June is National Homeownership Month, and it’s the perfect time to reflect on how impactful owning a home can truly be. When you purchase a house, it becomes more than just a space you occupy. It’s your stake in the community, an investment, and a place you can put your stamp on.

If you’re thinking about buying a home this year, here are some of the benefits you’ll experience when you do.

The Emotional Benefits of Homeownership

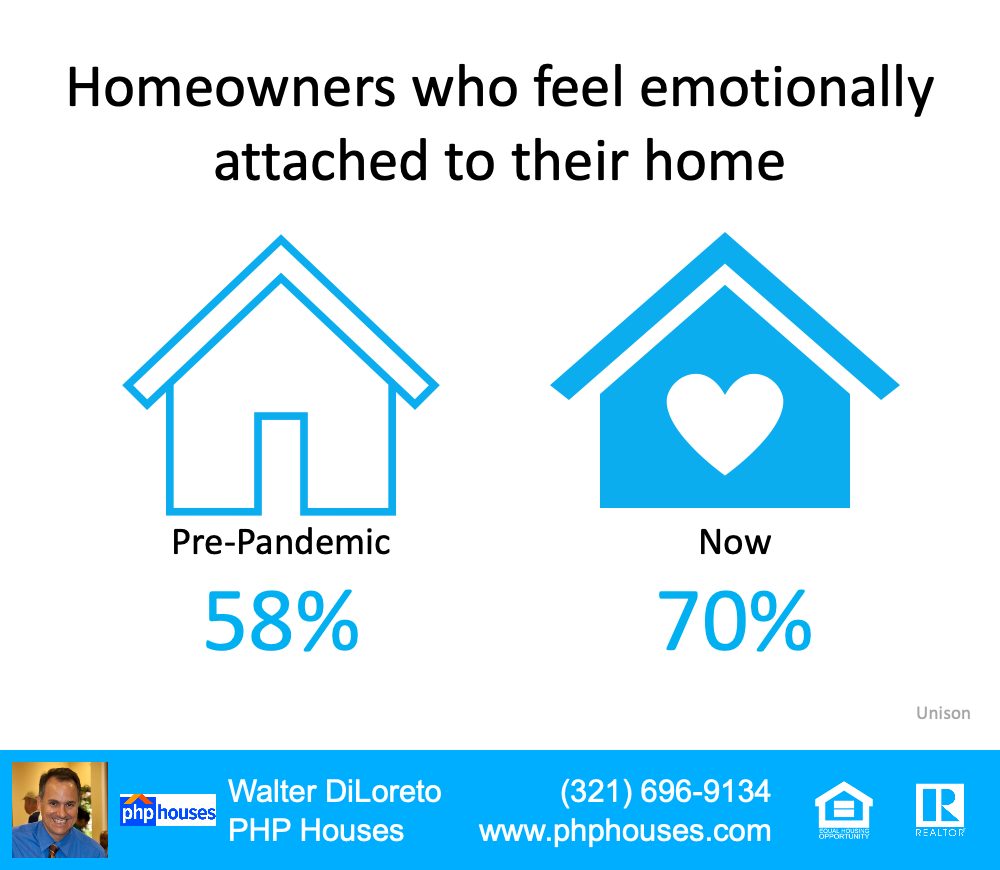

Because it’s a place that’s uniquely yours, owning a home can give you a sense of pride and happiness in several ways.

Your Home Can Reflect Your Tastes and Personality

Investopedia puts it like this:

“One often-cited benefit of homeownership is the knowledge that youown your little corner of the world.”

That knowledge can lead to a powerful, emotional connection to the place where you live. But so can the realization that your home will grow with you. Because it’s yours, you have the freedom to make updates to it as your needs and tastes change. As Logan Mohtashami, Lead Analyst for HousingWire, says:

“The psychology is that this is yours and you’re going to make it as good as possible because you’re in for a long time, . . . “

And that can create a greater sense of ownership, pride, and connection with your home and your community.

It Can Enhance Your Neighborhood and Civic Engagement

Homeownership can lead you to get even more involved with your local area. After all, you’re putting your roots down in a location and will want to do what you can to help improve it, much like your home. In a recent report, the National Association of Realtors (NAR) says:

“Living in one place for a longer amount of time creates and [sic] obvious sense of community pride, which may lead to more investment in said community.”

The Financial Benefits of Homeownership

When you choose to become a homeowner, you’re making a financial decision as well. That’s because your home is also an investment.

It Can Help You Feel Financially Stable

Homeownership is truly one of the best ways to improve your long-term financial position. Not only will you have a predictable monthly housing expense that can benefit your budget in the short term, but you’ll also gain equity as your home appreciates in value and you make your monthly mortgage payment. As Freddie Mac says:

“Building equity through your monthly principal payments and appreciation is a critical part of homeownership that can help you create financial stability.”

It Can Grow Your Wealth

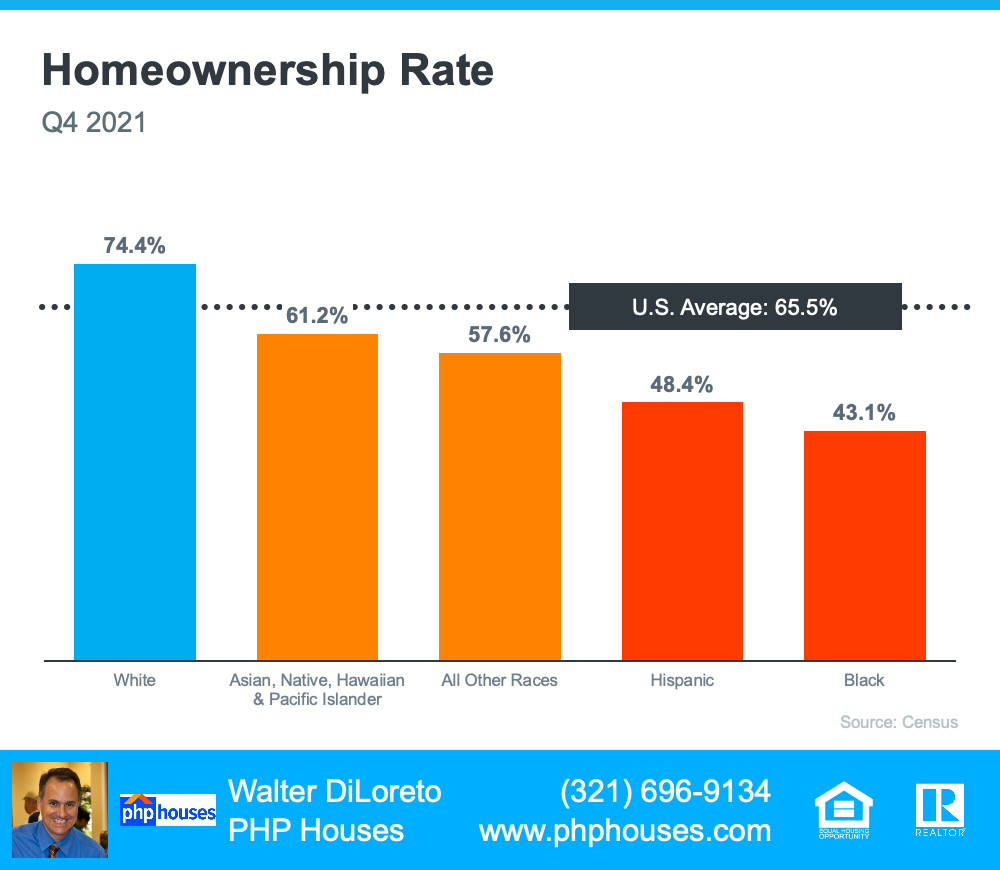

Because of your growing equity, you can build your net worth as a homeowner. And when you compare the difference in net worth between a renter and a homeowner, it’s clear that owning a home truly offers a great way to build your long-term financial position.

According to the latest data from NAR, the median household net worth of a homeowner is roughly $300,000, while the median net worth of renters is only about $8,000. That means a homeowner’s net worth is nearly 40 times that of a renter.

Bottom Line

Homeownership is truly a way to find greater satisfaction and happiness and to build financial freedom. If National Homeownership Month has you dreaming about purchasing a home, then let’s connect to begin the process today.

Contact us:

PHP Houses

142 W Lakeview Ave

Unit 1030

Lake Mary, FL 32746

Ph: (407) 519-0719

Fax: (407) 205-1951

email: info@phphouses.com

Let’s Connect:

Facebook

Linkedin

Twitter

Instagram

The information contained, and the opinions expressed, in this article are not intended to be construed as investment advice. The author does not guarantee or warrant the accuracy or completeness of the information or opinions contained herein. Nothing herein should be construed as investment advice. You should always conduct your own research and due diligence and obtain professional advice before making any investment decision. The author will not be liable for any loss or damage caused by your reliance on the information or opinions contained herein.