Sellers Are Ready To Enter the Housing Market

Sellers Are Ready To Enter the Housing Market

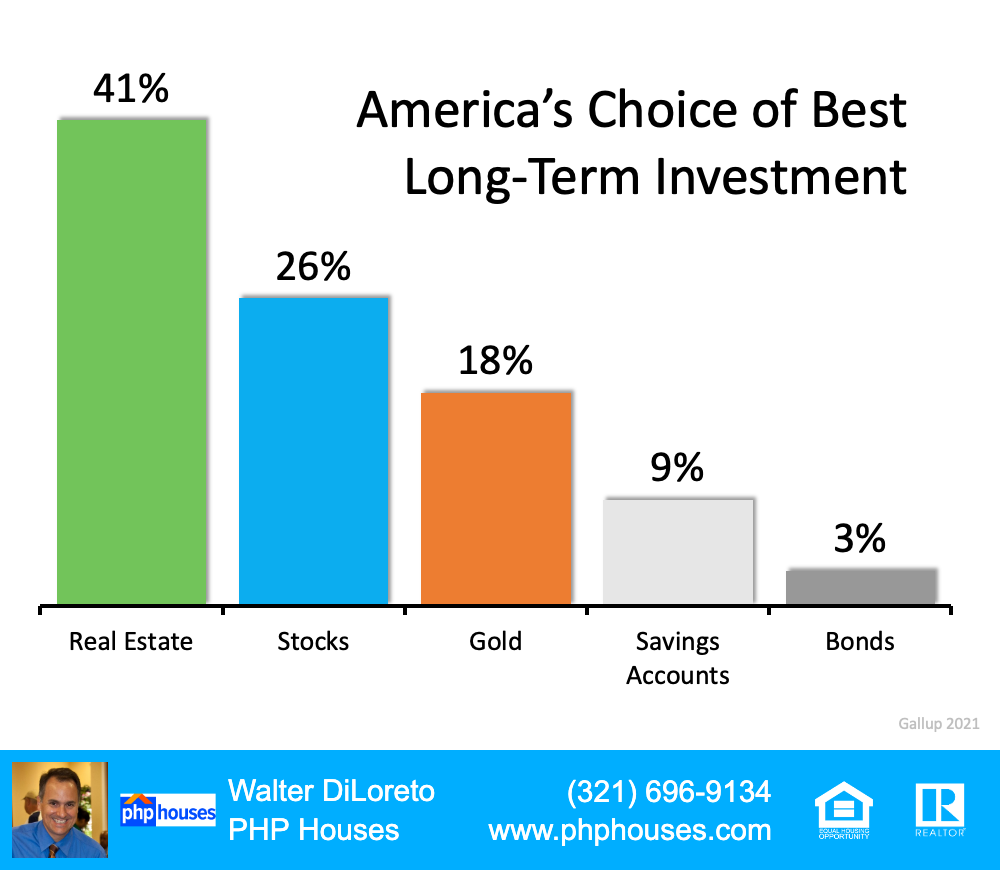

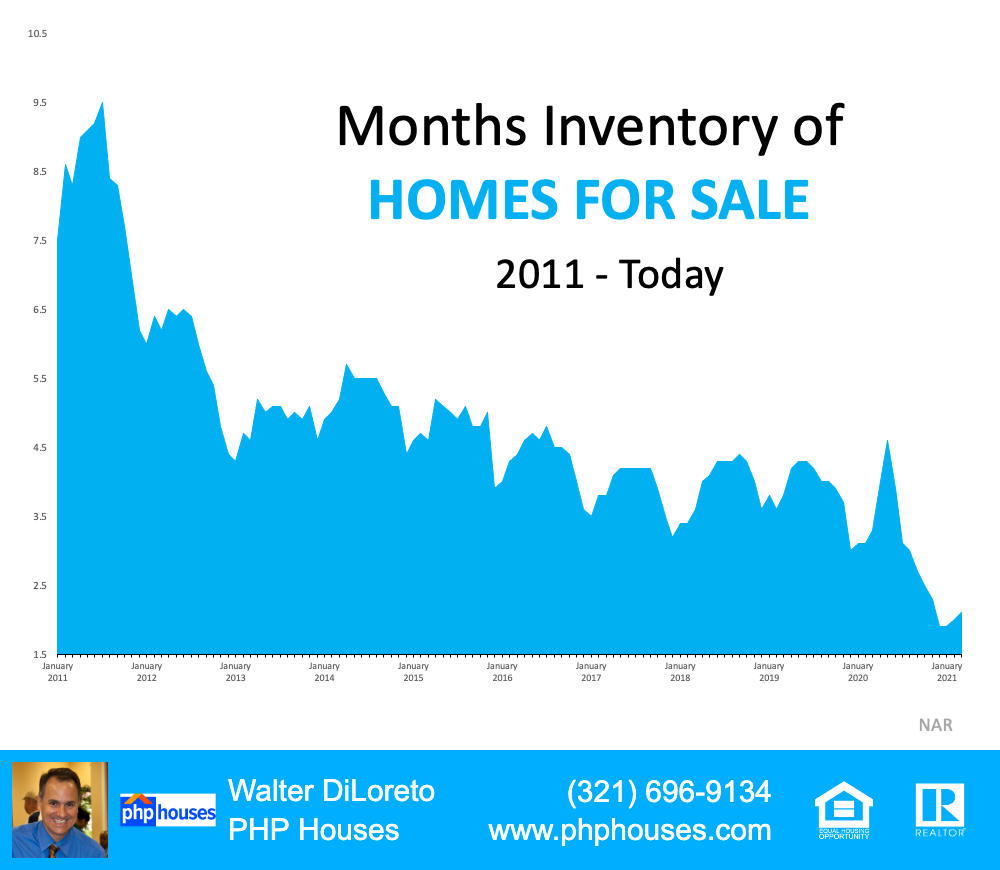

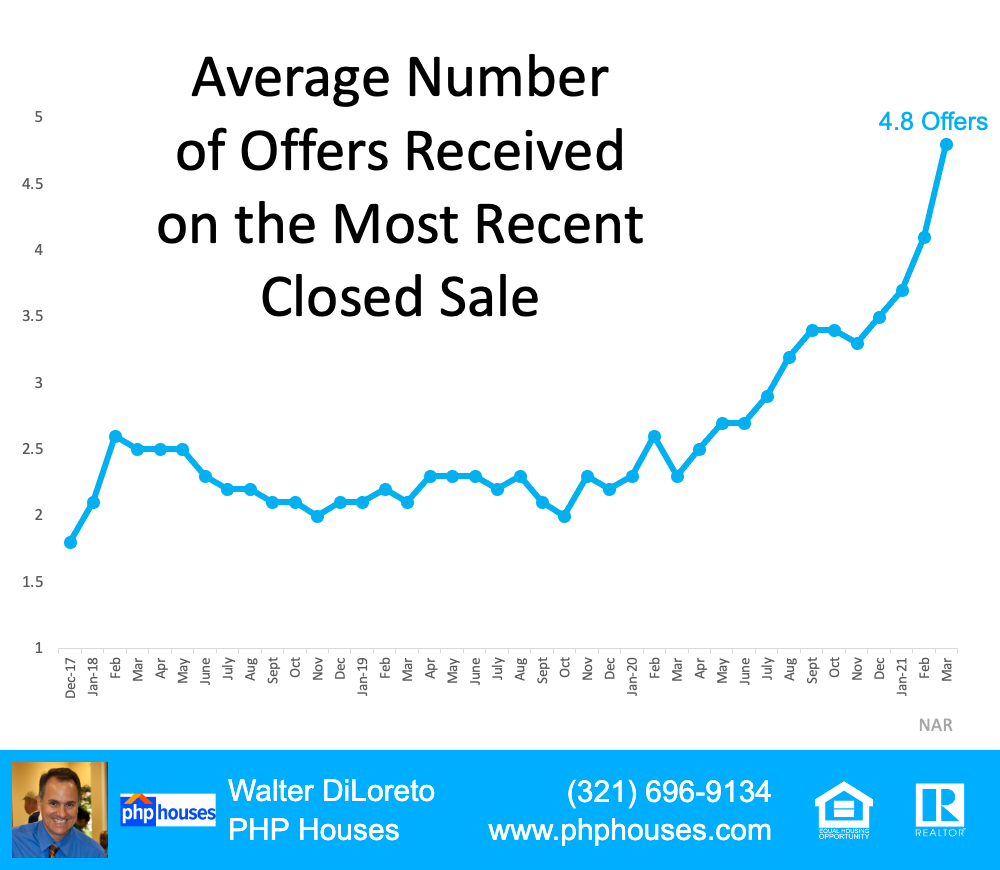

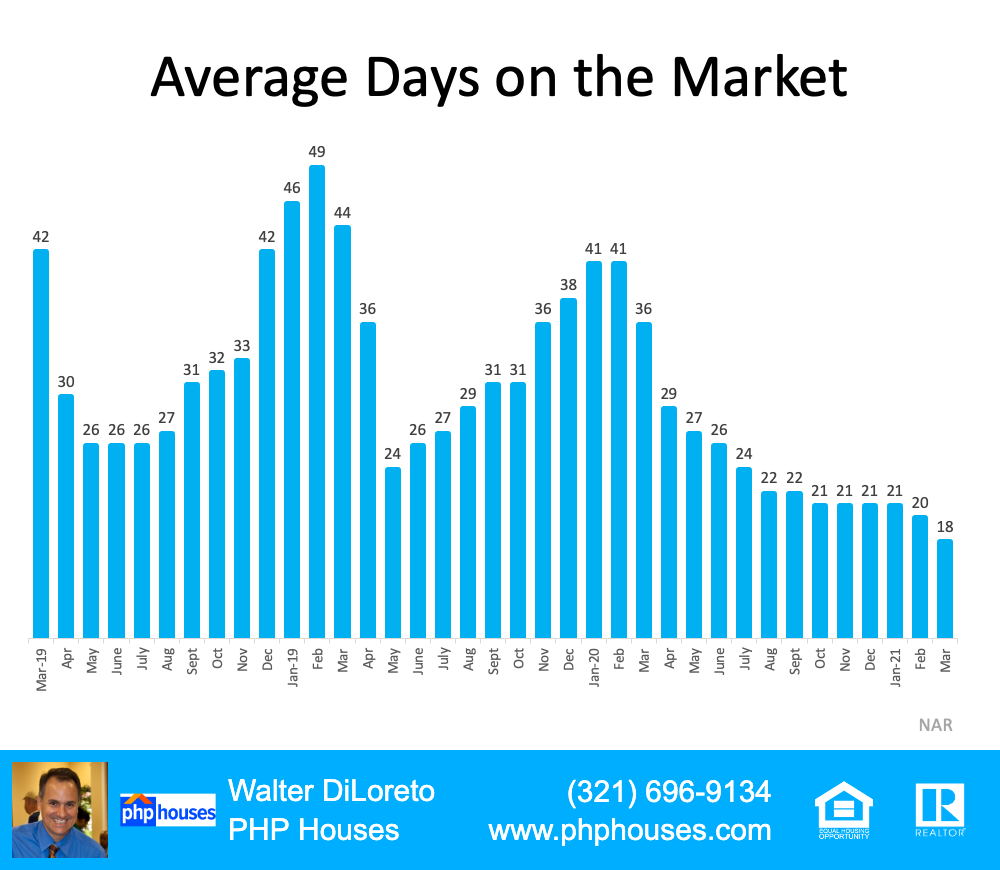

One of the biggest questions in real estate today is, “When will sellers return to the housing market?” An ongoing shortage of home supply has created a hyper-competitive environment for hopeful buyers, leading to the ultimate sellers’ market. However, as the economy continues to improve and more people get vaccinated, more sellers may finally be in sight.

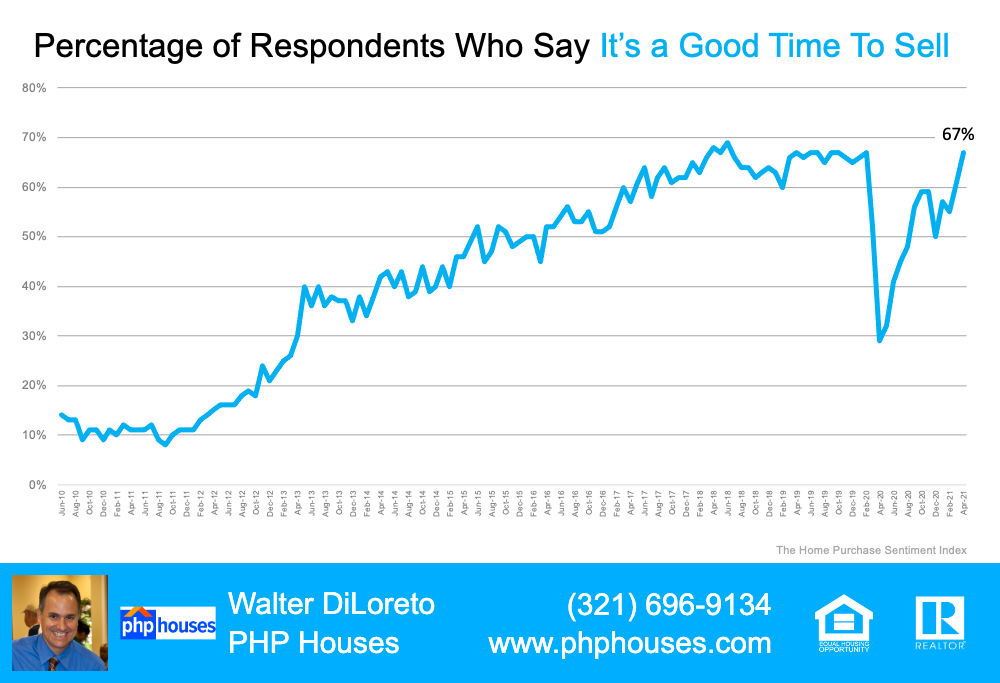

The Home Purchase Sentiment Index (HPSI) by Fannie Mae recently noted the percentage of consumer respondents who say it’s a good time to sell a home increased from 61% to 67%. Doug Duncan, Senior Vice President and Chief Economist at Fannie Mae, indicates:

“Consumer positivity regarding home-selling conditions nearly matched its all-time high.” (See graph below):

Percentage of Respondents Who Say It’s a Good Time to Sell

Fannie Mae isn’t the only expert group noticing a rise in the percentage of people thinking about selling. George Ratiu, Senior Economist at realtor.com, shares:

“The results of a realtor.com survey . . . showed that one-in-ten homeowners plans to sell this year, with 63 percent of those, looking to list in the next 6 months. Just as encouragingly, close to two-thirds of sellers plan to sell their homes at prices under $350,000, which would offer a tremendous boost to affordable housing for first-time buyers.”

Bottom Line

If you’re considering selling your house, don’t wait for more competition to pop up in your neighborhood. Let’s connect today to explore the benefits of selling your house now before more homes come to the market.

Contact us:

PHP Houses

142 W Lakeview Ave

Unit 1030

Lake Mary, FL 32746

Ph: (407) 519-0719

Fax: (407) 205-1951

email: info@phphouses.com

Let’s Connect:

Facebook

Linkedin

Twitter

Instagram