What Does the Future Hold for Home Prices?

If you’re looking to buy or sell a house, chances are you’ve heard talk about today’s rising home prices. And while this increase in home values is great news for sellers, you may be wondering what the future holds. Will prices continue to rise with time, or should you expect them to fall?

To answer that question, let’s first understand a few terms you may be hearing right now.

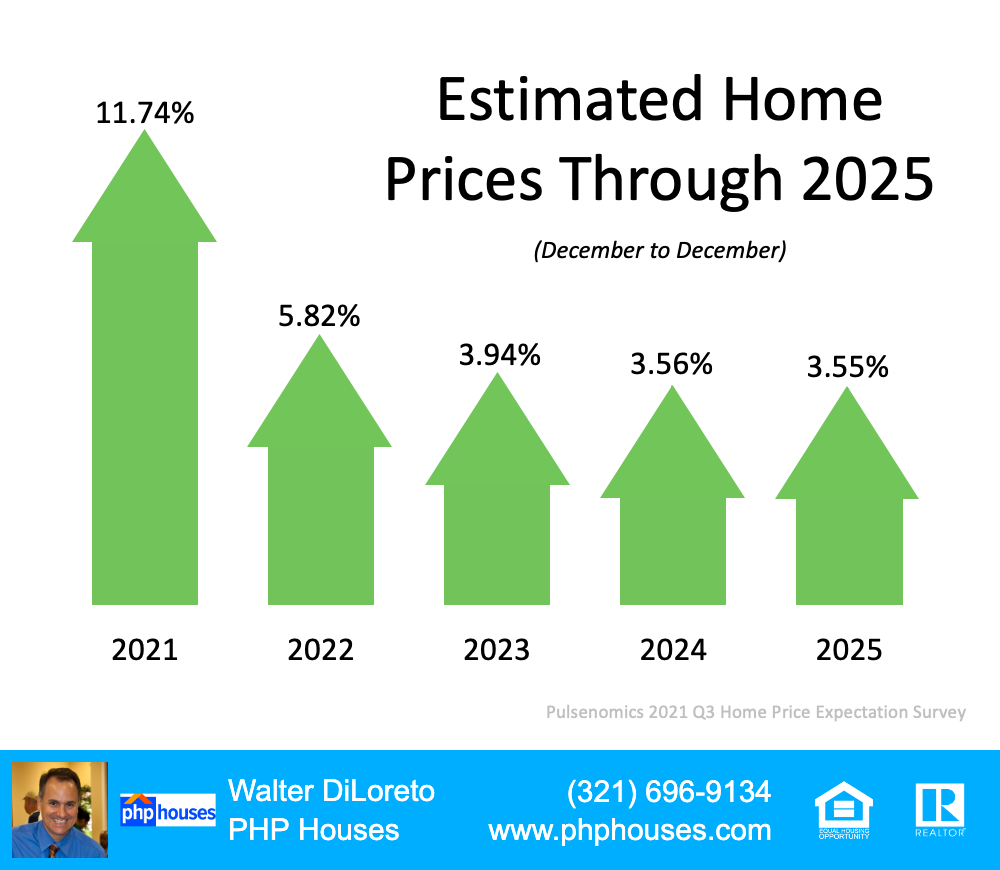

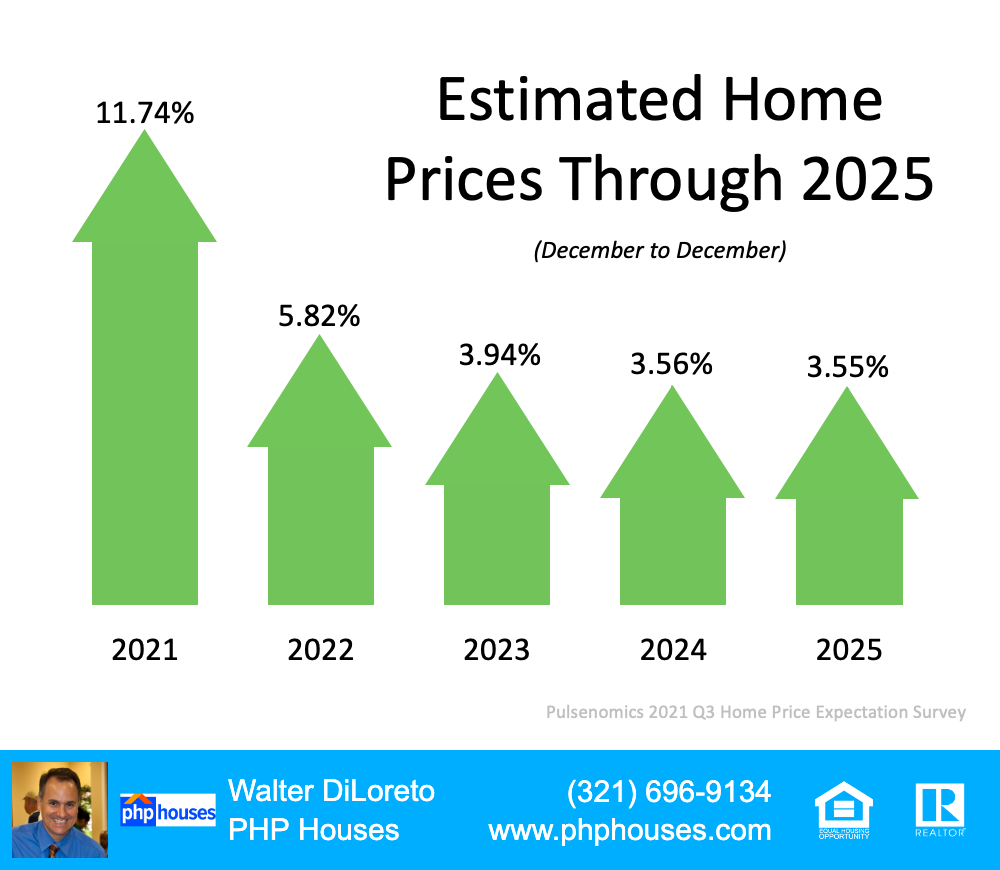

It’s important to note home prices have increased, or appreciated, for 114 straight months. To find out if that trend may continue, look to the experts. Pulsenomics surveyed over 100 economists, investment strategists, and housing market analysts asking for their five-year projections. In terms of what lies ahead, experts say the market may see some slight deceleration, but not depreciation.

Here’s the forecast for the next few years:

Estimate Home Prices Through 2025

As the graph above shows, prices are expected to continue to rise, just not at the same pace we’ve seen over the last year. Over 100 experts agree, there is no expectation for price depreciation. As the arrows indicate, each number is an increase, which means prices will rise each year.

Bill McBride, author of the blog Calculated Risk, also expects deceleration, but not depreciation:

“My sense is the Case-Shiller National annual growth rate of 19.7% is probably close to a peak, and that year-over-year price increases will slow later this year.”

Ivy Zelman of Zelman & Associates agrees, saying:

“. . . home price appreciation is on the cusp of flipping to a decelerating trend.”

A recent article from realtor.com indicates you should expect:

“. . . annual price increases will slow to a more normal level, . . .”

What Does This Deceleration Mean for You?

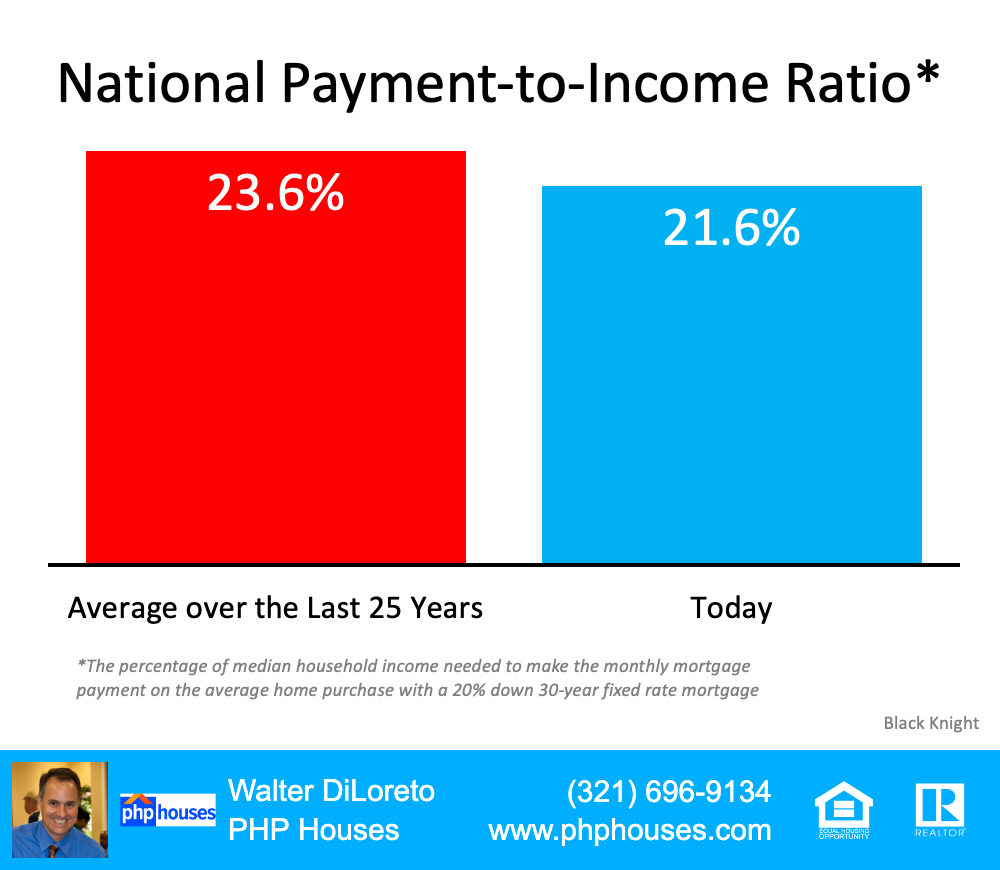

What experts are projecting for the years ahead is more in line with the historical norm for appreciation. According to data from Black Knight, the average annual appreciation from 1995-2020 is 4.1%. As you can see from the chart above, the expert forecasts are closer to that pace, which means you should see appreciation at a level that’s aligned with a more normal year.

If you’re a buyer, don’t expect a sudden or drastic drop in home prices – experts say it won’t happen. Instead, think about your homeownership goals and consider purchasing a home before prices rise further.

If you’re a seller, the continued home price appreciation is good news for the value of your house. Work with an agent to list your house for the right price based on market conditions.

Bottom Line

Experts expect price deceleration, not price depreciation over the coming years. Let’s connect to talk through what’s happening in the housing market today, where things are headed, and what it means for you.

Contact us:

PHP Houses

142 W Lakeview Ave

Unit 1030

Lake Mary, FL 32746

Ph: (407) 519-0719

Fax: (407) 205-1951

email: info@phphouses.com

Let’s Connect:

Facebook

Linkedin

Twitter

Instagram

The information contained, and the opinions expressed, in this article are not intended to be construed as investment advice. The author does not guarantee or warrant the accuracy or completeness of the information or opinions contained herein. Nothing herein should be construed as investment advice. You should always conduct your own research and due diligence and obtain professional advice before making any investment decision. The author will not be liable for any loss or damage caused by your reliance on the information or opinions contained herein.