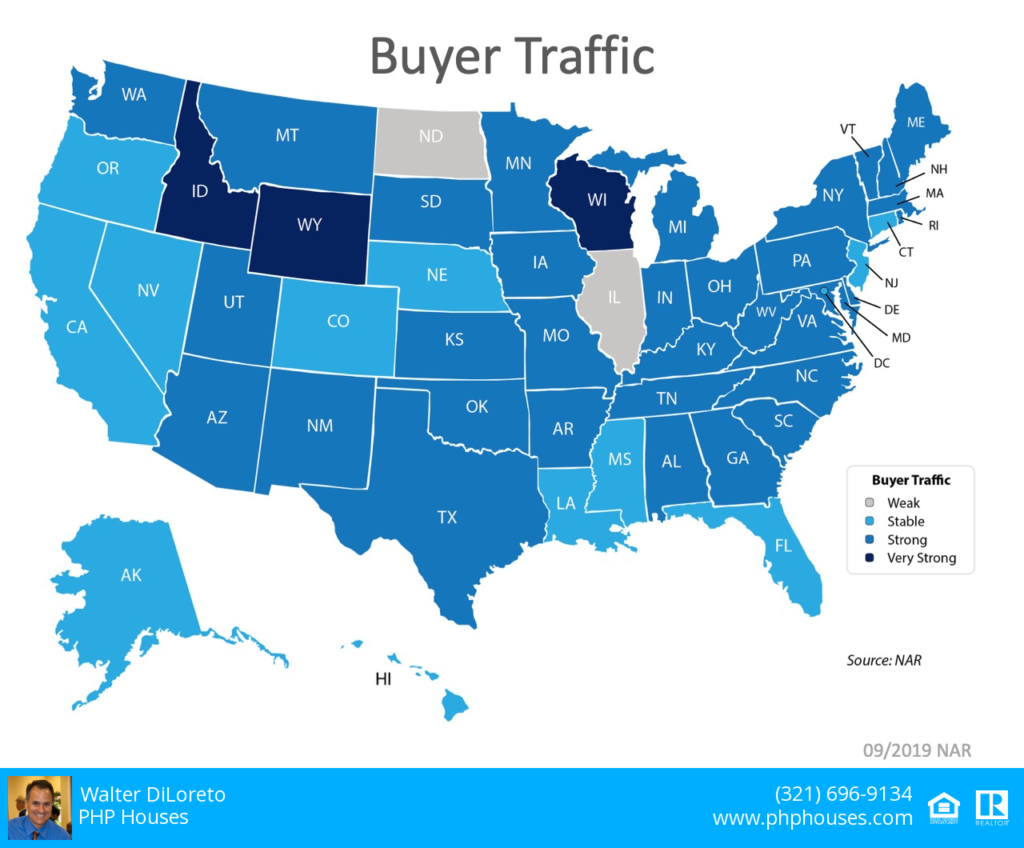

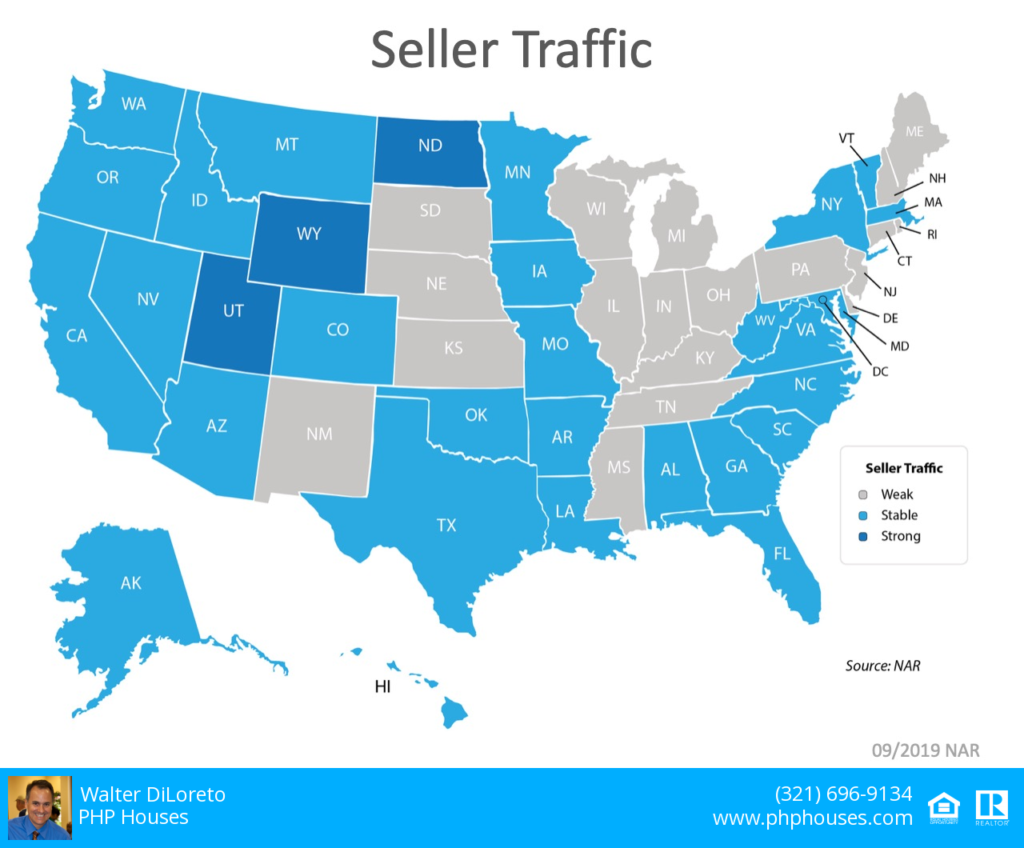

The best time to sell anything is when demand for that item is high and the supply of that item is limited. The latest Existing-Home Sales Report released by the National Association of Realtors (NAR), reveals that demand for housing continues to be strong, but the supply is struggling to keep pace. With this trend likely continuing throughout 2020, now is a great time to sell your house.

THE EXISTING-HOME SALES REPORT

The most important data revealed in this report was not actually sales. In reality, it was the inventory of homes for sale (supply). The report explained:

- Total housing inventory at the end of August decreased 2.6% to 1.86 million homes available for sale.

- Unsold inventory is lower than the 4.3-month figure recorded in August 2018.

- This represents a 1-month supply at the current sales pace.

According to Lawrence Yun, Chief Economist at NAR,

“Sales are up, but inventory numbers remain low and are thereby pushing up

home prices.”

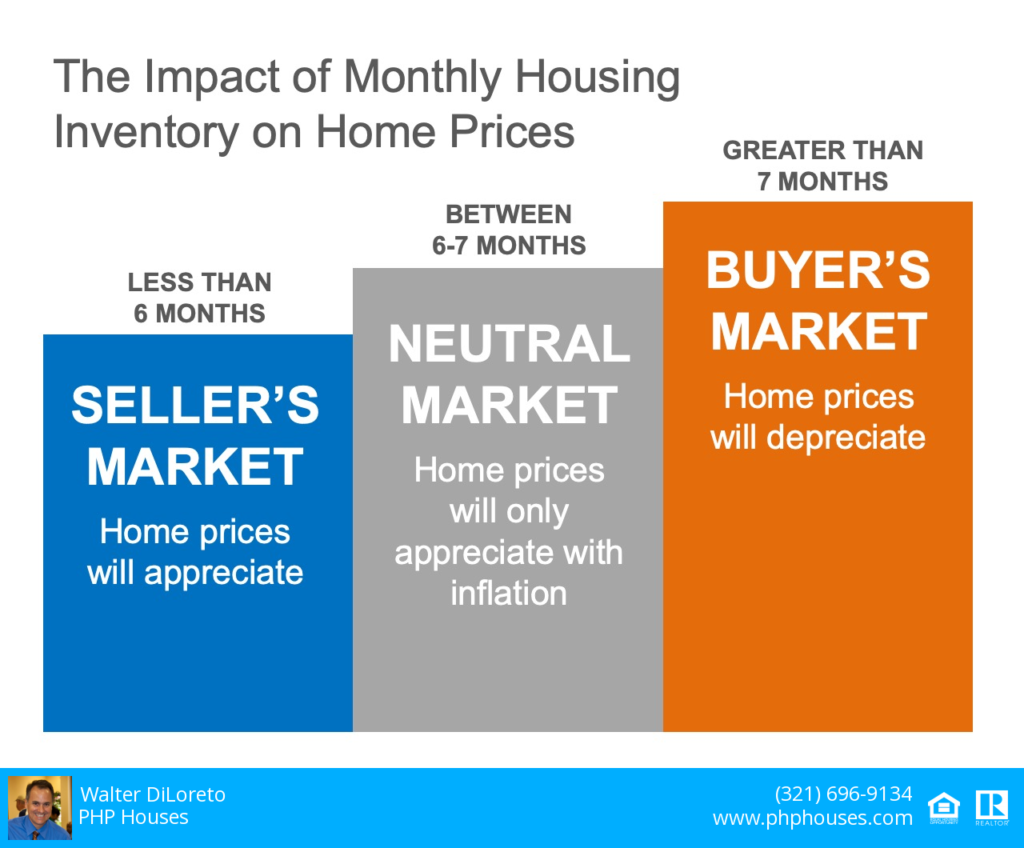

In real estate, there is a simple guideline that often applies here. Essentially, when there is less than a 6-month supply of inventory available, we are in a seller’s market and we will see greater appreciation. Between a 6 to 7-month supply is a neutral market, where prices will increase at the rate of inflation. More than a 7-month supply means we are in a buyer’s market and can expect depreciation in home values (see above).

As we mentioned before, there is currently a 4.1-month supply of homes on the market, and houses are going under contract fast. The Existing Home Sales Report also shows that 49% of properties were on the market for less than a month when they were sold. In August, properties sold nationally were typically on the market for 31 days. As Yun notes, this should continue,

“As expected, buyers are finding it hard to resist the current rates…The desire to take advantage of these promising conditions is leading more buyers to the market.”

Takeaway: Inventory of homes for sale is still well below the 6-month supply needed for a normal market, and supply will fail to catch up with demand if a sizable supply does not enter the market.

Bottom Line

If you are going to sell, now may be the time to take advantage of the ready, willing, and able buyers who are out there searching for your house to become their dream home.

Contact us:

PHP Houses

142 W Lakeview Ave

Unit 1030

Lake Mary, FL 32746

Ph: (407) 519-0719

Fax: (407) 205-1951

email: info@phphouses.com