In today’s housing market, homeowners have a great opportunity to sell their house and receive the best terms for their personal situation. That’s because there’s a limited number of homes for sale, which is creating competition among buyers. Right now, homebuyers want three things:

- To be the winning bid on their dream home

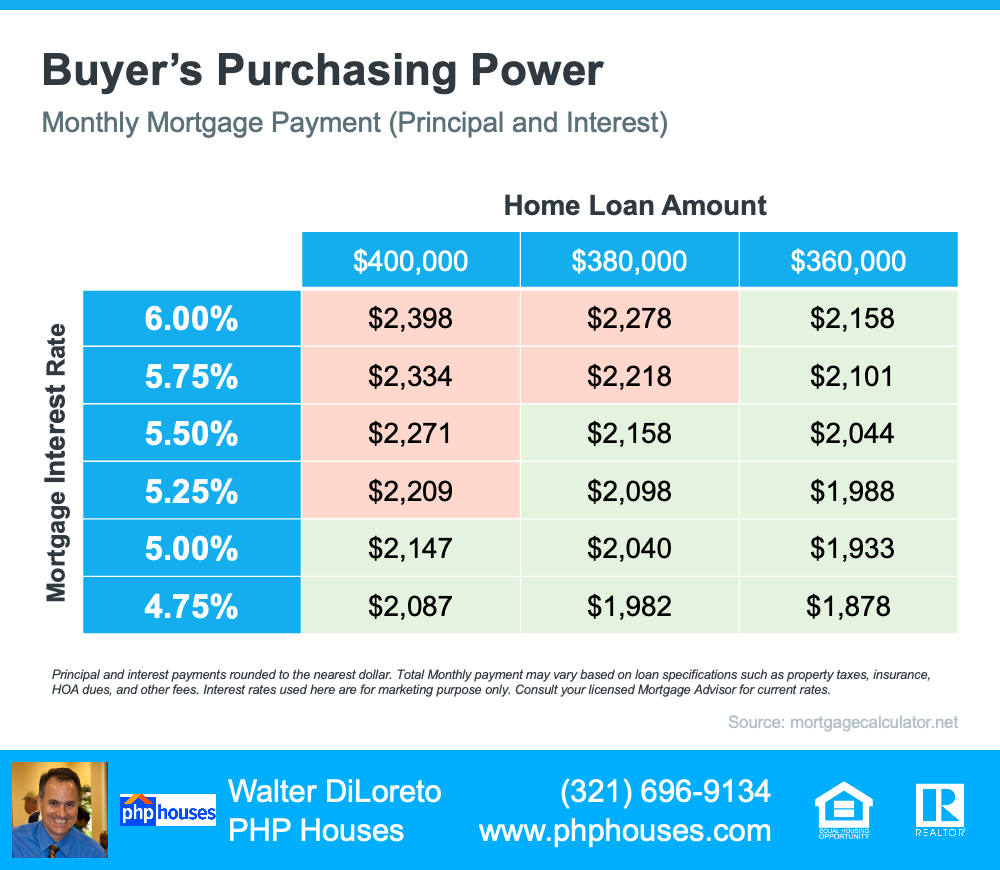

- To buy before mortgage rates rise more

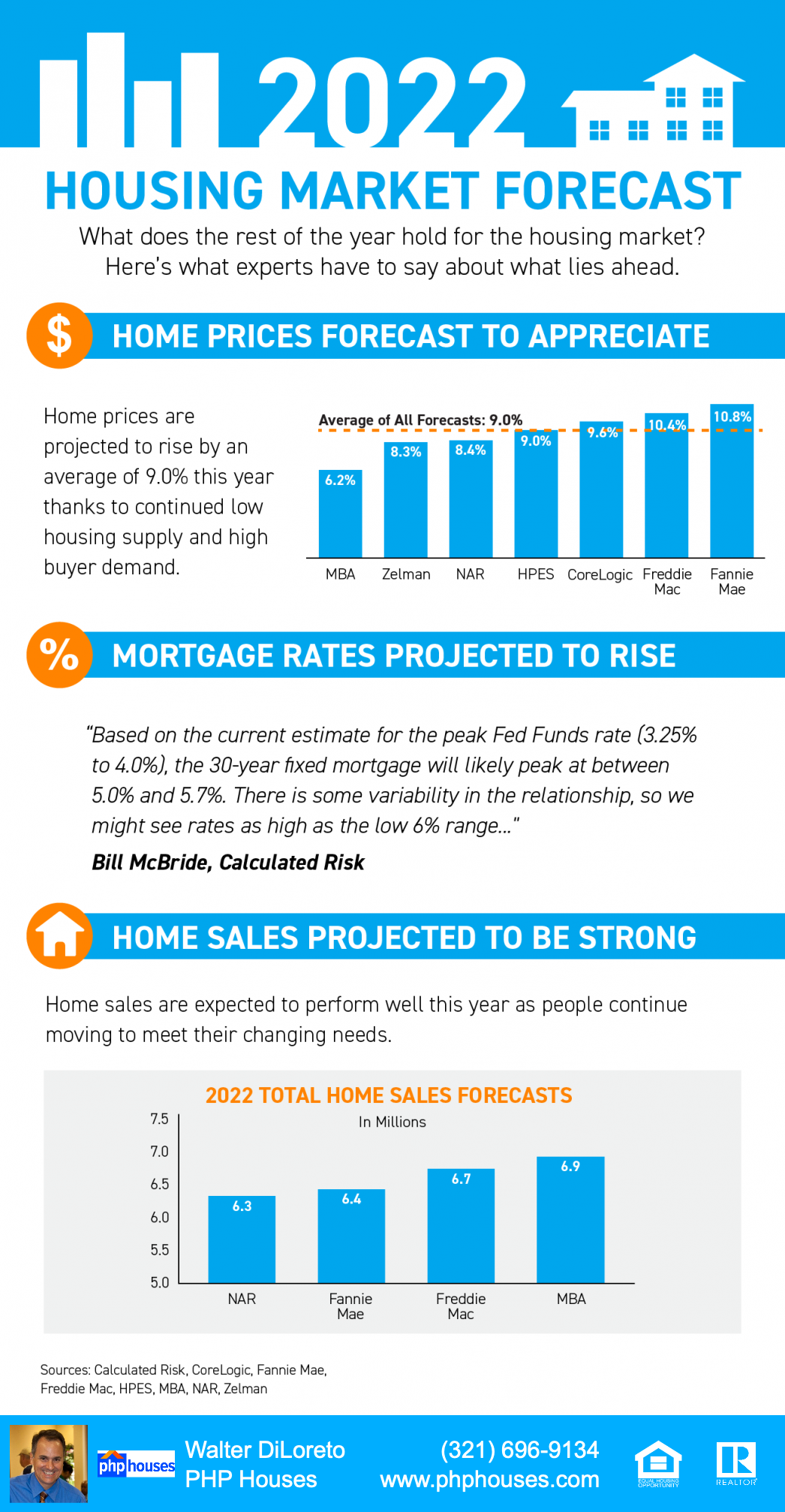

- To buy before home prices go even higher

These buyer needs give you an amazing advantage – also known as leverage – when you sell.

What Does This Mean for Sellers Today?

You might already realize this enables you to sell at a good price, but you’re also in a great position to get the best terms to suit your needs.

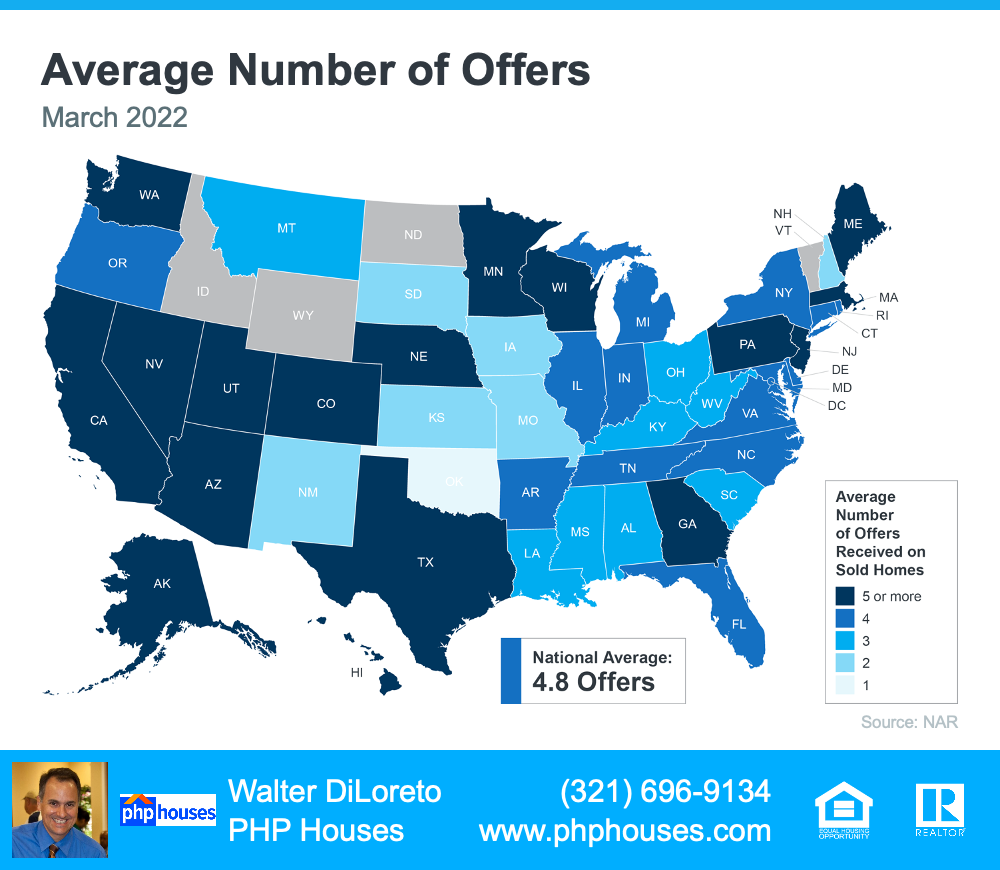

According to the latest Realtors Confidence Index from the National Association of Realtors (NAR), the average home sold is receiving 4.8 offers. That’s why there’s a good chance you’ll get offers from multiple buyers who are willing to compete for your house. When you do, you should look closely at the terms of each offer to find out which one has the best options for you.

And if you have questions at any point in the process, remember your trusted real estate advisor can help. They’re experts who understand the fine print, know how to compare the terms of various offers, and will help you select the best one for your situation.

Bottom Line

If you’re thinking of selling your home, know buyer demand in today’s market gives you a great opportunity to get the best terms and price when you sell your house. Let’s connect today to discuss how much leverage you have as a seller in today’s market.

Contact us:

PHP Houses

142 W Lakeview Ave

Unit 1030

Lake Mary, FL 32746

Ph: (407) 519-0719

Fax: (407) 205-1951

email: info@phphouses.com

Let’s Connect:

Facebook

Linkedin

Twitter

Instagram

The information contained, and the opinions expressed, in this article are not intended to be construed as investment advice. The author does not guarantee or warrant the accuracy or completeness of the information or opinions contained herein. Nothing herein should be construed as investment advice. You should always conduct your own research and due diligence and obtain professional advice before making any investment decision. The author will not be liable for any loss or damage caused by your reliance on the information or opinions contained herein.