Today, Americans are moving for a variety of different reasons. The current health crisis has truly re-shaped our lifestyles and our needs. Spending extra time where we currently live is enabling many families to re-evaluate what homeownership means and what they find most important in a home.

According to Zillow:

“In 2020, homes went from the place people returned to after work, school, hitting the gym or vacationing, to the place where families do all of the above. For those who now spend the majority of their hours at home, there’s a growing wish list of what they’d change about their homes, if possible.”

With a new perspective on homeownership, here are some of the top reasons people are reconsidering where they live and making moves this year.

1. Working from Home

Remote work is becoming the new norm in 2020, and it’s continuing on longer than most initially expected. Many in the workforce today are discovering they don’t need to live close to the office anymore, and they can get more for their money if they move a little further outside the city limits. Lawrence Yun, Chief Economist for the National Association of Realtors (NAR) notes:

“With the sizable shift in remote work, current homeowners are looking for larger homes and this will lead to a secondary level of demand even into 2021.”

If you’ve tried to convert your guest room or your dining room into a home office with minimal success, it may be time to find a larger home. The reality is, your current house may not be optimally designed for this kind of space, making remote work and continued productivity very challenging.

2. Virtual Schooling

With school about to restart this fall, many districts are beginning the new academic year online. Education Week is tracking the reopening plans of schools across the country, and as of August 21, 21 of the 25 largest school districts are choosing remote learning as their back-to-school instructional model, affecting over 4.5 million students.

With a need for a dedicated learning space, it may be time to find a larger home to provide your children with the same kind of quiet room to focus on their schoolwork, just like you likely need for your office work.

3. A Home Gym

Staying healthy and active is a top priority for many Americans. With various levels of concern around the safety of returning to health clubs across the country, dreams of space for a home gym are growing stronger. The Home Builders Association of Greater New Orleans explains:

“For many in quarantine, a significant decrease in activity is more than a vanity issue – it’s a mental health issue.”

Having room to maintain a healthy lifestyle at home – mentally and physically – may prompt you to consider a new place to live that includes space for at-home workouts.

4. Outdoor Space

Especially for those living in an apartment or a small townhouse, this is a new priority for many as well. Zillow also notes the benefits of being able to use yard space throughout the year:

“People want more space in their next home, and one way to get it is by turning part of the backyard into a functional room, ‘an outdoor space for play as well as entertaining or cooking.’”

You may, however, not have the extra square footage today to have these designated areas – indoor or out.

Moving May Be Your Best Option

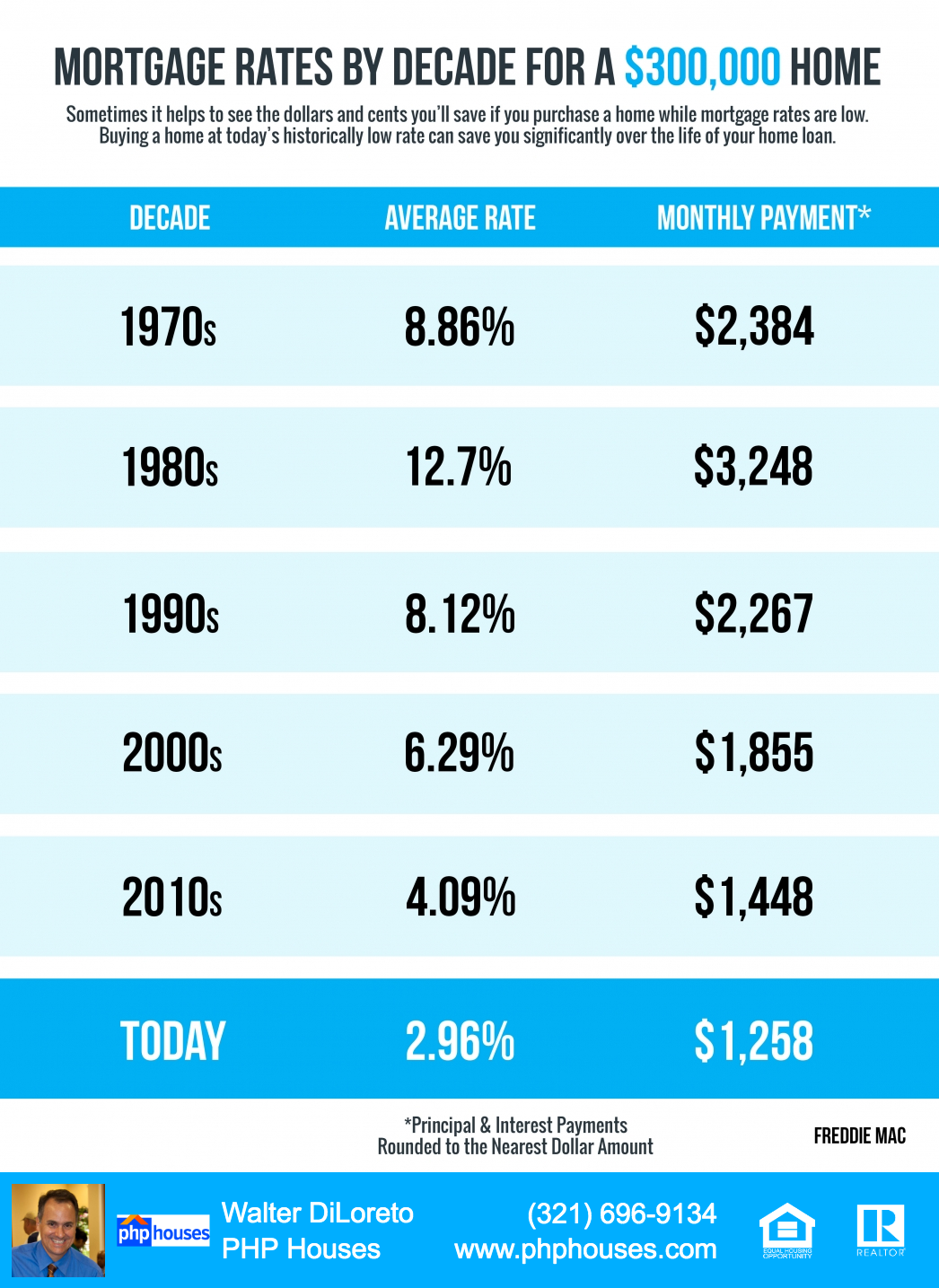

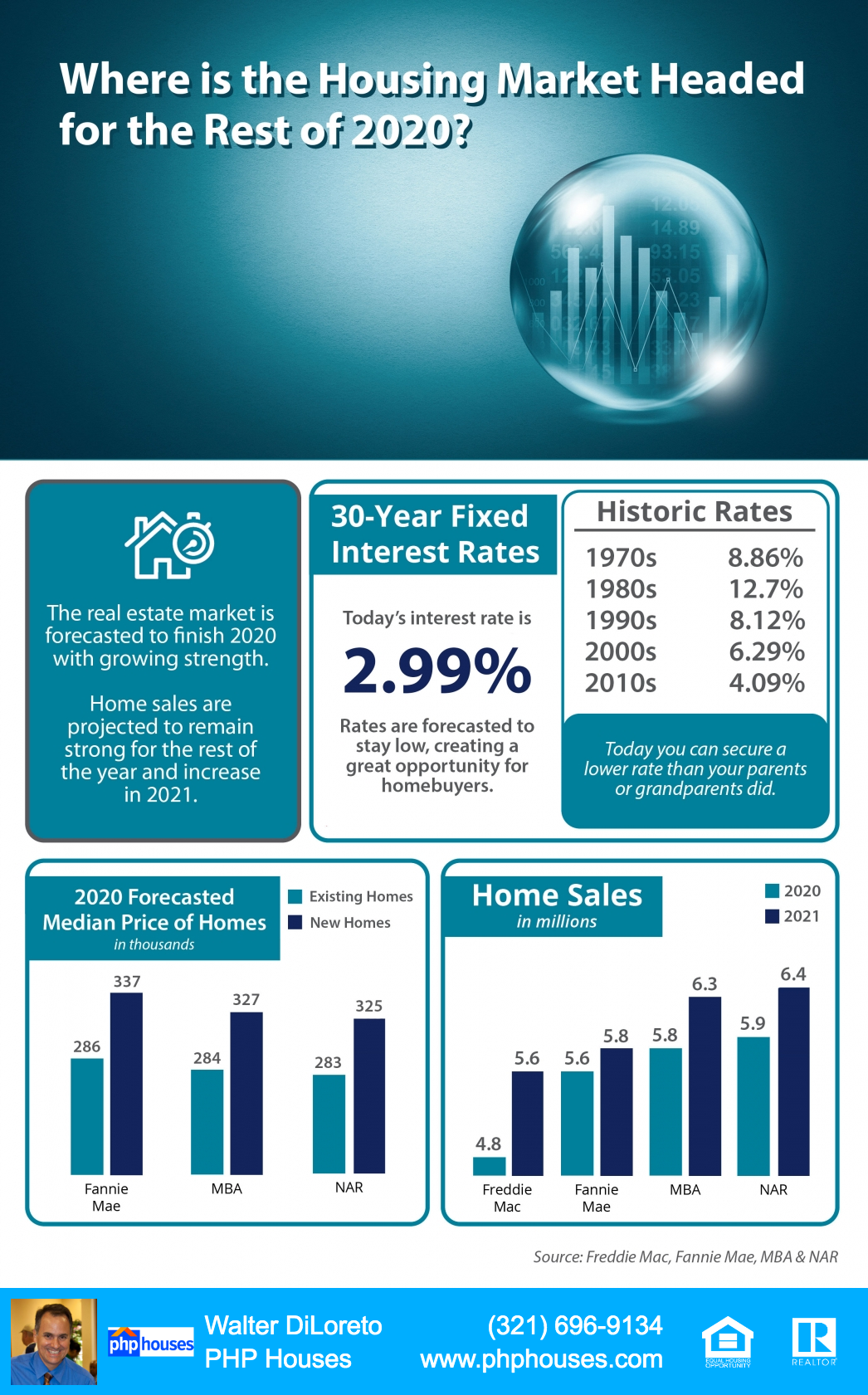

If you’re clamoring for extra space to accommodate your family’s changing needs, making a move may be your best bet, especially while you can take advantage of today’s low mortgage rates. Low rates are making homes more affordable than they have been in years. According to Black Knight:

“Buying power for those shopping for a home is up 10% year over year, with home buyers able to afford nearly $32,000 more home than they could have 1 year ago while keeping their monthly payment the same.”

It’s a great time to get more home for your money, just when you need the extra space.

Bottom Line

People are moving for a variety of different reasons today, and many families’ needs have changed throughout the year. If you’ve been trying to decide if now is the time to buy a new home, let’s connect to discuss your needs.

Contact us:

PHP Houses

142 W Lakeview Ave

Unit 1030

Lake Mary, FL 32746

Ph: (407) 519-0719

Fax: (407) 205-1951

email: info@phphouses.com

Let’s Connect:

Facebook

Linkedin

Twitter

Instagram