Housing Challenge or Housing Opportunity? It Depends.

Housing Challenge or Housing Opportunity? It Depends.

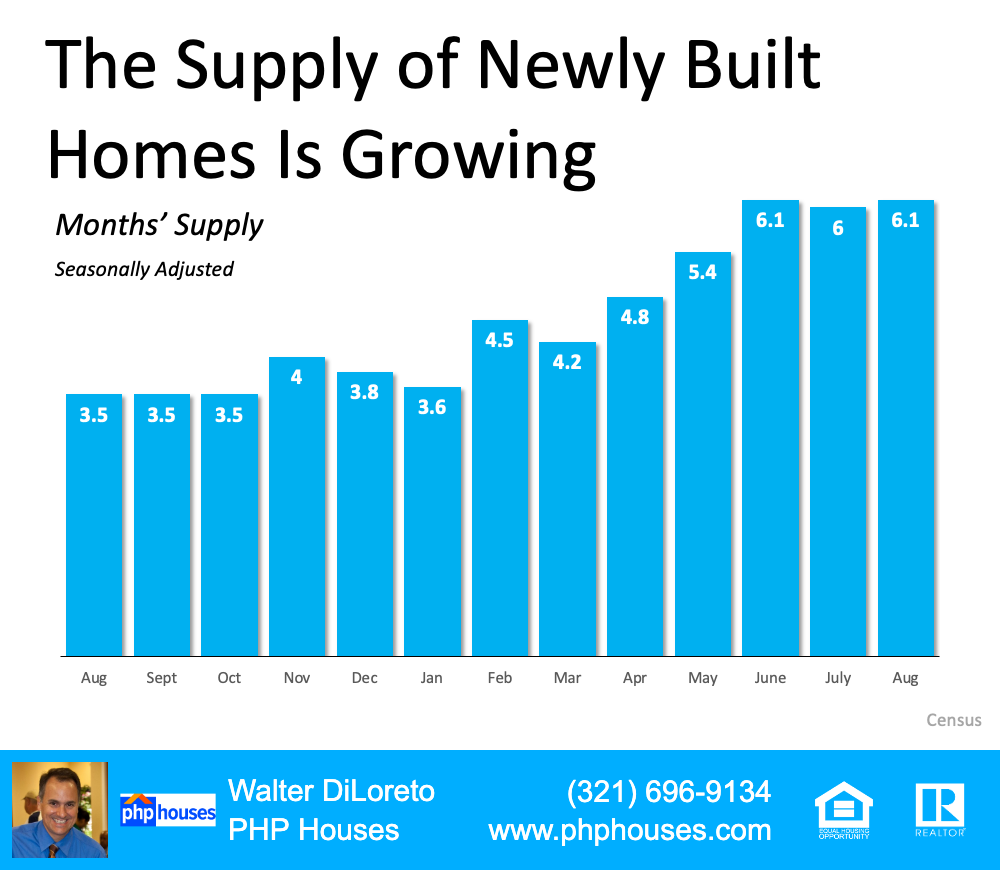

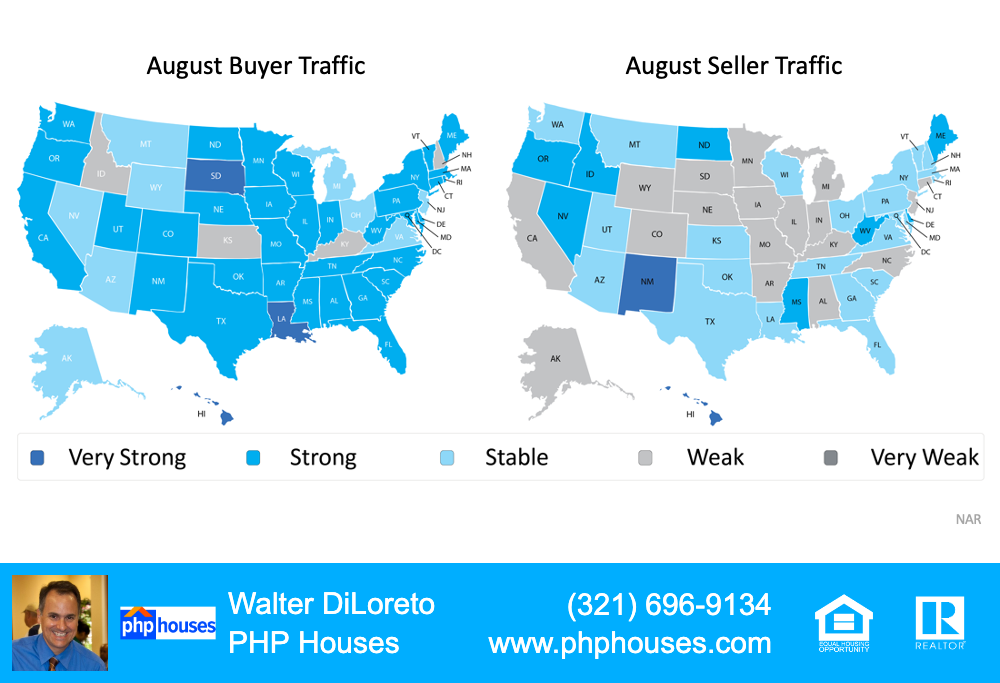

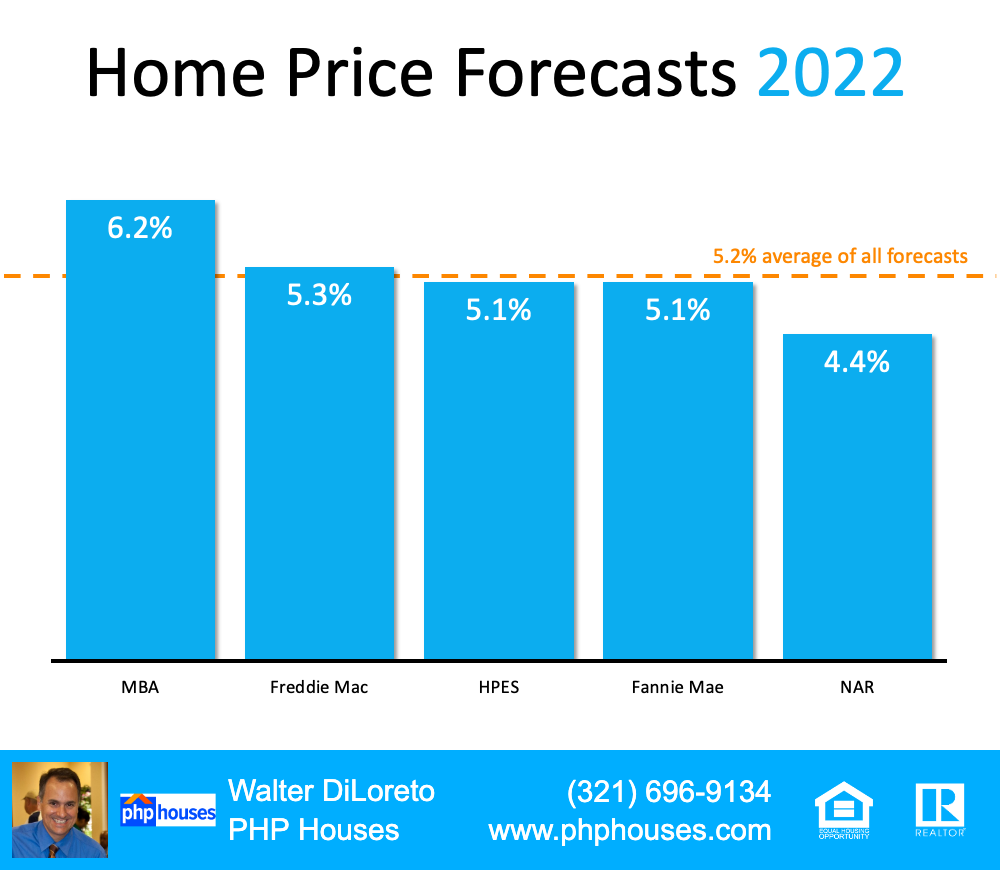

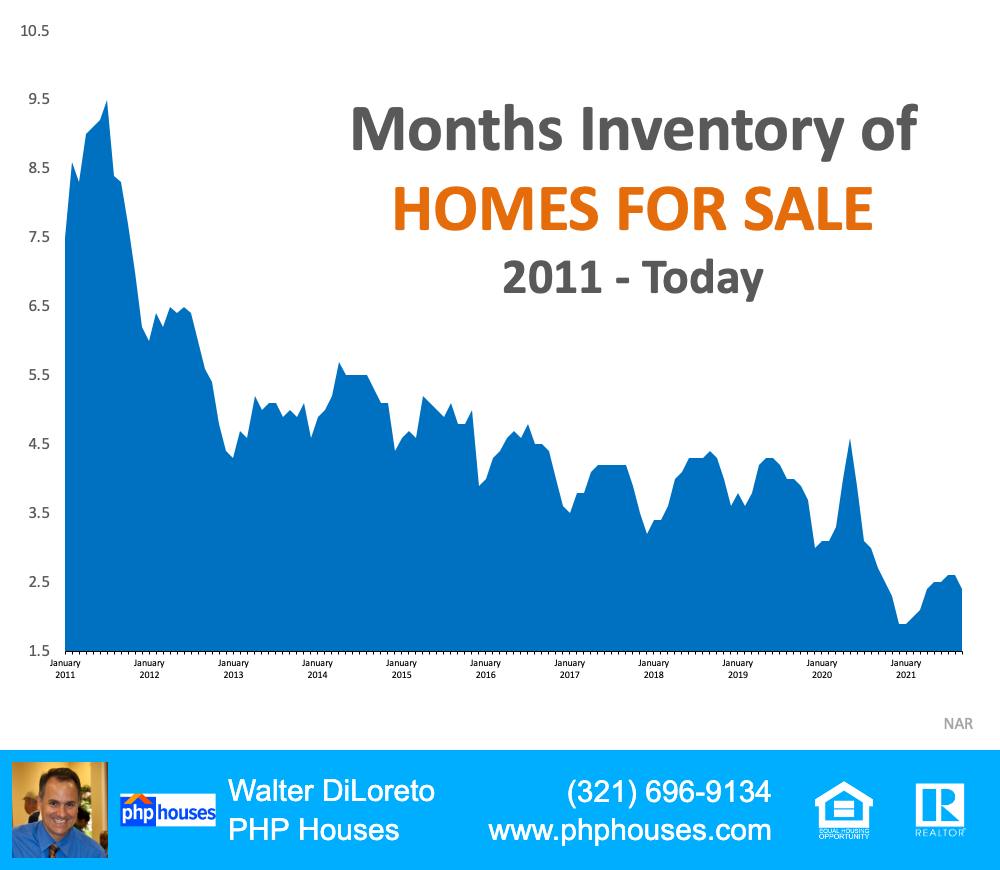

The biggest challenge in real estate today is the lack of available homes for sale. The low housing supply has caused homes throughout the country to appreciate at a much faster rate than what we’ve experienced historically.

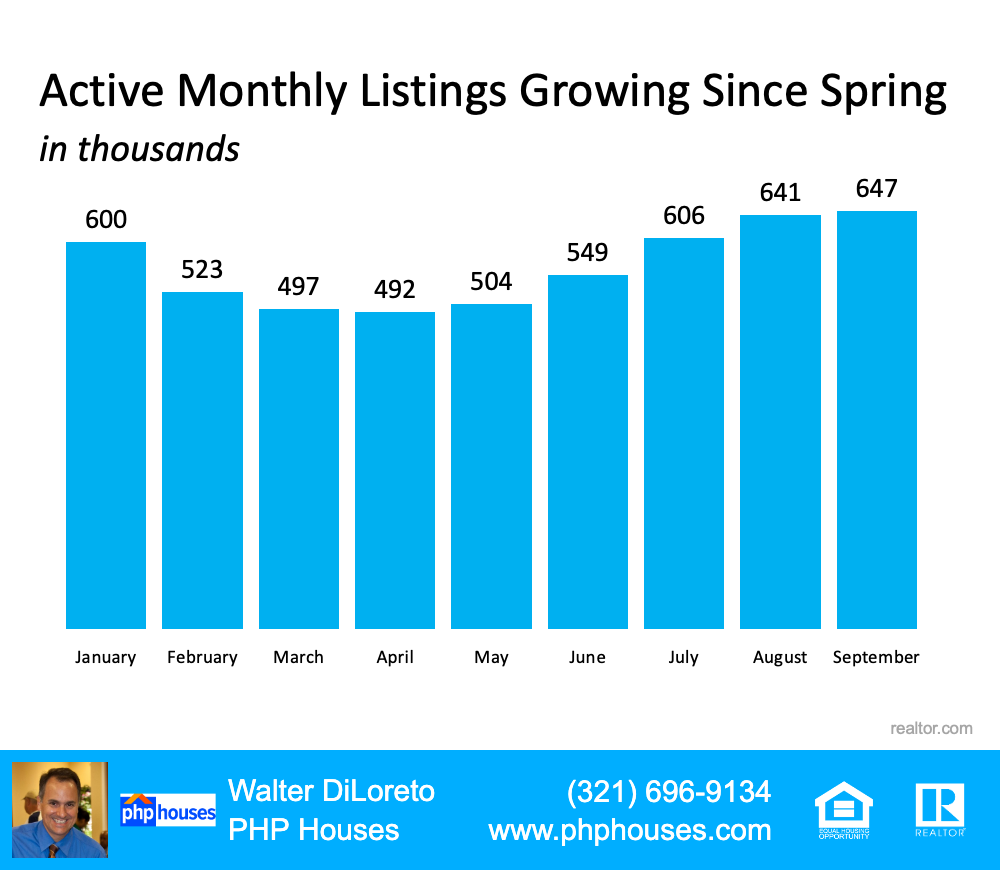

There are many reasons for the limited number of homes on the market, but as you can see in the graph below, we’re well below where we’ve been for most of the past 10 years. Today, across the country, there is only a 2.4-month supply of homes available for sale.

Months Inventory of Homes for Sale

The Opportunity

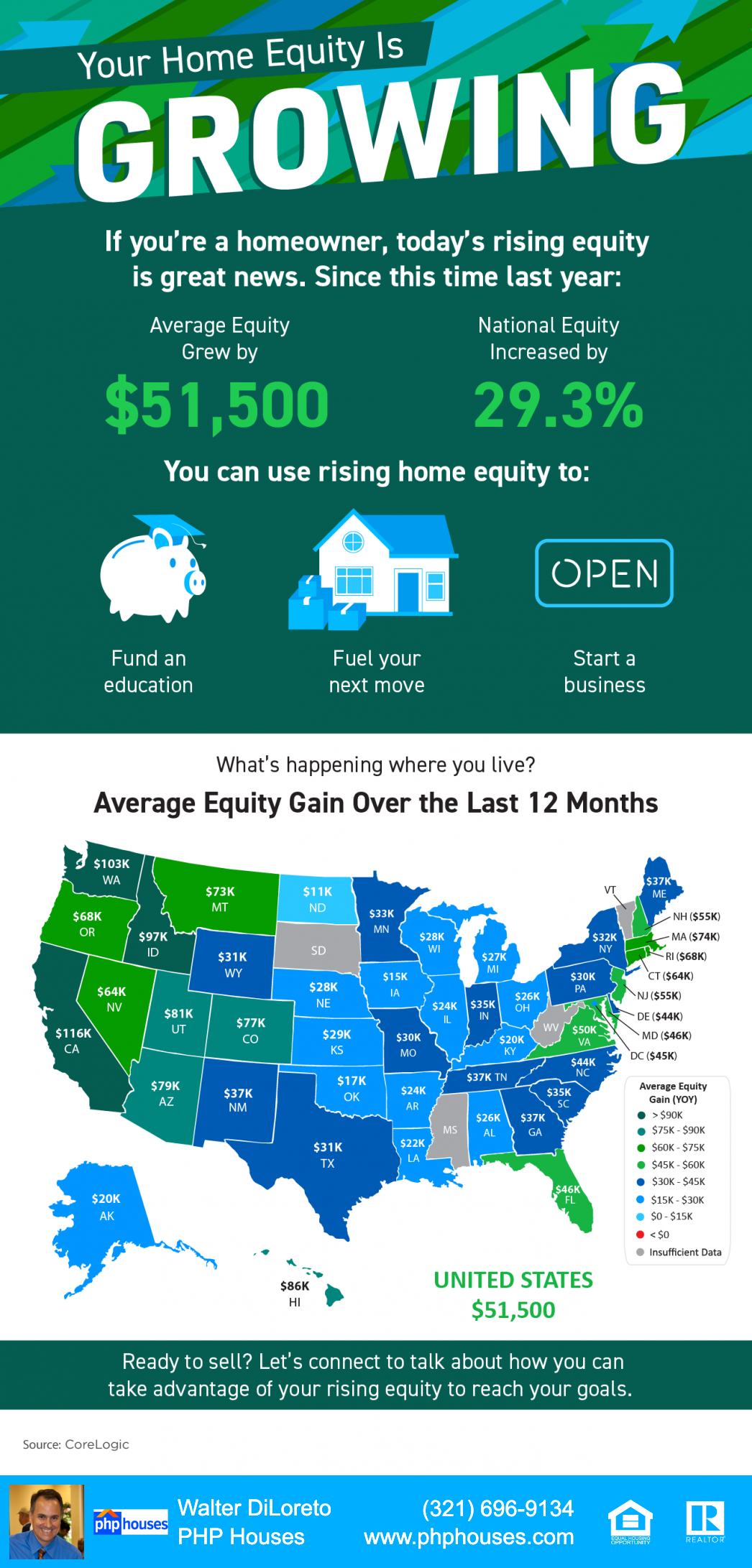

This lack of homes for sale is creating a challenge for many buyers who are growing frustrated in their search. On the other hand, this is a huge opportunity for sellers as low supply is driving up home values. According to CoreLogic, the average home has appreciated by more than $50,000 over the past year. And for many homeowners, that’s opening new doors as they re-think their needs and use their equity to move up or downsize.

According to Dr. Frank Nothaft, Chief Economist at CoreLogic:

“The average homeowner with a mortgage has more than $200,000 in home equity as of mid-2021.”

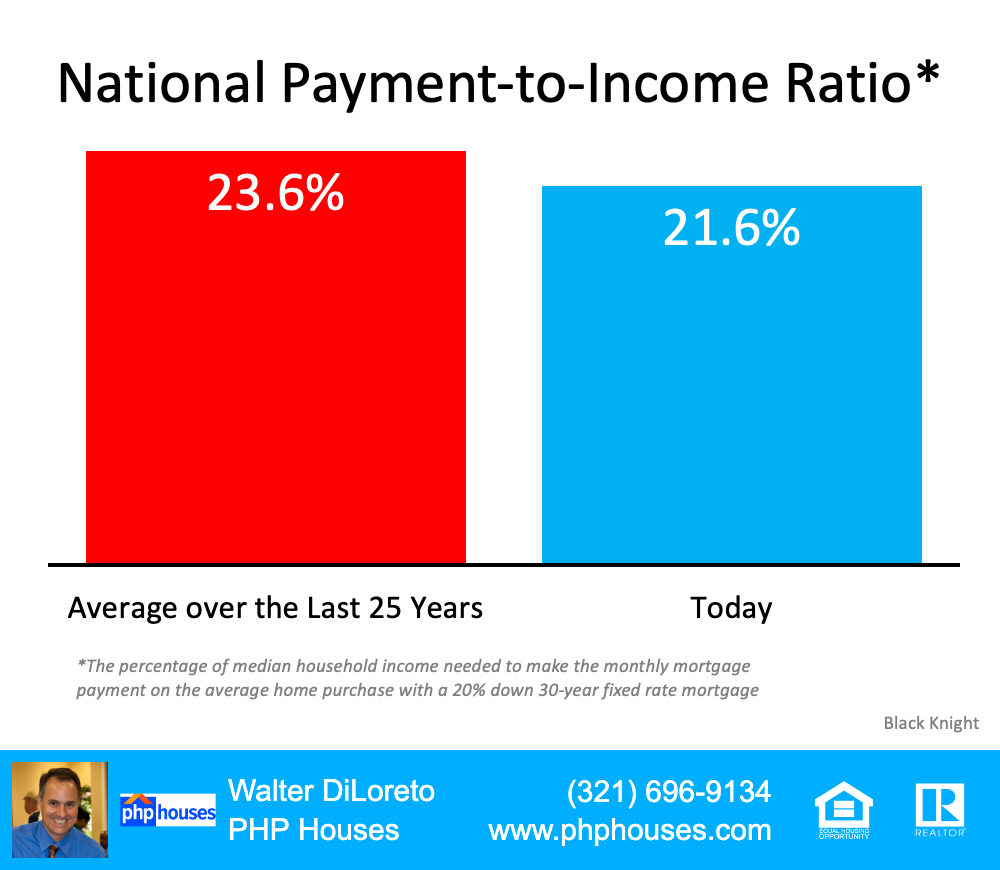

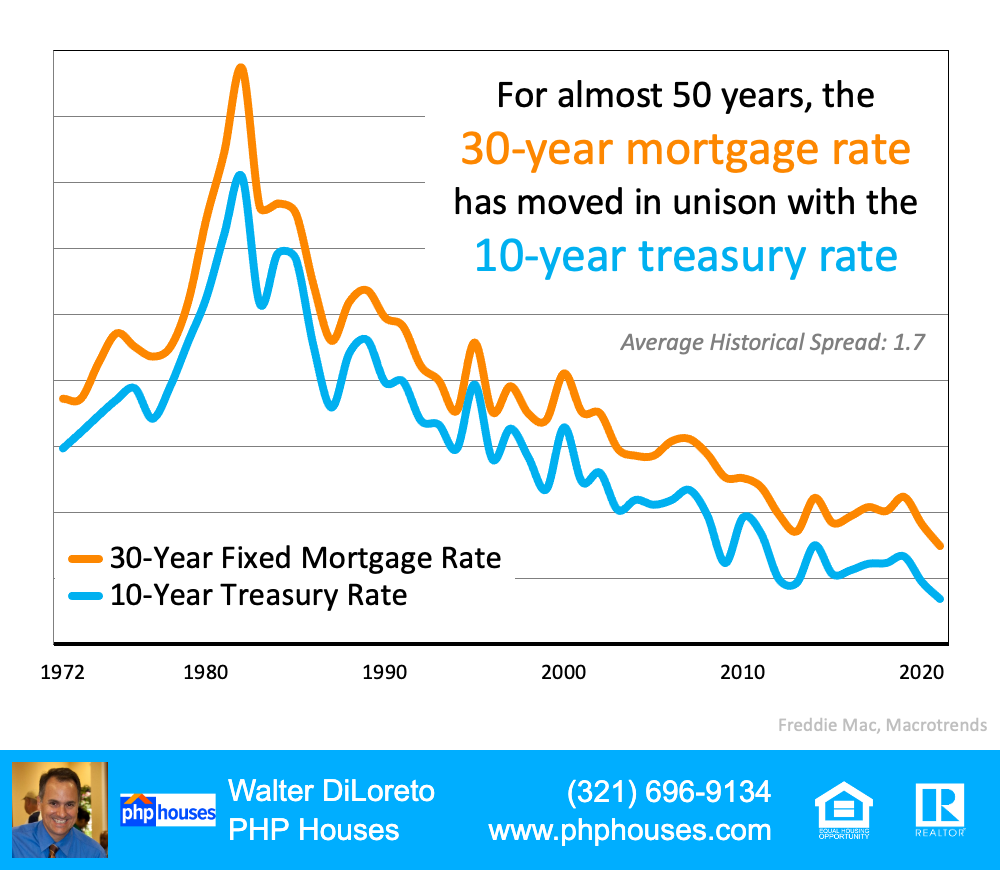

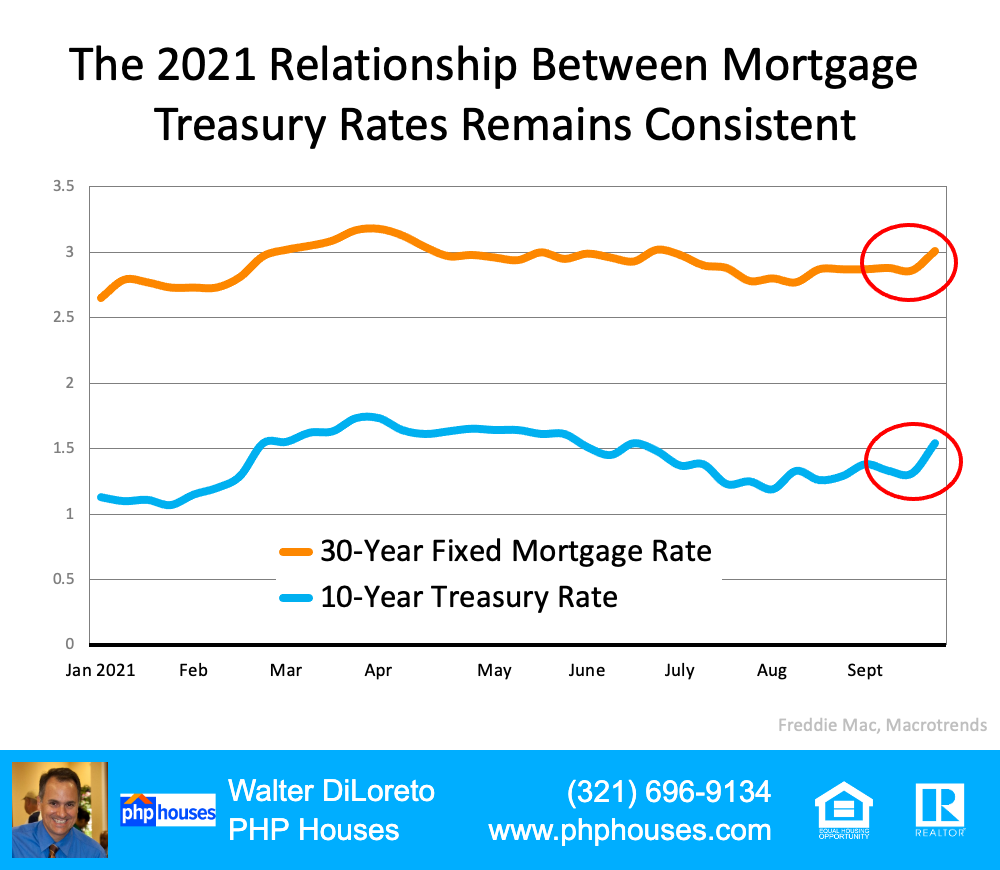

Today, many sellers are taking advantage of low interest rates and the equity they have in their homes to make a move.

Bottom Line

The biggest challenge in real estate is the lack of homes for sale, but this challenge is also an opportunity for sellers. If you’re thinking about selling your house, let’s connect to start the process.

Contact us:

PHP Houses

142 W Lakeview Ave

Unit 1030

Lake Mary, FL 32746

Ph: (407) 519-0719

Fax: (407) 205-1951

email: info@phphouses.com

Let’s Connect:

Facebook

Linkedin

Twitter

Instagram