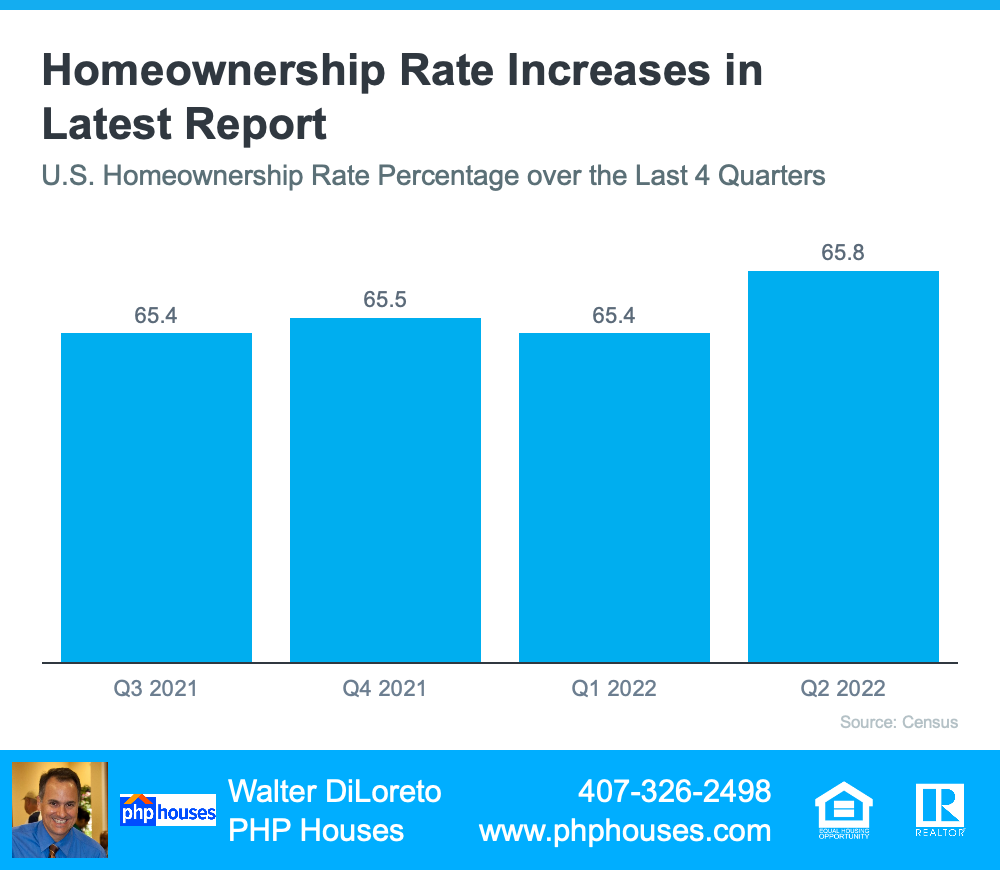

The desire to own a home is still strong today. In fact, according to the Census, the U.S. homeownership rate is on the rise. To illustrate the increase, the graph below shows the homeownership rate over the last year:

That data shows more than half of the U.S. population live in a home they own, and the percentage is growing with time.

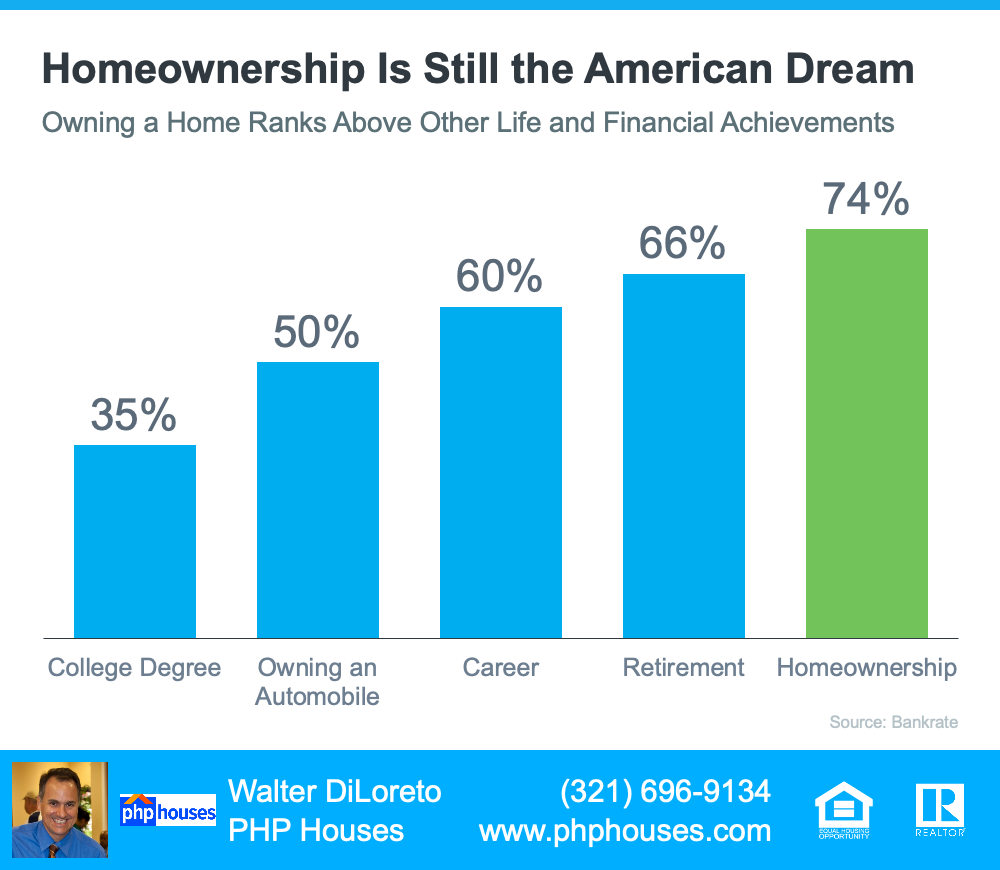

If you’re thinking about buying a home this year, here are just a few reasons why so many people see the value of homeownership.

Why Are More People Becoming Homeowners?

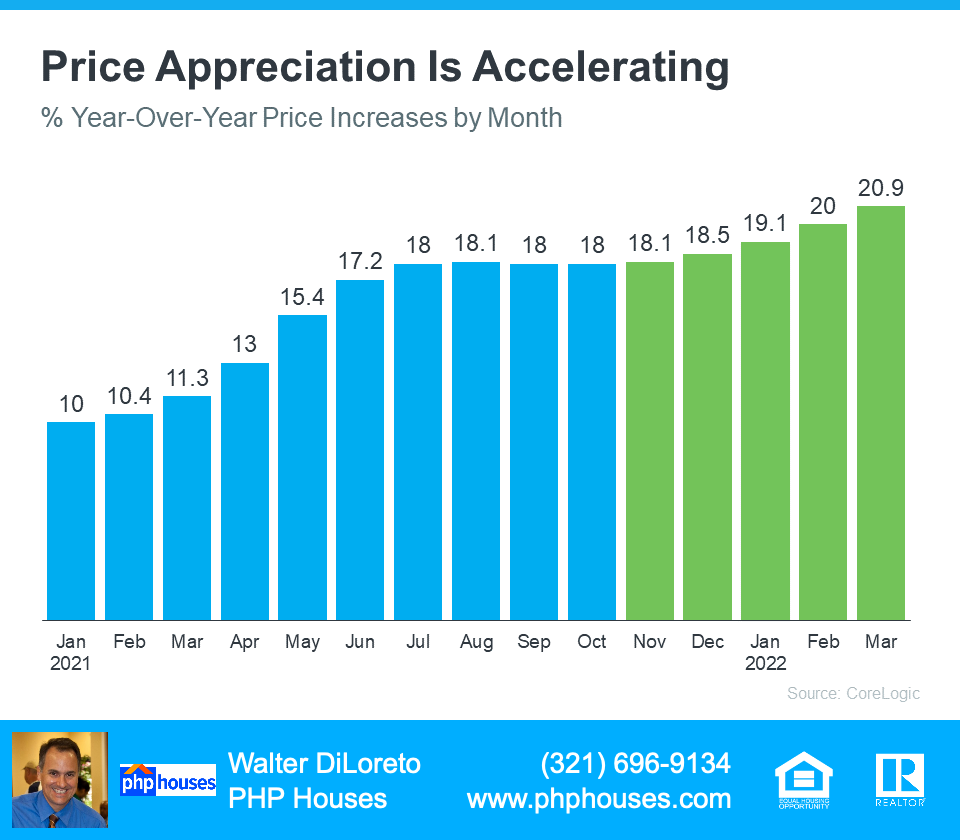

There are several benefits to owning your home. A significant one, especially when inflation is high like it is today, is that homeownership can help protect you from rising costs. Lawrence Yun, Chief Economist at the National Association of Realtors (NAR), explains:

“In the 1970s, when inflation was running around 10%, home prices were rising at approximately the same rate. Renters actually have a harder time in inflationary periods, because rents tend to rise along with inflation, whereas mortgage payments stay the same for homeowners with fixed-rate mortgages.”

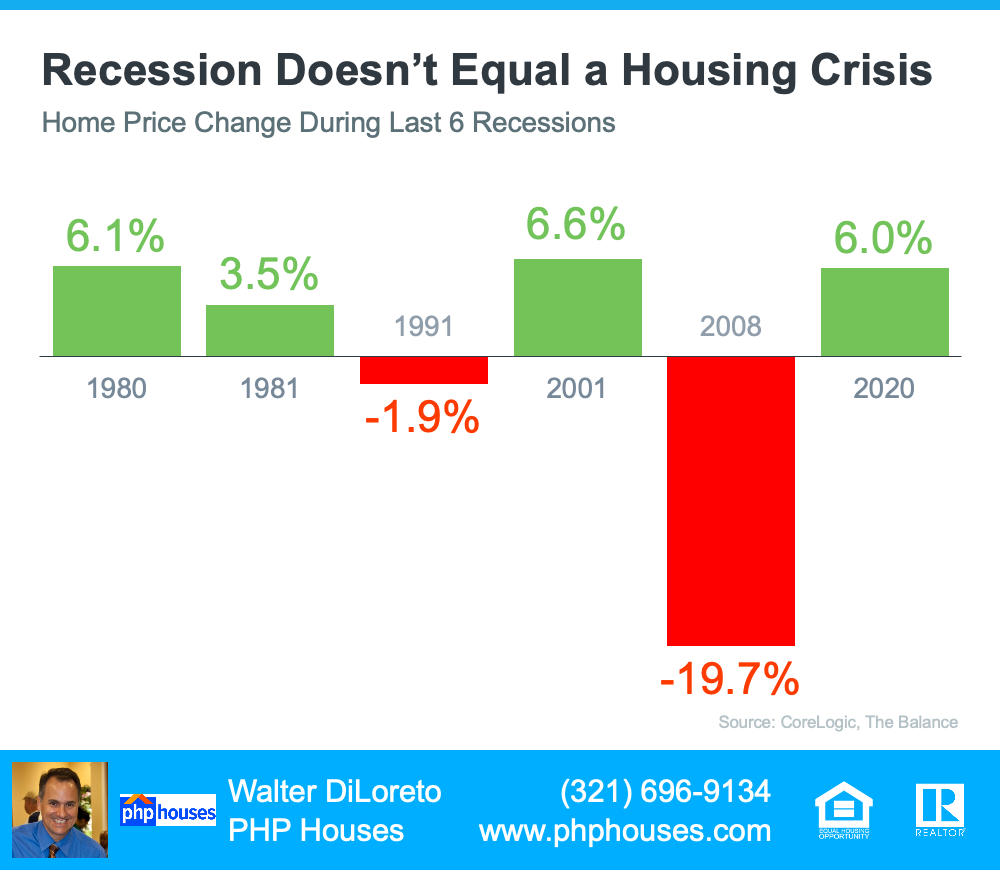

When you buy a home with a fixed-rate mortgage, you can lock in what’s likely your biggest monthly expense – your housing payment – for the duration of that loan, often 15-30 years.

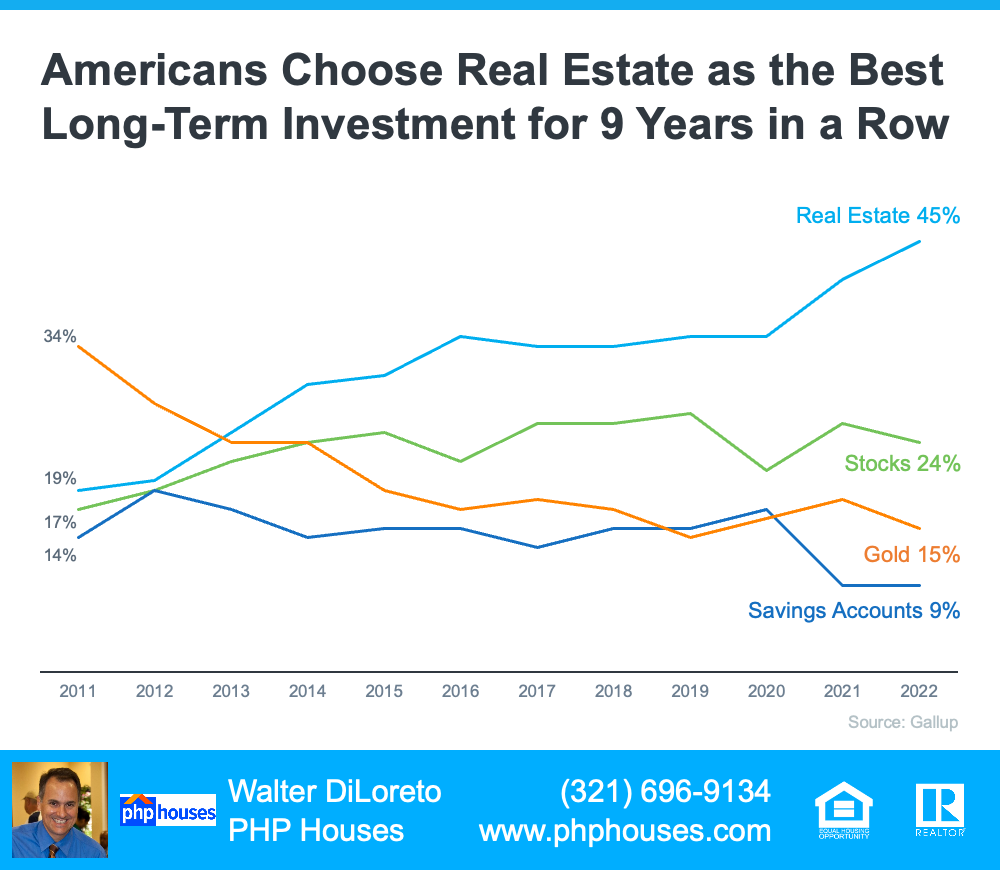

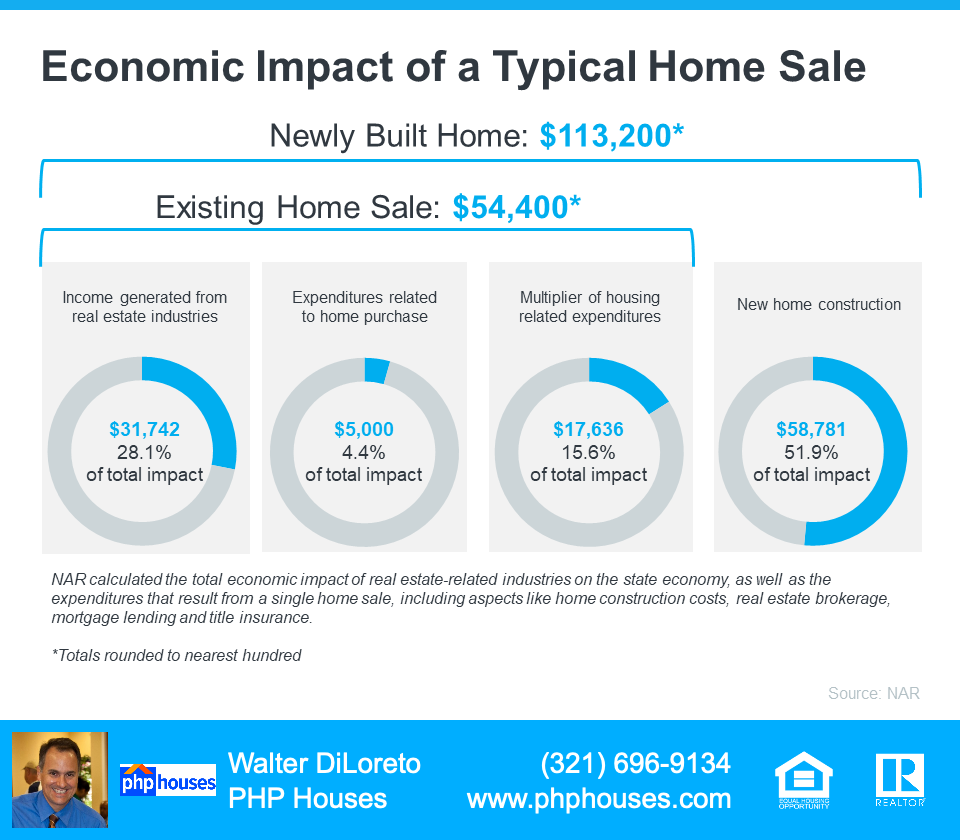

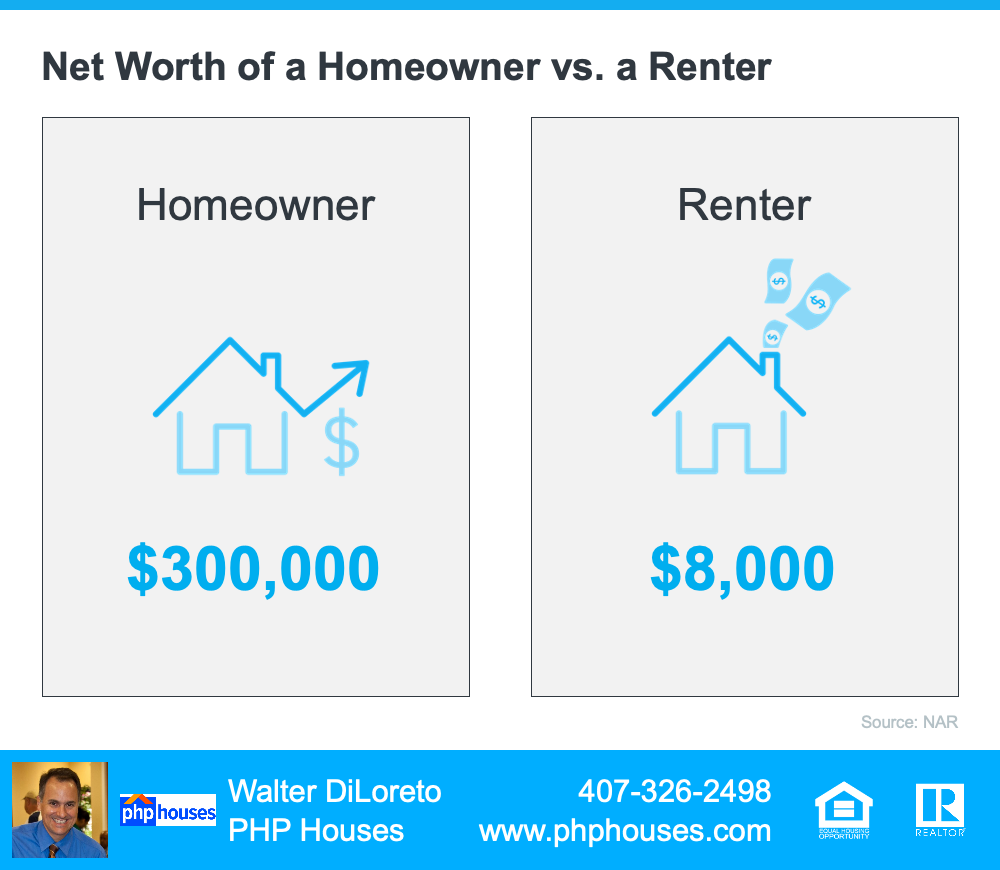

That gives you a predictable monthly housing expense that can benefit you in the short term, but you’ll also gain equity over time as your home appreciates in value and you make your monthly mortgage payment.

And with that growing equity, your net worth will increase as well. In fact, the latest data from NAR shows the median household net worth of a homeowner is roughly $300,000, while the median net worth of renters is only about $8,000. That means a homeowner’s net worth is nearly 40 times that of a renter.

Bottom Line

The U.S. homeownership rate is growing. If you’re ready to purchase the home of your dreams, let’s connect so you can begin the homebuying process today.

Contact us:

PHP Houses

142 W Lakeview Ave

Unit 1030

Lake Mary, FL 32746

Ph: (407) 641-1531

Fax: (407) 205-1951

email: info@phphouses.com

Let’s Connect:

Facebook

Linkedin

Twitter

Instagram

The information contained, and the opinions expressed, in this article are not intended to be construed as investment advice. The author does not guarantee or warrant the accuracy or completeness of the information or opinions contained herein. Nothing herein should be construed as investment advice. You should always conduct your own research and due diligence and obtain professional advice before making any investment decision. The author will not be liable for any loss or damage caused by your reliance on the information or opinions contained herein.