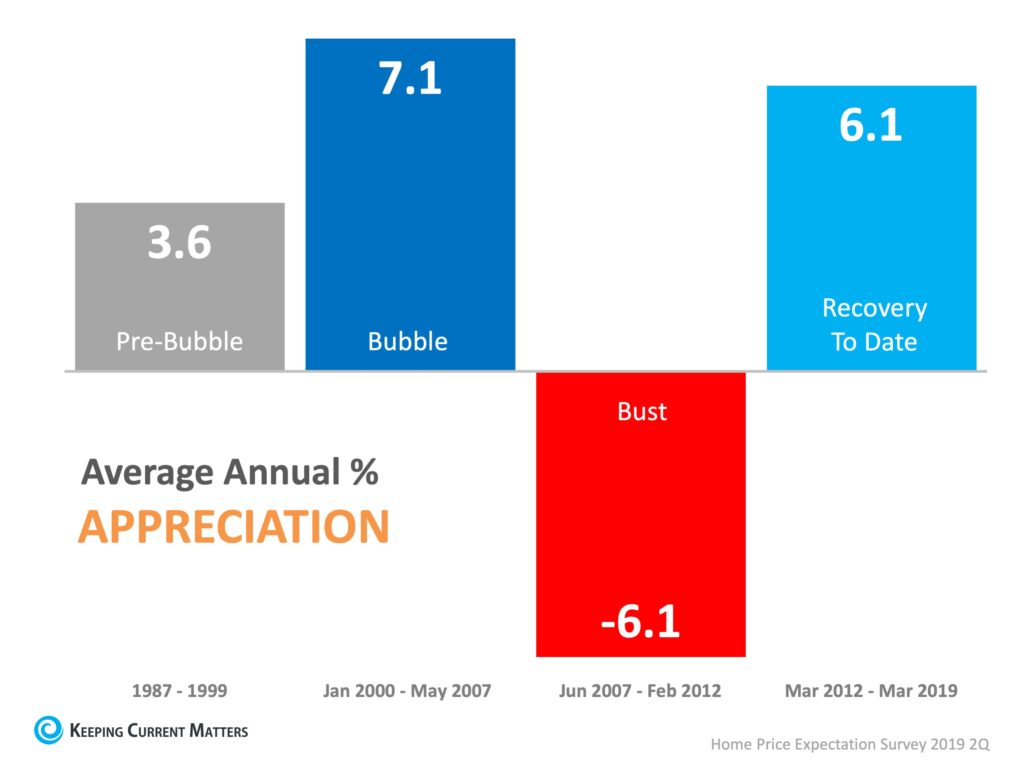

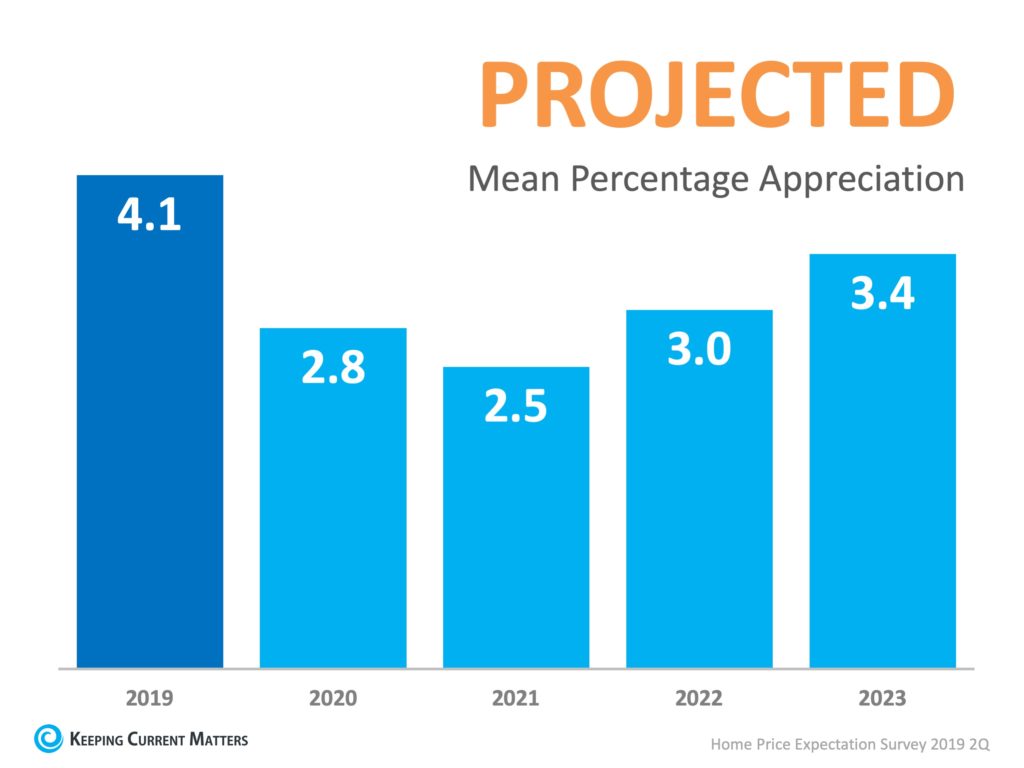

This could especially be worthwhile to you if the Real Estate market is on the rise and you see the potential for selling your existing home somewhere down the line for a more substantial profit.

Doing Work Before You Move In

Another significant benefit to buying another home before selling the one you currently own is the ability to go in ahead of time and make the improvements you desire so it is a place you will want to call home.

Some of the improvements that are a heck of a lot easier to complete when a home is vacant are refinishing hardwood floors, painting, and even remodeling projects like kitchens and baths. Many would kill to be able to have all of these things done before the moving truck ever pulls into the driveway.

All of these benefits are things you might gain from buying before selling your property. However, it is worthwhile to look at the risks of such a proposition. There are reasons why so few people go this route.

Risks of Buying Before Selling Your Home

Finances

Buying a home before selling existing property can bring with it a lot of financial risks. The first thing to look at before you go buying the new house is your finances. Can you afford to pay both mortgages for an extended period?

This is something the bank is going to want to know, and something you should be clear on before you jump in. Selling a house is an uncertain business, and it could take months – possibly a year or more – before you can sell. If all things go well, this will not be the case. But you must be able to cover the payments on both mortgages for some time.

If you do not have this kind of money, you probably should not buy before selling. However, there are other ways that people have accomplished this, so they are worth mentioning. Whether they are an option in today’s market is another story, and will depend heavily on your particular money situation, the lending market and whether the housing market is currently for buyers or sellers.

Home Sale Contingencies

Few sellers are interested in home sale contingency clauses; the chances are very slim a prudent seller will be except one – especially in a seller’s market. By making a contingency offer, you tell a seller that you will buy his or her house for a certain price if and when your home sells.

You put your home up for sale as soon as you decide to do this, and you hope that it will sell quickly so you can buy the new house.

The problem with this arrangement and the reason why so few home sellers accept it is that they lose control of their transaction. A seller has no idea if you are going to do what it takes to sell your home.

They don’t know if you are going to price it correctly, market it right, or even have the best Realtor to sell it. The seller is virtually at your mercy to do what it takes to move onto the next phase of the transaction.

The seller on the other hand without accepting this type of contingency is still able to do what is necessary to get his or her place sold by dropping the price. They certainly know if you are truly serious when you put your home under contract you will be back anyways.

A right of First Refusal

Another typical arrangement you see in some Real Estate contracts is what’s called a right of first refusal. You establish agreed upon terms in a contract and give a specified amount of time that the seller has to provide you to exercise your right to proceed with the transaction should the seller receive another offer.

When the seller gets another offer, you have a short period (typically 24 -48 hours) to purchase the home before the deal dissolves – whether you have sold first or not. Most sellers today do not need to deal in contingency clauses, but it could be worth asking if you have no other choice.

What I need to make painfully clear about this is that the chances are incredibly remote the seller will accept either of these arrangements. When you submit, an offer on a property, a good listing agent representing the seller is going to want to know you can qualify to purchase without selling your existing home.

In fact, one of the requirements I will have any buyer who currently owns a home and puts an offer in on one of my client’s homes is to provide a pre-approval mortgage letter that states exactly that.

The language must be explicit – “the buyer does not need to close on their existing home to make this purchase.” This assures the seller that they do not need to worry about a customer completing a transaction before the acquisition. Otherwise, a buyer could use the mortgage contingency clause in most Real Estate contracts as an escape clause to get their deposits back.

In regards to the right of first refusal unless the seller knows you can qualify to buy his/her home without selling it does not make sense to accept this kind of contract. A ready, willing and able buyer has made an offer on his/her home – why would they want to turn around and wait for someone to say yes or no who doesn’t even qualify to complete the sale?

They would be losing a buyer in hand who has nothing to sell! A few years back while working with a buyer client in Central Florida, even though I had explained to them that the vast majority of home sellers would not accept a contingency sale and they needed to get their home sold first, they didn’t listen.

Unfortunately for them, it took losing a home they wanted before coming to grips they needed to get their home listed and sold first.

After being in the Real Estate business for over 14 years, I find this is something that needs to be explained quite a bit. The are many buyers that think sellers are going to accept their contingency offer. Many have in the back of their mind that this is normal or that they have a very salable home – SORRY it does not work that way!

A seller could care less that YOU think your home is marketable.

Bridge Loan

You may have heard of a bridge loan, but do not bet on being able to get one. Bridge loans allow you to combine the payments of the old and the new home together, making it possible for you to transition from one residence to another. However, the catch with bridge loans is that you need to have considerable finances and excellent credit.

Mostly, you need to be one of the rare few that could afford the dual mortgage payments without the loan. A bridge loan was quite common many years ago, but this type of financing is far rarer nowadays.

Renters

Another avenue you can potentially look into when buying a home before you have sold the one you own is renting it out instead of selling. You may be thinking you can just rent out the old house to cover the mortgage while you move into your new home.

While this is an option, it does carry some risks. Renters can lead to severe wear and tear on your property and have little incentive to treat it with love and care you might.

If you are planning on keeping renters there just until you can sell it, you may run into even more problems. Your renters may want to continue living there and might make it unnecessarily difficult to show the house because of this.

Regarding finances, the lender is only going to count a portion of the rent you collect into the equation of whether or not you can qualify to carry both mortgages. Keep this in mind and make sure you do your due diligence before putting in the offer on your dream home.

Buying a Home Before Selling: Do So Only If Financially Wise

Not everyone sells his or her current home before buying a new one. However, the reality of buying a home makes such actions inadvisable for most. You may be able to do it, but make very certain that it is a smart financial move before doing so.

In my experience, most homeowners will opt to get their home sold first and then make an offer on their next place.

By doing so, you remove quite a bit of stress from the equation.

The next worry, of course, will be selling your home before you have found another home you really want to buy. This brings a whole different set of things to keep you up at night including finding temporary housing and a place to store all of your belongings.

These of course are legitimate concerns as nobody likes to think about making a “double move.”

In Real Estate we like to call the decision process for buying before selling or vice versa as the “chicken and egg question.” Essentially which option makes the most sense to do first based upon your life and financial position.

Only you can decide that, but these are the things you need to consider. As you can see, there are risks and benefits of buying a new property before you have sold your current home. Hopefully, you are now better informed to make the right decision when buying and selling real estate.

PHP Houses

142 W Lakeview Ave

Ste 1030

Lake Mary, Florida 32746

Ph: (407) 519-0719

Fax: (407) 205-1951

email: info@phphouses.com

website: www.PHPHouses.com

Connect to us:

Facebook

Twitter

Linkedin

Instagram