Did you know that each year in the United States, we celebrate “National Roof Over Your Head Day” on December 3rd?

As noted on the National Calendar, it was “created as a day to be thankful for what you have, starting with the roof over your head. There are many things that we have that we take for granted and do not stop to appreciate how fortunate we are for having them.”

From bungalows to cottages, and farmhouses to treehouses, today we show our appreciation and gratitude for the places we call home. Owning the roof that shelters us is something many renters still aspire to, knowing there are so many financial and non-financial benefits to homeownership.

According to the 2019 State of the Nation’s Housing from the Joint Center for Housing Studies of Harvard University,

“Cost-burdened renters now outnumber cost-burdened homeowners by more than 3.0 million. In addition, renters make up 10.8 million of the 18.2 million severely burdened households that pay more than half their incomes for housing.”

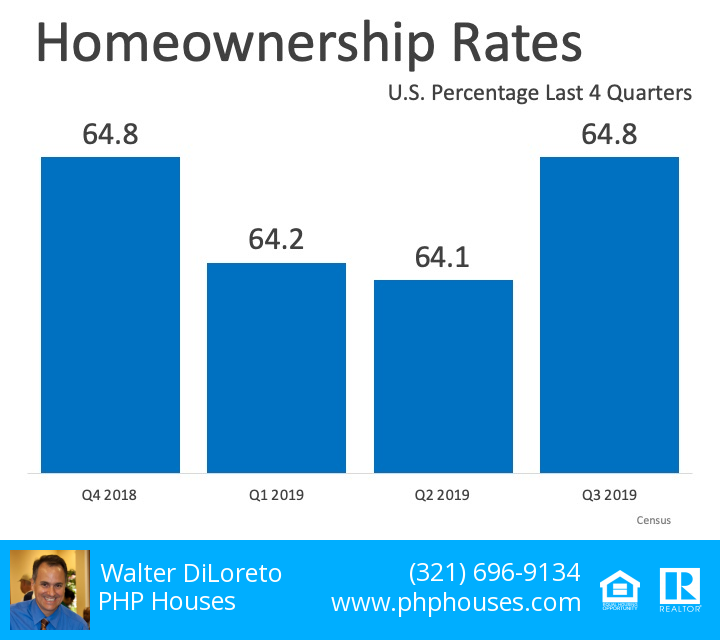

Homeownership drives many benefits, including providing families with a place to feel secure. It also helps promote confidence that they are investing proactively in themselves and their communities. That is why there are 77.7 million owner-occupied housing units in the United States.

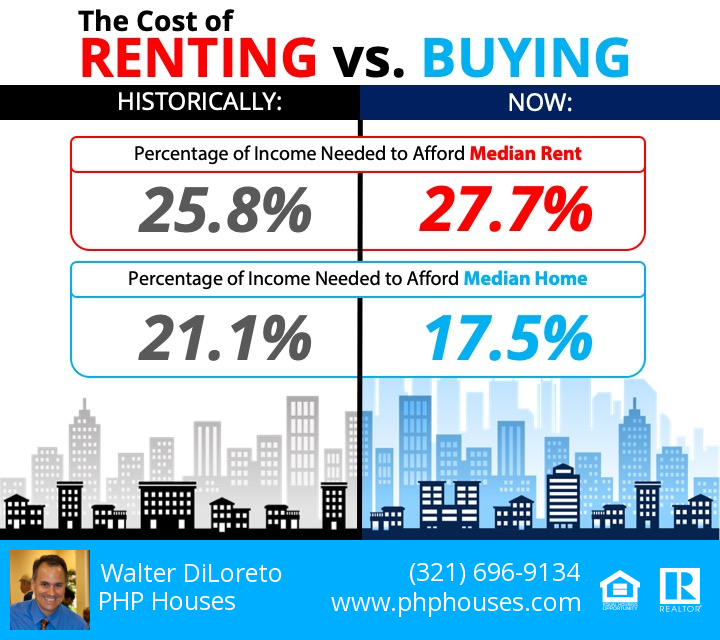

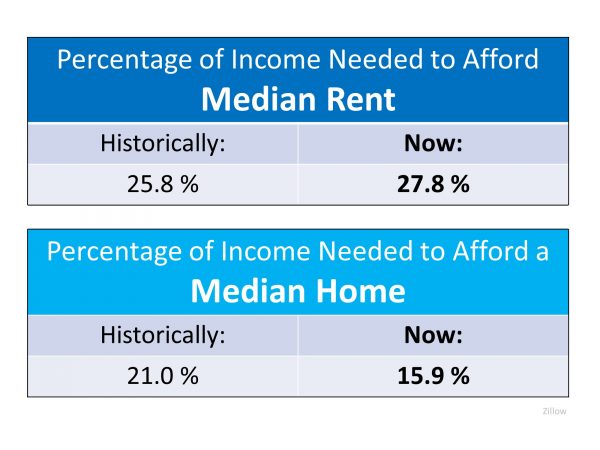

Many, however, fear it is too expensive to own a home. In reality, however, it’s actually more expensive to rent. Above’s the breakdown as a percentage of income necessary for both – affording median rent and owning a home.

Bottom Line

Today we pause to appreciate the places we call home, and all of the other reasons we have to be truly thankful. For those who don’t own yet and would like to, it’s a wonderful time to start identifying the steps to take toward homeownership. Let’s connect today to begin creating your plan.

Contact us:

PHP Houses

142 W Lakeview Ave

Unit 1030

Lake Mary, FL 32746

Ph: (407) 519-0719

Fax: (407) 205-1951

email: info@phphouses.com