Buyers Want To Know: Why Is Housing Supply Still So Low?

Buyers Want To Know: Why Is Housing Supply Still So Low?

One key question that’s top of mind for homebuyers this year is: why is it so hard to find a house to buy? The truth is, we’re in the ultimate sellers’ market, so real estate is ultra-competitive for buyers right now. The number of buyers searching for a home greatly outweighs how many homes are available for sale.

While low inventory in the housing market isn’t new, it’s a challenge that continues to grow over time. Here’s a look at two reasons why today’s housing supply is low and what that means for you.

1. New Home Construction Fell Behind for Several Years

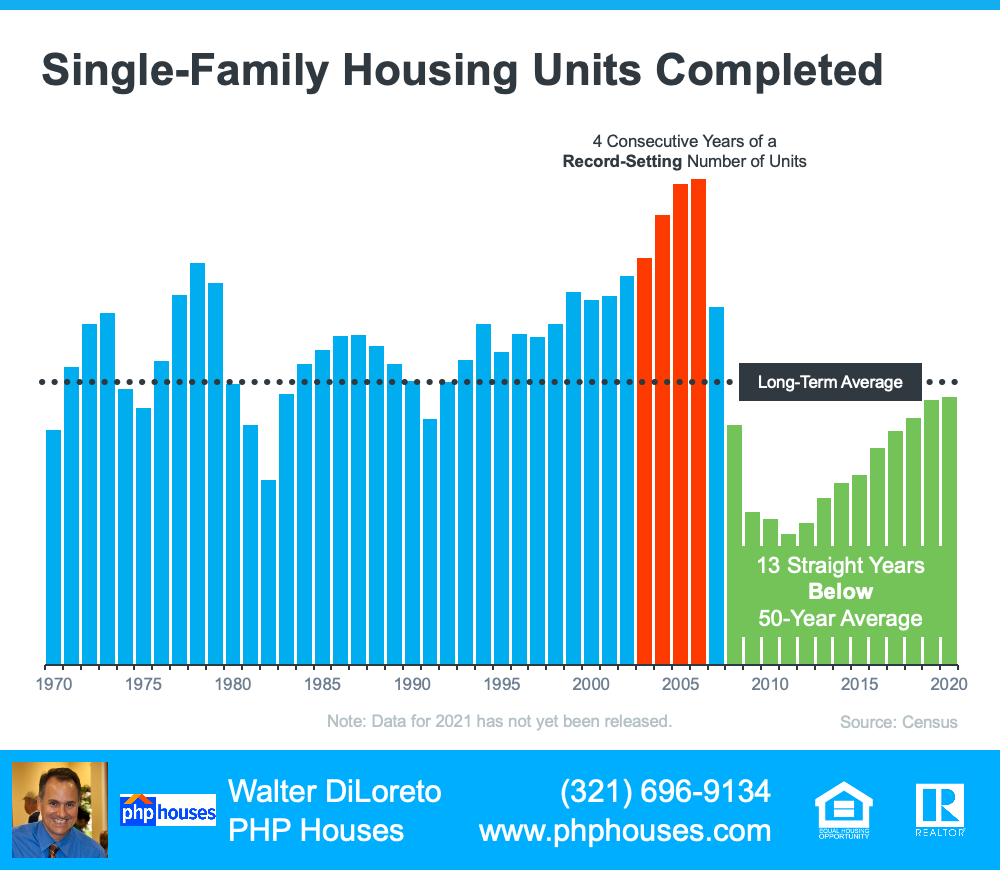

The graph below shows new home construction for single-family homes over the past five decades, including the long-term average for housing units completed. Builders exceeded that average during the housing bubble (shown in red on the graph). The result was an oversupply of homes on the market, so home values declined. That was one of the factors that led to the housing crash back in 2008.

Since then, the level of new home construction has fallen off. For the last 13 straight years, builders haven’t been able to construct enough homes to meet the historical average (as illustrated in green on the graph). That underbuilding left us with a multi-year inventory deficit going into the pandemic.

Single-Family Housing Units Completed

2. The Pandemic’s Impact on the Housing Market

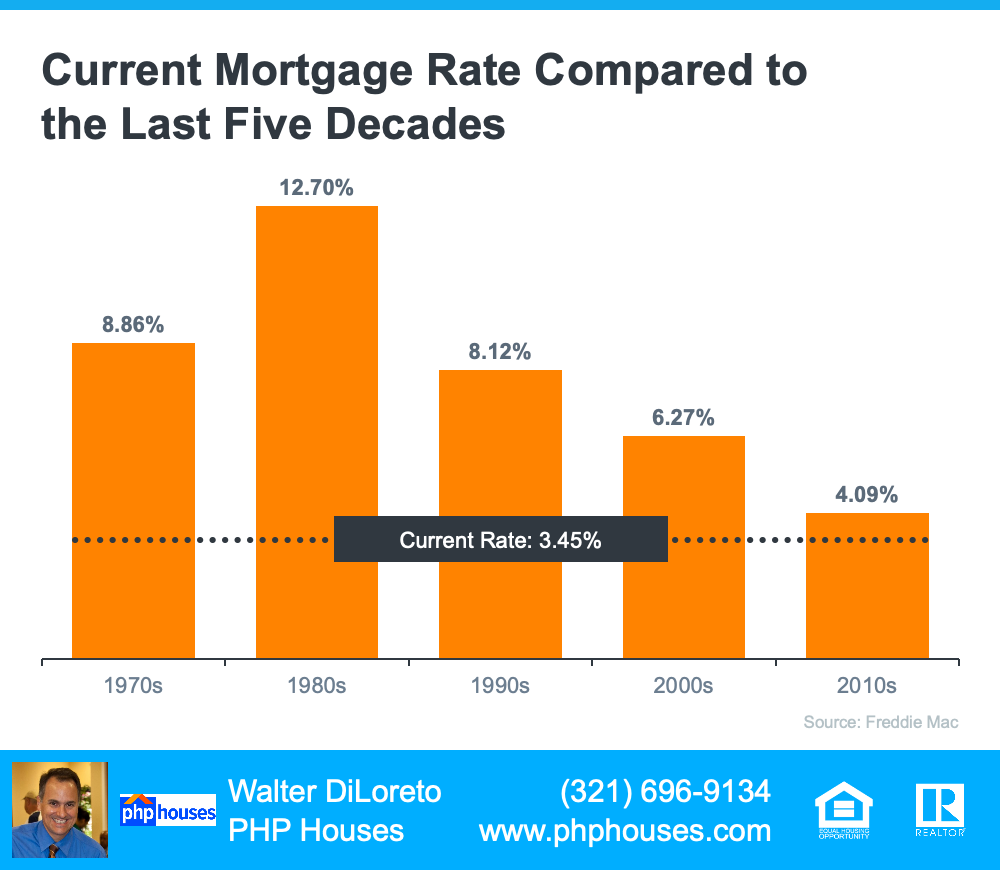

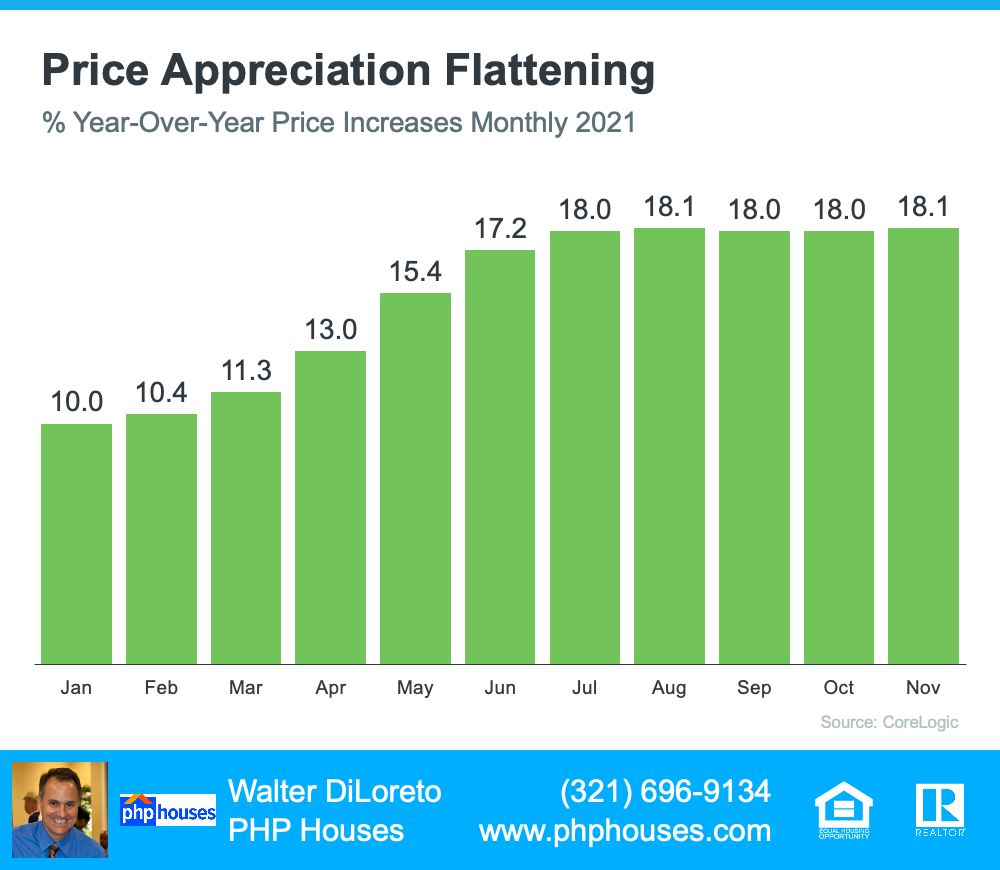

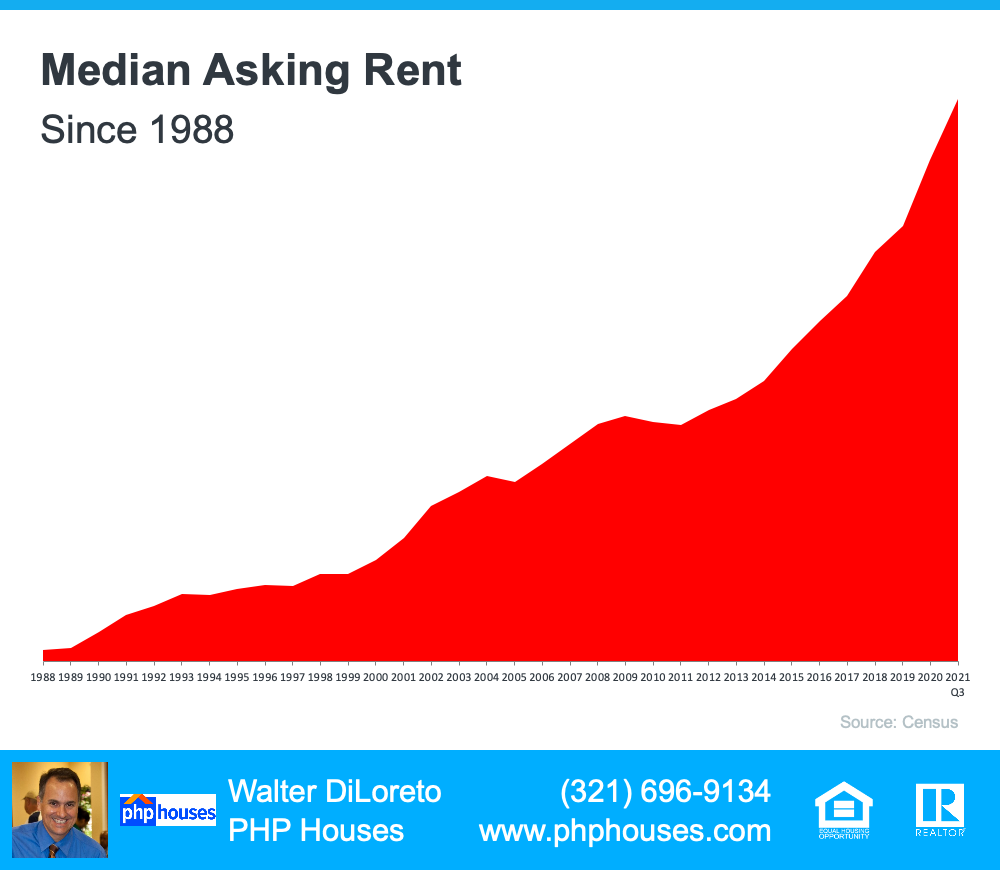

Then, when the pandemic hit, it fueled a renewed appreciation and focus on the meaning of home. Having a safe space to live, work, school, and exercise became even more important for Americans throughout the country. So, as mortgage rates dropped to at or below 3%, buyers eagerly entered the market looking to capitalize on those low rates to secure a home that would fulfill their changing needs. At the same time, sellers hesitated to put their houses on the market as concerns about the pandemic mounted.

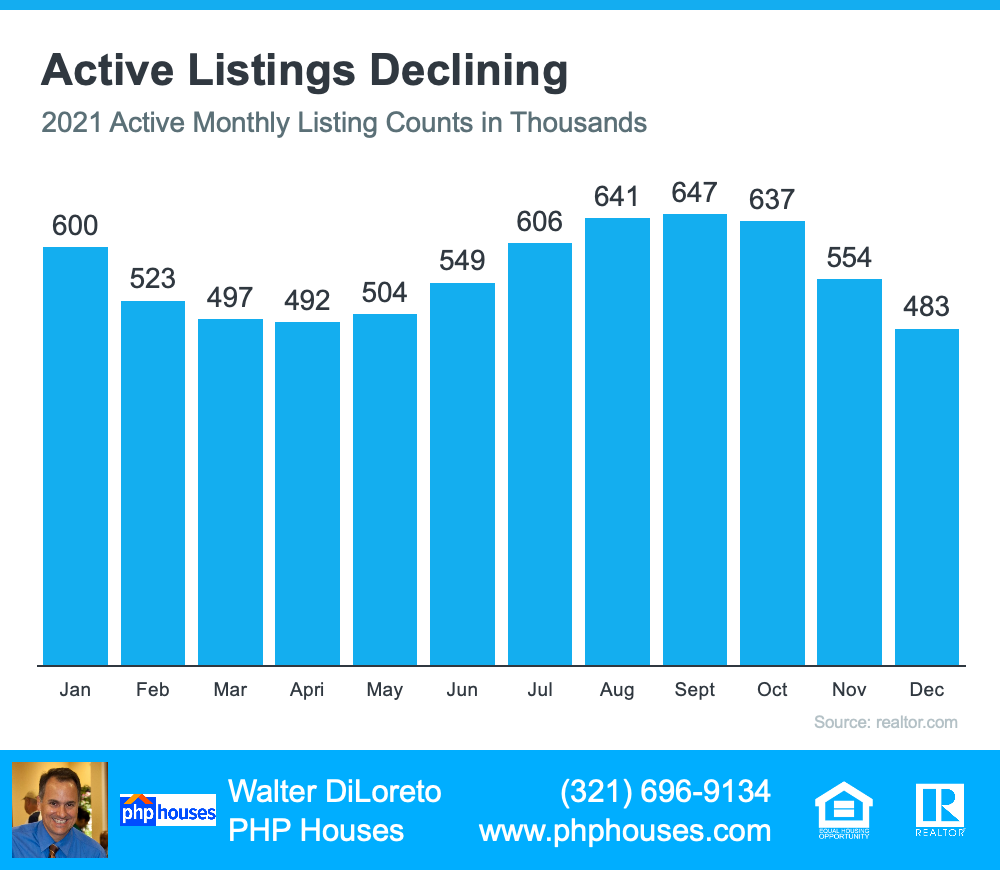

The result? The number of homes available for sale dropped even further. A recent article from realtor.com explains:

“Last month, the number of home listings dropped 26.8% compared with the same time a year earlier. This meant there were about 177,000 fewer homes listed in what’s already typically a slower month due to the holidays and colder weather. . . .”

What Does All of This Mean for You?

For a buyer, low inventory can be a challenge. You want to find the home of your dreams, and you don’t want to settle. But what if there just aren’t that many homes to choose from?

There is some good news. Experts are projecting more homes will soon become available thanks to sellers re-entering the market. Danielle Hale, Chief Economist at realtor.com, shares this hope, but offers perspective:

“We expect that we’ll start to see a turnaround and inventory will stabilize and start to go up a little bit in 2022. . . . But that means we’re looking at inventory levels of roughly half of what we saw before the pandemic. For buyers, the market is likely to continue to move fast. If you see a home you like, you want to jump on it right away.”

Basically, inventory is still low, even though more homes are coming. But you shouldn’t put your plans on hold because you’re waiting for those additional houses to hit the market. Instead, stick with your search and persevere through today’s low inventory. You can find your next home if you’re patient and focused.

Remember your goals and why finding a home is so important. Those things should be the driving force behind your search. Share them with your agent and be clear about your priorities. Your trusted advisor is your greatest support as you navigate today’s low housing supply to find the home of your dreams.

Bottom Line

If you’re planning to buy this year, the key to success will be patience given today’s low inventory. Let’s connect to discuss what’s happening in our area, what homes are available, and why it’s still worthwhile to prioritize your home search today.

Contact us:

PHP Houses

142 W Lakeview Ave

Unit 1030

Lake Mary, FL 32746

Ph: (407) 519-0719

Fax: (407) 205-1951

email: info@phphouses.com

Let’s Connect:

Facebook

Linkedin

Twitter

Instagram