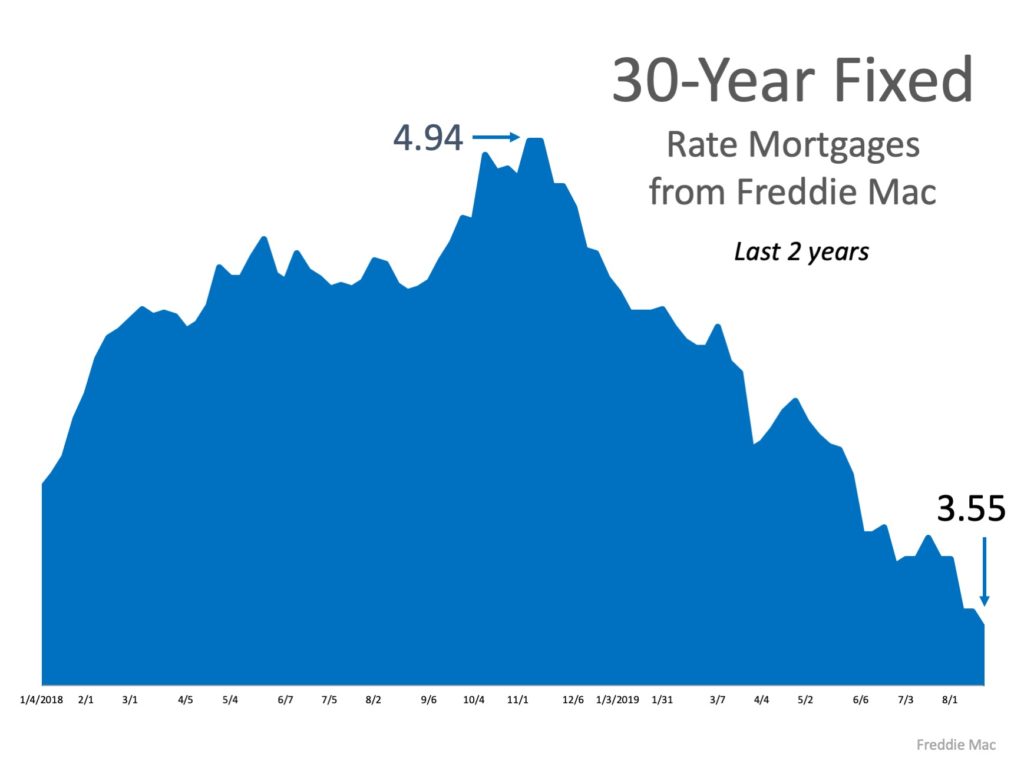

What’s the Latest on Interest Rates?

Mortgage rates have fallen by over a full percentage point since Q4 of 2018, settling at near-historic lows. This is big news for buyers looking to get more for their money in the current housing market.

According to Freddie Mac’s Primary Mortgage Market Survey,

“the 30-year fixed-rate mortgage (FRM) rate averaged 3.60 percent, the lowest it has been since November 2016.”

Sam Khater, Chief Economist at Freddie Mac, notes how this is great news for homebuyers. He states,

“…consumer sentiment remains buoyed by a strong labor market and low rates that will continue to drive home sales into the fall.”

As a potential buyer, the best thing you can do is work with a trusted advisor who can help you keep a close eye on how the market is changing. Relying on current expert advice is more important than ever when it comes to making a confident and informed decision for you and your family.

Bottom Line

Even a small increase (or decrease) in interest rates can impact your monthly housing cost. If buying a home is on your short list of goals to achieve, let’s get together to determine your best move.

PHP Houses

142 W Lake Mary Blvd

Ste 1030

Lake Mary FL 32746

Ph: (407) 519-0719

Fax: (407) 205-1951

email: info@phphouses.com

Experts Predict a Strong Housing Market for the Rest of 2019

We’re in the back half of the year, and with a decline in interest rates as well as home price and wage appreciation, many are wondering what the predictions are for the remainder of 2019.

Here’s what some of the experts have to say:

Ralph McLaughlin, Deputy Chief Economist for CoreLogic

“We see the cooldown flattening or even reversing course in the coming months and expect the housing market to continue coming into balance. In the meantime, buyers are likely claiming some ground from what has been seller’s territory over the past few years. If mortgage rates stay low, wages continue to grow, and inventory picks up, we can expect the U.S. housing market to further stabilize throughout the remainder of the year.”

Lawrence Yun, Chief Economist at NAR

“We expect the second half of year will be notably better than the first half in terms of home sales, mainly because of lower mortgage rates.”

“The drop in mortgage rates continues to stimulate the real estate market and the economy. Home purchase demand is up five percent from a year ago and has noticeably strengthened since the early summer months…The benefit of lower mortgage rates is not only shoring up home sales, but also providing support to homeowner balance sheets via higher monthly cash flow and steadily rising home equity.”

Bottom Line

The housing market will be strong for the rest of 2019. If you’d like to know more about our specific market, let’s get together to discuss what’s happening in our area.

PHP Houses

142 W Lake Mary Blvd

Ste 1030

Lake Mary FL 32746

Ph: (407) 519-0719

Fax: (407) 205-1951

email: info@phphouses.com

American Confidence in Housing at an All-Time High

Fannie Mae just released the July edition of their Home Purchase Sentiment Index (HPSI). The HPSI takes information regarding consumers’ confidence in the real estate market from Fannie Mae’s National Housing Survey and condenses it into a single number. Therefore, the HPSI reflects consumers’ current views and forward-looking expectations of housing market conditions.

Great News! The index reached its highest level since Fannie Mae began their survey. Breaking it down, the report revealed:

- The share of Americans who say it is a good time to buy a home increased from the same time last year.

- The share of those who say it is a good time to sell a home increased from the same time last year.

- The share of Americans who say they are not concerned about losing their job over the next 12 months increased dramatically (16 percentage points) from the same time last year.

- The share of Americans who say mortgage rates will go down over the next 12 months increased dramatically (24 percentage points) from the same time last year.

The day after the index was released, Freddie Mac also announced the 30-year fixed-rate mortgage rate fell to its lowest level in three years.

Doug Duncan, Senior Vice President and Chief Economist at Fannie Mae explained the uptick in the index:

“Consumer job confidence and favorable mortgage rate expectations lifted the HPSI to a new survey high in July, despite ongoing housing supply and affordability challenges. Consumers appear to have shaken off a winter slump in sentiment amid strong income gains. Therefore, sentiment is positioned to take advantage of any supply that comes to market, particularly in the affordable category.”

Bottom Line

Consumers are feeling good about the real estate market. Since Americans are not worried about their jobs, see mortgage rates near an all-time low, and believe it is a good time to buy, the housing market will remain strong for the rest of the year.

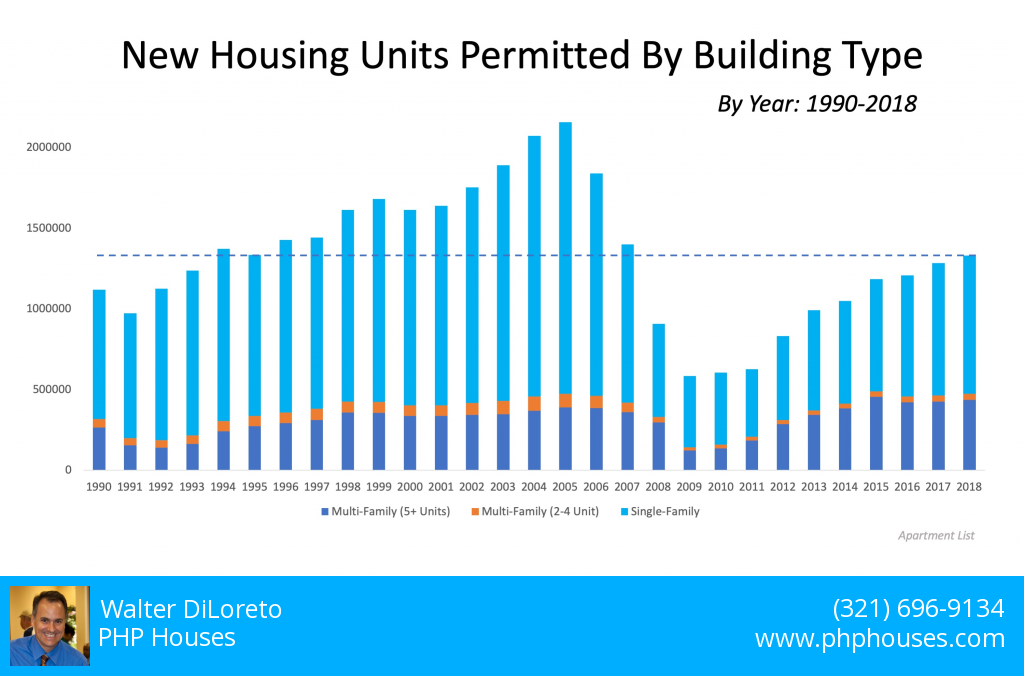

Housing Supply Not Keeping Up with Population Increase

Many buyers are wondering where to find houses for sale in today’s market. It’s a true dilemma. We see an increase in buyer demand, but the supply available for purchase isn’t keeping up.

The number of new housing permits issued prior to the great recession increased for 15 years until 2005 (from 1.12 million in 1990 to a pre-recession peak of 2.16 million in 2005). According to Apartment List,

“From 1990 to 2005, the number of single-family permits issued more than doubled, while the number of multi-family permits grew by 49 percent.”

When the housing market crashed, the number of new homes permitted decreased to its lowest level in 2009 (see below):

Since then, supply and demand have been out of balance when it comes to new construction. According to the same report,

“Construction of single-family homes has recovered much more slowly — the number of single-family housing units permitted in 2018 was barely half the number permitted in 2005.”

Why is new construction so important?

As the U.S. population increases, there is also an increase in the need for new homes. Today, new construction is not keeping up with the increase in the nation’s population. The report continues:

“The total number of residential housing units permitted in 2018 was roughly the same as the number permitted in 1994, when the country’s population was 20 percent less than it is today.”

Essentially, the dip in home building coupled with the steadily increasing U.S. population means there is now a selling opportunity for homeowners willing to list their current houses.

Bottom Line

If you’re considering selling your home to move up, now is a great time to get a positive return on your investment in a market with high demand. Let’s get together to determine the specific options available for you and your family.

Contact Us:

PHP Houses

142 W Lakeview Ave Ste 1030

Lake Mary, FL 32746

Ph: (407) 519-0719

Fax: (407) 205-1951

email: info@phphouses.com

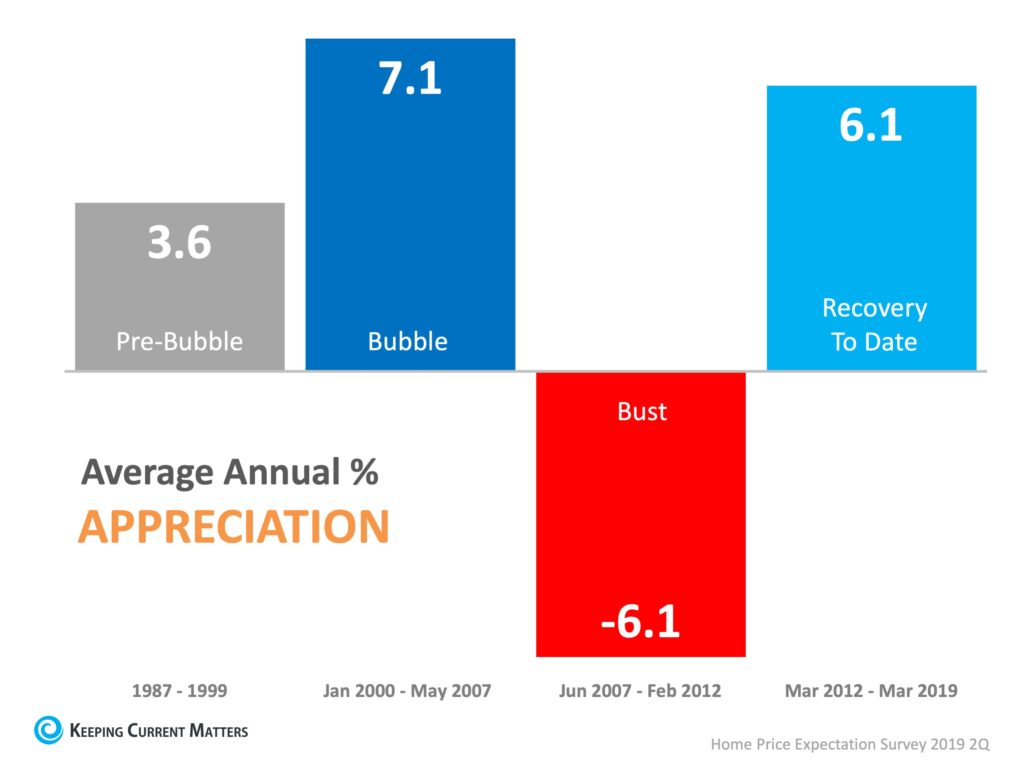

Appreciation Is Strong: It Might Be Time To Sell

There’s no doubt that today’s housing market is changing, and everything we see right now indicates it is time to sell. Here’s a look at why selling now is likely to drive the greatest return on your largest investment.

Home values have been appreciating for several years now, growing at a strong, steady, and impressive pace. In fact, the average annual appreciation rate since 2012 has nearly doubled the average rate from the more normal market of the 1990s (think: pre-bubble).

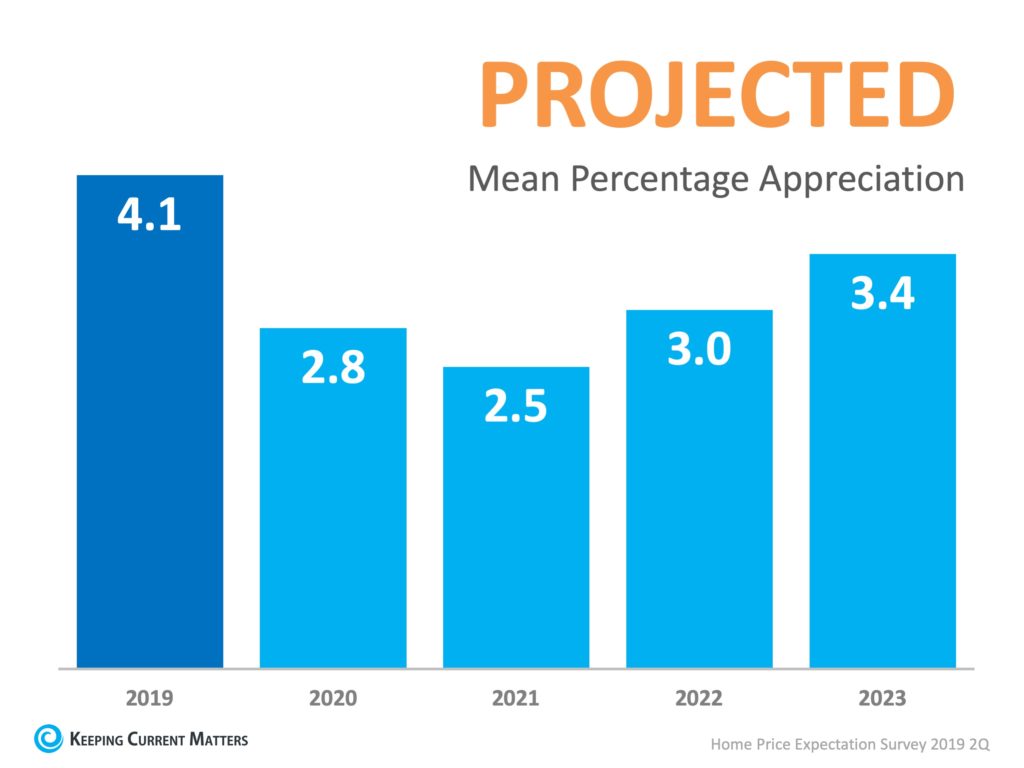

Appreciation, however, is projected to shift back toward normal, meaning home prices will likely keep climbing over the next few years, but they are not projected to continue to increase at such a high rate.

Here’s What That Means for Homeowners:

As noted in the latest Home Price Expectation Survey (HPES) powered by Pulsenomics, experts forecast an average annual appreciation rate closer to 3.2% over the next 5 years, which is more in line with a historically normal market (3.6%). The good news is, there’s still time to take advantage of the current strength of home prices by selling your house now.

Looking at the projections as they stand today, 2019 is slated to drive the strongest appreciation as compared to the upcoming few years. With average home prices still on the rise, the pace at which they are predicted to continue increasing will likely soften by 2020.

Bottom Line

If you’re thinking about selling your house, now is a great time to make your move. Don’t get stuck waiting until projected home price appreciation rates potentially re-accelerate again in 2023. You’ll likely earn the greatest return on your investment by selling now before the prices start to normalize next year.

Content by Keeping Current Matters

PHP Houses

142 W Lakeview Ave Ste 1030

Lake Mary, FL 32746

Ph: (407) 519-0719

Fax: (407) 205-1951

email: info@phphouses.com

5 Real Estate Reality TV Myths Explained

Have you ever been flipping through the channels, only to find yourself glued to the couch in an HGTV binge session? We’ve all been there, watching entire seasons of shows like “Property Brothers,” “Fixer Upper,”and “Love It or List It,” all in one sitting.

When you’re in the middle of your real estate-themed TV show marathon, you might start to think everything you see on the screen must be how it works in real life. However, you may need a reality check.

Reality TV Show Myths vs. Real Life:

Myth #1: Buyers look at 3 homes and decide to purchase one of them.

Truth: There may be buyers who fall in love and buy the first home they see, but according to the National Association of Realtors, the average homebuyer tours 10 homes as a part of their search.

Myth #2: The houses the buyers are touring are still for sale.

Truth: Everything is staged for TV. Many of the homes shown are already sold and are off the market.

Myth #3: The buyers haven’t made a purchase decision yet.

Truth: Since there is no way to show the entire buying process in a 30-minute show, TV producers often choose buyers who are further along in the process and have already chosen a home to buy.

Myth #4: If you list your home for sale, it will ALWAYS sell at the open house.

Truth: Of course, this would be great! Open houses are important to guarantee the most exposure to buyers in your area, but they are only one piece of the overall marketing of your home. Keep in mind, many homes are sold during regular showing appointments as well.

Myth #5: Homeowners decide to sell their homes after a 5-minute conversation.

Truth: Similar to the buyers portrayed on the shows, many of the sellers have already spent hours deliberating the decision to list their homes and move on with their lives and goals.

Bottom Line

Having an experienced professional on your side while navigating the real estate market is the best way to guarantee you can make the home of your dreams a true reality.

PHP Houses

142 W Lakeview Ave

Ste 1030

Lake Mary, FL 32746

Ph: (407) 519-0719

Fax: (407) 205-1951

email: info@phphouses.com

10 Tips to Sell Your Home Fast!

1. Get rid of clutter. Throw out or file stacks of newspapers and

magazines. Pack away most of your small decorative items. Store

and out of season clothing to make closets seem roomier.

Clean out the garage.

2. Wash your windows and screens to let more light into the interior.

3. Keep everything extra clean. Wash fingerprints from light switch

plates. Mop and wax floors. Clean the stove and refrigerator. A

clean house makes a better first impression and convinces buyers that

the home has been well cared for.

4. Get rid of smells. Clean carpeting and drapes to eliminate cooking

odors, smoke, and pet smells. Open the windows.

5. Put higher wattage bulbs in light sockets to make rooms seem

brighter, especially basements and other dark rooms. Replace any

burnt-out bulbs.

6. Make minor repairs that can create a bad impression. Small problems,

such as sticky doors, torn screens, cracked caulking, or a dripping

faucet, may seem trivial, but they’ll give buyers the impression

that the house isn’t well maintained.

7. Tidy your yard – cut the grass, rake the leaves, trim the bushes and edge

the walkways. In the winter, keep the stairs and driveway snow free.

8. Patch holes in your driveway and reapply sealant, if applicable.

9. Clean out your gutters and polish your front door, doorknob and house numbers.

10. Finally, list your home with Walter DiLoreto for maximum exposure and to ensure your home gets the attention it deserves. Walter will be there to help you every step of the way and make sure your home gets sold in today’s competitive market. Free Market Analysis

Contact Us:

Walter DiLoreto

142 W Lakeview Ave

Ste 1030

Lake Mary, FL 32746

Ph: (407) 519-0719

Fax: (407) 205-1951

email: info@phphouses.com

Connect to Us:

Facebook

Linkedin

Twitter

Instagram

Buying A Home Before Selling Your Existing Property

By Bill Gassett

Buying a home before selling an existing property you own is one of those real estate topics that I know gets debated quite a bit at the kitchen table all across America. It often happens unexpectedly.

You might be browsing the online housing ads, or you may just be driving in a neighborhood you like when you see it – a house you want, and for a great price to boot.

Unfortunately, you are still making payments on your current home.

You haven’t put it on the market yet, or you have, but it has yet to sell. Either way, you are in a tight position. Buying another home before selling your current property is a risky proposition for anyone without serious income. It is possible, but for most people, it is not recommended.

The question then becomes is buying a home before selling yours a smart move? Buying a house before selling your existing home is something only you can decide, but there are some things worth considering.

Benefits of Buying Before Selling

Even though most buyers are in no position to buy before selling their existing property, there are still a few benefits worth mentioning. There is a reason why you considered the idea in the first place, so it might be beneficial to review what you would have to gain.

You’re probably considering buying first because you found a property that is exactly what you want or one that is such a great deal that you feel like you cannot pass it up.

The reason could be more space is needed but just hadn’t gotten around to be a serious home buyer yet.

These are all legitimate reasons to want to buy a home, and opportunities like this can pop up, even if you have yet to sell your current home.

Everyone intends to get a great deal, and everyone has a dream home whether they have thoroughly thought through the idea yet or not.

When you come upon a house that fits one or both of these criteria, it can trigger some emotions and desires. You can picture yourself perfectly living in this new place, or you can see how much money you will net once you do sell your home.

You can also look forward to a smooth transition once you sell your home because you will have already purchased your new one.

If you have the finances, you may even see the potential benefits of carrying both houses – the old one with renters paying the mortgage while you enjoy your new home.

This could especially be worthwhile to you if the Real Estate market is on the rise and you see the potential for selling your existing home somewhere down the line for a more substantial profit.

Doing Work Before You Move In

Another significant benefit to buying another home before selling the one you currently own is the ability to go in ahead of time and make the improvements you desire so it is a place you will want to call home.

Some of the improvements that are a heck of a lot easier to complete when a home is vacant are refinishing hardwood floors, painting, and even remodeling projects like kitchens and baths. Many would kill to be able to have all of these things done before the moving truck ever pulls into the driveway.

All of these benefits are things you might gain from buying before selling your property. However, it is worthwhile to look at the risks of such a proposition. There are reasons why so few people go this route.

Risks of Buying Before Selling Your Home

Finances

Buying a home before selling existing property can bring with it a lot of financial risks. The first thing to look at before you go buying the new house is your finances. Can you afford to pay both mortgages for an extended period?

This is something the bank is going to want to know, and something you should be clear on before you jump in. Selling a house is an uncertain business, and it could take months – possibly a year or more – before you can sell. If all things go well, this will not be the case. But you must be able to cover the payments on both mortgages for some time.

If you do not have this kind of money, you probably should not buy before selling. However, there are other ways that people have accomplished this, so they are worth mentioning. Whether they are an option in today’s market is another story, and will depend heavily on your particular money situation, the lending market and whether the housing market is currently for buyers or sellers.

Home Sale Contingencies

Few sellers are interested in home sale contingency clauses; the chances are very slim a prudent seller will be except one – especially in a seller’s market. By making a contingency offer, you tell a seller that you will buy his or her house for a certain price if and when your home sells.

You put your home up for sale as soon as you decide to do this, and you hope that it will sell quickly so you can buy the new house.

The problem with this arrangement and the reason why so few home sellers accept it is that they lose control of their transaction. A seller has no idea if you are going to do what it takes to sell your home.

They don’t know if you are going to price it correctly, market it right, or even have the best Realtor to sell it. The seller is virtually at your mercy to do what it takes to move onto the next phase of the transaction.

The seller on the other hand without accepting this type of contingency is still able to do what is necessary to get his or her place sold by dropping the price. They certainly know if you are truly serious when you put your home under contract you will be back anyways.

A right of First Refusal

Another typical arrangement you see in some Real Estate contracts is what’s called a right of first refusal. You establish agreed upon terms in a contract and give a specified amount of time that the seller has to provide you to exercise your right to proceed with the transaction should the seller receive another offer.

When the seller gets another offer, you have a short period (typically 24 -48 hours) to purchase the home before the deal dissolves – whether you have sold first or not. Most sellers today do not need to deal in contingency clauses, but it could be worth asking if you have no other choice.

What I need to make painfully clear about this is that the chances are incredibly remote the seller will accept either of these arrangements. When you submit, an offer on a property, a good listing agent representing the seller is going to want to know you can qualify to purchase without selling your existing home.

In fact, one of the requirements I will have any buyer who currently owns a home and puts an offer in on one of my client’s homes is to provide a pre-approval mortgage letter that states exactly that.

The language must be explicit – “the buyer does not need to close on their existing home to make this purchase.” This assures the seller that they do not need to worry about a customer completing a transaction before the acquisition. Otherwise, a buyer could use the mortgage contingency clause in most Real Estate contracts as an escape clause to get their deposits back.

In regards to the right of first refusal unless the seller knows you can qualify to buy his/her home without selling it does not make sense to accept this kind of contract. A ready, willing and able buyer has made an offer on his/her home – why would they want to turn around and wait for someone to say yes or no who doesn’t even qualify to complete the sale?

They would be losing a buyer in hand who has nothing to sell! A few years back while working with a buyer client in Central Florida, even though I had explained to them that the vast majority of home sellers would not accept a contingency sale and they needed to get their home sold first, they didn’t listen.

Unfortunately for them, it took losing a home they wanted before coming to grips they needed to get their home listed and sold first.

After being in the Real Estate business for over 14 years, I find this is something that needs to be explained quite a bit. The are many buyers that think sellers are going to accept their contingency offer. Many have in the back of their mind that this is normal or that they have a very salable home – SORRY it does not work that way!

A seller could care less that YOU think your home is marketable.

Bridge Loan

You may have heard of a bridge loan, but do not bet on being able to get one. Bridge loans allow you to combine the payments of the old and the new home together, making it possible for you to transition from one residence to another. However, the catch with bridge loans is that you need to have considerable finances and excellent credit.

Mostly, you need to be one of the rare few that could afford the dual mortgage payments without the loan. A bridge loan was quite common many years ago, but this type of financing is far rarer nowadays.

Renters

Another avenue you can potentially look into when buying a home before you have sold the one you own is renting it out instead of selling. You may be thinking you can just rent out the old house to cover the mortgage while you move into your new home.

While this is an option, it does carry some risks. Renters can lead to severe wear and tear on your property and have little incentive to treat it with love and care you might.

If you are planning on keeping renters there just until you can sell it, you may run into even more problems. Your renters may want to continue living there and might make it unnecessarily difficult to show the house because of this.

Regarding finances, the lender is only going to count a portion of the rent you collect into the equation of whether or not you can qualify to carry both mortgages. Keep this in mind and make sure you do your due diligence before putting in the offer on your dream home.

Buying a Home Before Selling: Do So Only If Financially Wise

Not everyone sells his or her current home before buying a new one. However, the reality of buying a home makes such actions inadvisable for most. You may be able to do it, but make very certain that it is a smart financial move before doing so.

In my experience, most homeowners will opt to get their home sold first and then make an offer on their next place.

By doing so, you remove quite a bit of stress from the equation.

The next worry, of course, will be selling your home before you have found another home you really want to buy. This brings a whole different set of things to keep you up at night including finding temporary housing and a place to store all of your belongings.

These of course are legitimate concerns as nobody likes to think about making a “double move.”

In Real Estate we like to call the decision process for buying before selling or vice versa as the “chicken and egg question.” Essentially which option makes the most sense to do first based upon your life and financial position.

Only you can decide that, but these are the things you need to consider. As you can see, there are risks and benefits of buying a new property before you have sold your current home. Hopefully, you are now better informed to make the right decision when buying and selling real estate.

PHP Houses

142 W Lakeview Ave

Ste 1030

Lake Mary, Florida 32746

Ph: (407) 519-0719

Fax: (407) 205-1951

email: info@phphouses.com

website: www.PHPHouses.com

Best Ways To Find Homes For Rent Or Rent To Own

Numerous families are searching for elective lodging programs, things like lease to claim and proprietor financing. Much more families are searching for only a house to lease as contradict to a condo. Well in the event that you have ever attempted to discover a lease to possess house or a house offering proprietor financing, you may see that the undertaking is very testing. You don’t realize which organizations or merchants are legitimate and you don’t have the foggiest idea how to get the most determination to take a gander at. Here are a couple of tips on how you should direct your quest when searching for a decent, quality, lease to claim home or for leasing a house by and large.

Tip #1

Search for organizations that offer lease to claim lodging not proprietors willing to give you a lease to possess rent

Organizations that offer lease to possess lodging are substantially more liable to have assets that can enable you to buy the home you are leasing. Many lease to possess organizations have associations with bank moneylender and now and again have credit fix programs. An individual proprietor is progressively worried about simply selling their home and they might not have great working learning of what can assist you with purchasing the home. Proprietors are considerably more liable to leave the obtaining part to you and won’t offer any assistance.

Tip #2

Begin your hunt online before you drive through a territory

As though you didn’t know,you can look through regions a lot quicker on the web than driving and with the present gas costs, why trouble? Most lease to possess homes are recorded on the web and many don’t have signage on the real property. So you won’t realize that the houses are accessible. Notwithstanding, via looking through online you can qualify the property and ensure you meet all requirements for the property before consistently going out. It is certain to spare you some time.

Tip # 3

Quest the top locales for lease to claim, proprietor financing, or rent choices

The top locales that organizations and financial specialists post to are eBay Classifieds, Craigslist, Hot cushions, and lease bits. These locales have the most lease to claim, proprietor financing properties and will lead you to organizations that have some expertise in these kinds of exchanges.

Tip #4

Think about utilizing a real estate agent

A few real estate agents work with lease to possess and proprietor financing, particularly in this tight market. Call a couple of real estate agents and see what they can discover for you.

Utilizing these tips, you should locate an extraordinary, moderate spot. Simply ensure you discover a program you feel works for you and the conditions of your buy are clear.

Walter DiLoreto is the proprietor of PHP Houses. They have offered many houses to meriting families that were not ready to get bank credits at the time.