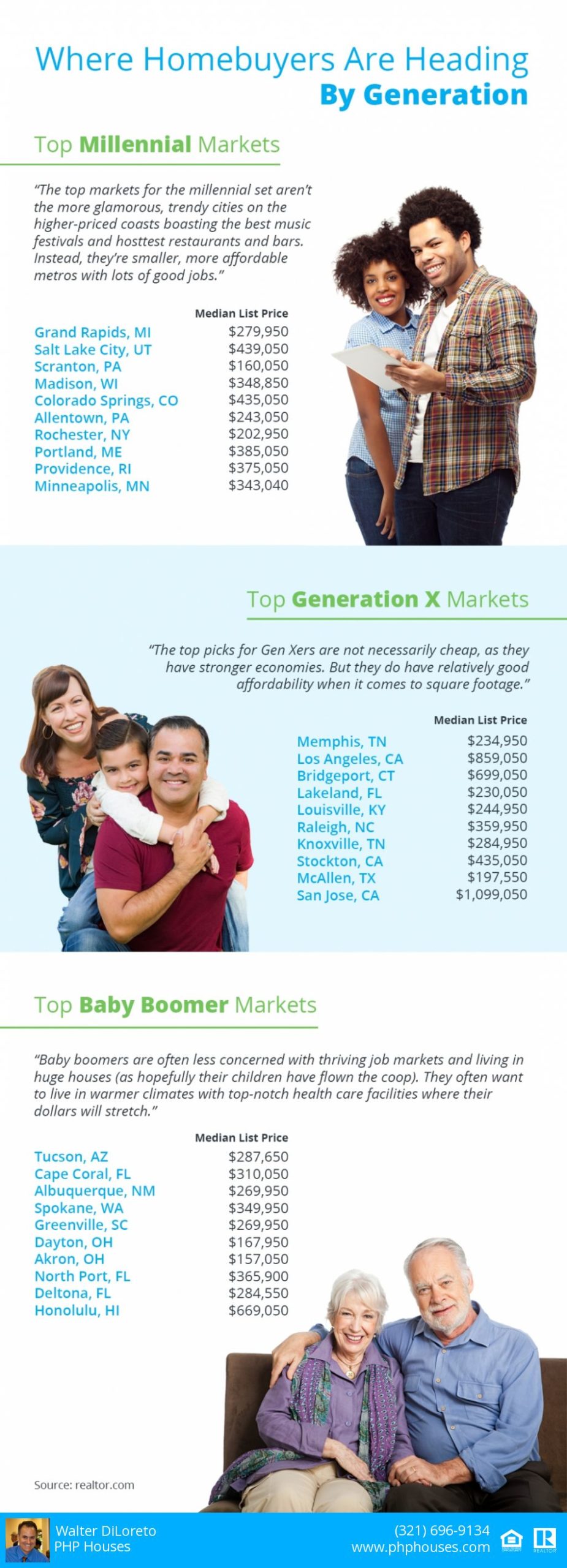

If you’re a millennial, homebuying might be top of mind for you. Your generation is the largest group of homebuyers in the market today and has been since 2014, according to the National Association of Realtors (NAR). And while other millennials are looking to buy for the first time, you may be one of the many who are now discovering you’ve outgrown your home.

If that’s the case, you’re not alone. The past two years brought about significant changes for many people, and today, homeowners are reevaluating what they truly need in a home. As a recent report from the Wall Street Journal states:

“They say the pandemic and the emergence of remote work accelerated millennial home-buying trends already under way. . . . Millennials who already owned homes traded up for more space.”

So, if you’re working remotely now or simply have a growing need for additional space, it may be time to move. And even if you purchased your current home sometime over the last few years, you can still move into a different one that has the space and features you’re looking for. That’s because there’s a good chance you have more equity than you realize. As Diana Olick, Real Estate Correspondent for CNBC, notes:

“The stunning jump in home values over the course of the Covid-19 pandemic has given U.S. homeowners record amounts of housing wealth. . . . Even homeowners who weren’t listing their properties for sale were gaining equity. About 42% of homeowners were considered equity-rich at the end of last year, meaning their mortgages were half or less than half the value of their home.”

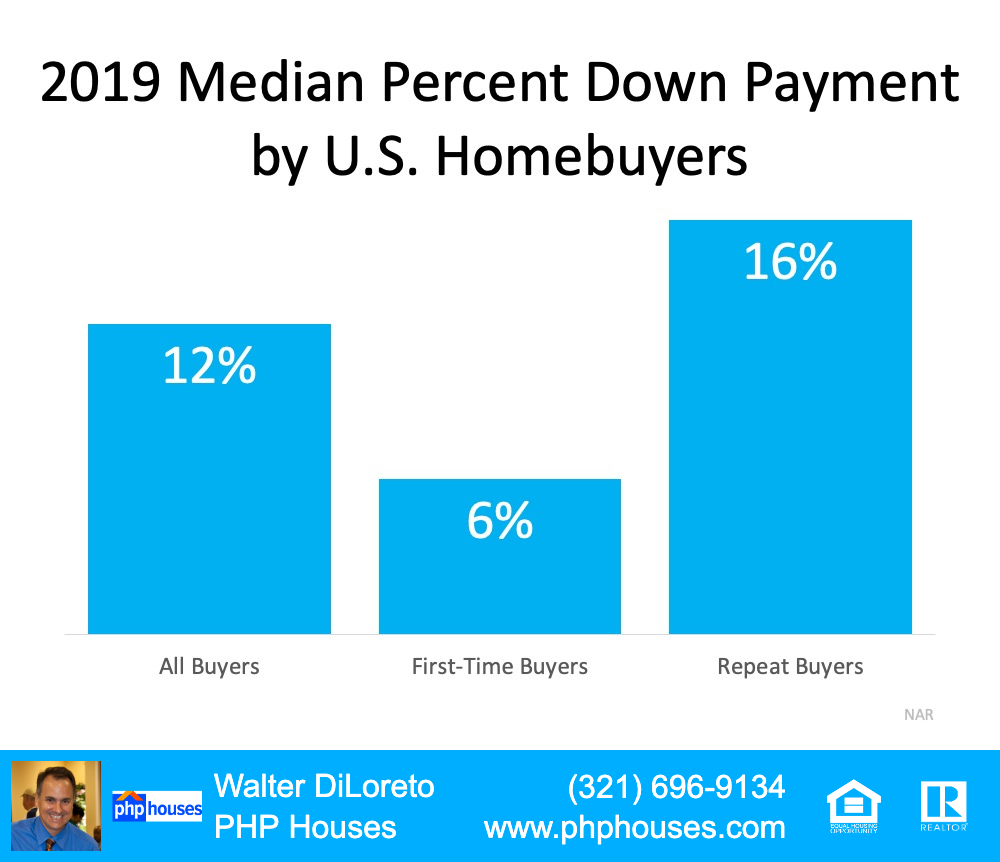

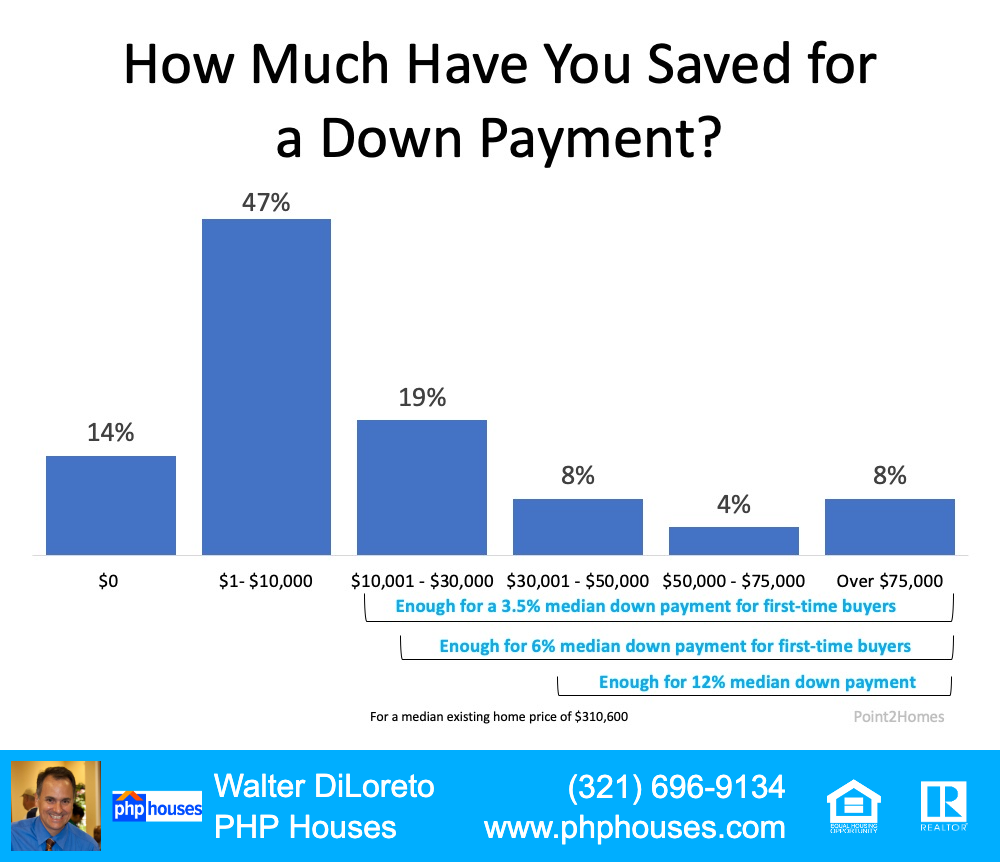

Growing equity can be the key you need to fuel your next move, especially if you’re looking to purchase a larger home. When you sell your current house, the equity that comes back to you in the sale can be used toward the down paymenton your next home.

In other words, your purchasing power may be greater than you realize, making a move to a larger home a realistic option. That, plus your changing needs, might make moving now more desirable than ever.

Bottom Line

If you’re a millennial thinking about moving this year, you’re not alone. Let’s connect today to discuss the equity you have in your current home and the opportunities it can create.

Contact us:

PHP Houses

142 W Lakeview Ave

Unit 1030

Lake Mary, FL 32746

Ph: (407) 519-0719

Fax: (407) 205-1951

email: info@phphouses.com

Let’s Connect:

Facebook

Linkedin

Twitter

Instagram

The information contained, and the opinions expressed, in this article are not intended to be construed as investment advice. The author does not guarantee or warrant the accuracy or completeness of the information or opinions contained herein. Nothing herein should be construed as investment advice. You should always conduct your own research and due diligence and obtain professional advice before making any investment decision. The author will not be liable for any loss or damage caused by your reliance on the information or opinions contained herein.