A recent survey by Lending Tree tapped into behaviors of over 1,000 prospective buyers. The results indicated 53% of all homebuyers are more likely to buy a home in the next year, even amid the current health crisis. The survey further revealed why, naming several reasons buyers are more likely to move this year (see graph below):

Let’s break down why these are a few of the key factors motivating buyers to actively engage in the home search process, and the corresponding wins for sellers as well.

1. Low Mortgage Rates

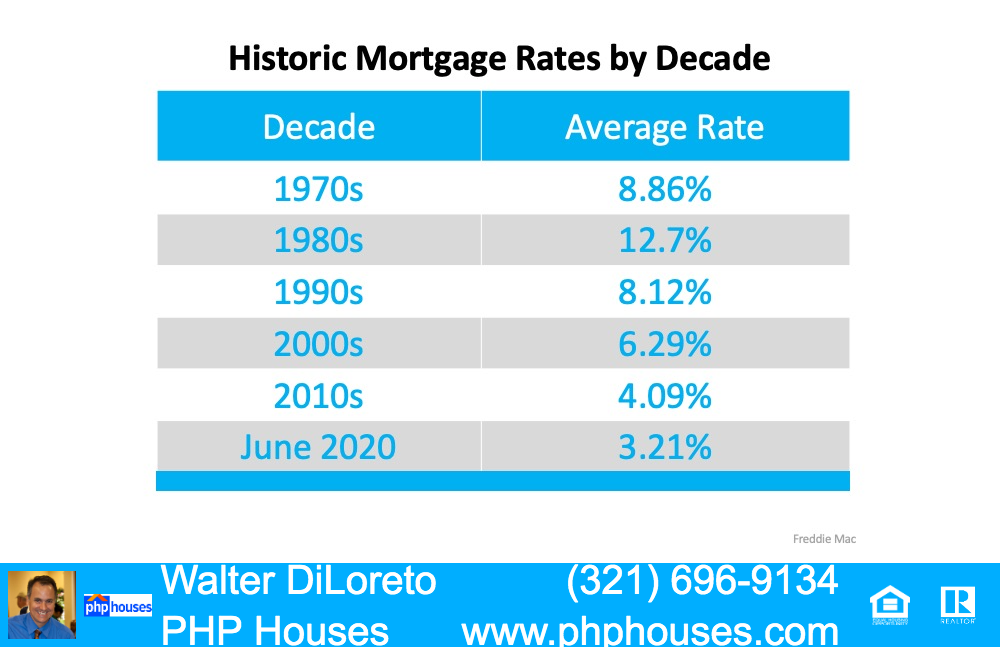

The biggest reason potential homebuyers indicated they’re eager to purchase this year is due to current mortgage rates, which are hovering near all-time lows. Today’s low rates are making it more affordable than ever to buy a home, which is a huge incentive for purchasers. In fact, 67% of respondents in the Lending Tree survey want to take advantage of low mortgage rates. This is no surprise when comparing historic mortgage rates by decade (see below):

Sam Khater, Chief Economist at Freddie Mac recently said:

“As the economy is slowly rebounding, all signs continue to point to a solid recovery in home sales activity heading into the summer as prospective buyers jump back into the market. Low mortgage rates are a key factor in this recovery.”

2. Reduced Spending

Some people have also been able to save a little extra money over the past few months while sheltering in place. One of the upsides of staying home recently is that many have been able to work remotely and minimize extra spending on things like commuting expenses, social events, and more. For those who fall into this category, they may have a bit more saved up for down payments and closing costs, making purchasing a home more feasible today.

3. Re-Evaluating Their Space

Spending time at home has also given buyers a chance to really evaluate their living space, whether renting or as a current homeowner. With time available to craft a wish list of what they really need in their next home, from more square footage to a more spacious neighborhood, they’re ready to make it happen.

What does this mean for buyers and sellers?

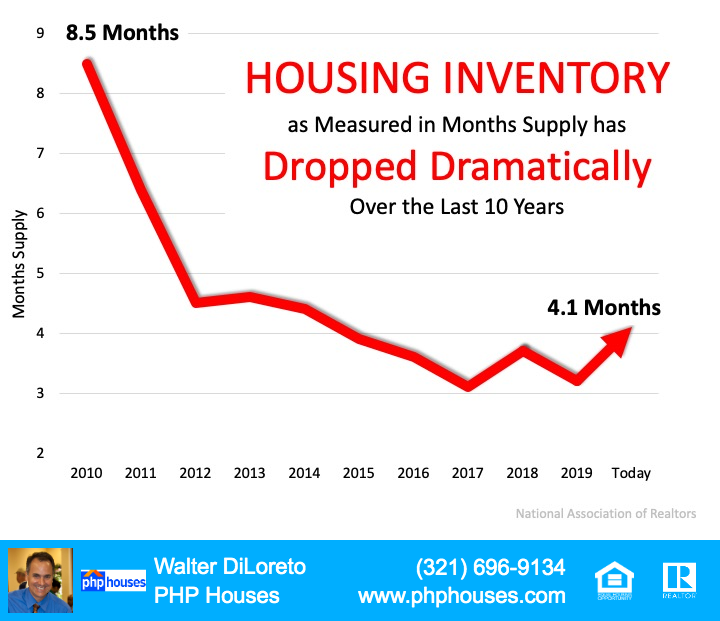

With these three factors in play, the demand for housing will keep growing this year, especially over the summer as more communities continue their phased approach to reopening. Buyers can take advantage of additional savings and low mortgage rates. And if you’re thinking of selling, know that your home may be in high demand as buyer interest grows and the number of homes for sale continues to dwindle. This may be your moment to list your house and make a move into a new space as well.

Bottom Line

If you’re ready to buy or sell – or maybe both – let’s connect to put your plans in motion. With low mortgage rates leading the way, it’s a great time to take advantage of your position in today’s market.

Contact us:

PHP Houses

142 W Lakeview Ave

Unit 1030

Lake Mary, FL 32746

Ph: (407) 519-0719

Fax: (407) 205-1951

email: info@phphouses.com

Let’s Connect:

Facebook

Linkedin

Twitter

Instagram