Are You Ready To Fall in Love with Homeownership?

Are You Ready To Fall in Love with Homeownership?

Financial benefits are always a key aspect of homeownership, but it’s also important to understand that the nonfinancial and personal benefits are why so many people genuinely fall in love with their homes. When you own your home, you likely feel a sense of emotional attachment because of the comfort it provides, but also because it’s a space that’s truly yours.

Over the past two years, we’ve learned to love our homes even more as we’ve stayed home more than ever due to the ongoing pandemic. As a result, the personal and emotional benefits our homes provide have become even more important to us.

As the most recent State of the American Homeowner from Unison puts it:

“Despite the upheaval and uncertainty of the past year, one thing has stayed the same: the home continues to be of the utmost importance and a place of security and comfort.”

When the health crisis began, the world around us changed almost overnight, and our homes were redefined. Our needs shifted, and our shelters became a place that protected us on a whole new level. The same study from Unisonnotes:

- 91% of homeowners say they feel secure, stable, or successful owning a home

- 64% of American homeowners say living through a pandemic has made their home more important to them than ever

- 83% of homeowners say their home has kept them safe during the COVID-19 pandemic

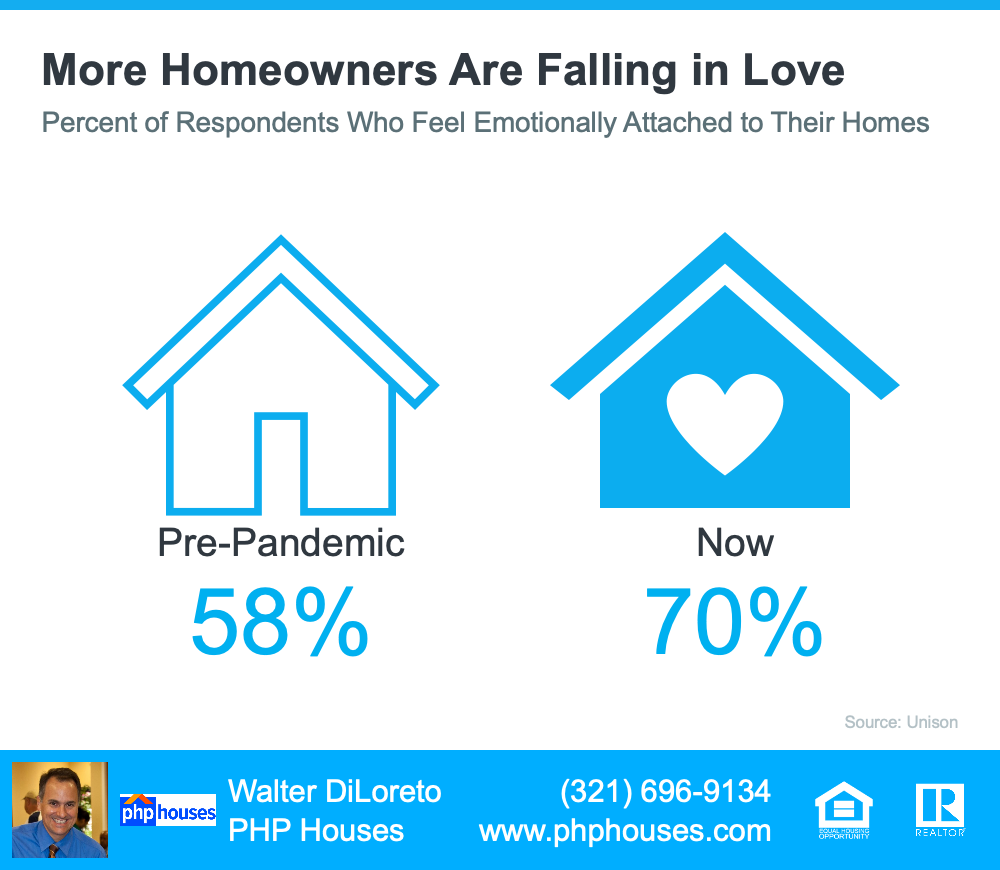

It’s no surprise this study also reveals that homeowners now love their homes even more as our emotional attachments to them have grown:

More Homeowners Are Falling in Love

That sense of emotional connection genuinely reaches far beyond the financial aspect of homeownership. Because they’re our shelters – ones that we can genuinely call our own. Our homes touch our hearts and can also positively impact our mental health.

As JD Esajian, President of CT Homes, LLC, says:

“Aside from the financial factors, there are several social benefits of homeownership and stable housing to consider. It has long been thought that buying a home contributes to a sense of accomplishment. Still, most individuals fail to realize that homeownership can benefit your mental health and the community around you.”

Whether you’re thinking of buying your first home, moving up to your dream home, or downsizing to something that better fits your changing lifestyle, take a moment to reflect on what Mark Fleming, Chief Economist at First American, notes:

“Buying a home is not just a financial decision. It’s also a lifestyle decision.”

Bottom Line

There are so many reasons to fall head over heels for homeownership. Your home will provide a place to customize and call your own, in addition to stability and security. If you’re ready to fall in love with homeownership, let’s connect so you can get started on your homebuying journey today.

Contact us:

PHP Houses

142 W Lakeview Ave

Unit 1030

Lake Mary, FL 32746

Ph: (407) 519-0719

Fax: (407) 205-1951

email: info@phphouses.com

Let’s Connect:

Facebook

Linkedin

Twitter

Instagram

The information contained, and the opinions expressed, in this article are not intended to be construed as investment advice. The author does not guarantee or warrant the accuracy or completeness of the information or opinions contained herein. Nothing herein should be construed as investment advice. You should always conduct your own research and due diligence and obtain professional advice before making any investment decision. The author will not be liable for any loss or damage caused by your reliance on the information or opinions contained herein.