3 Tips for Buying a Home Today

3 Tips for Buying a Home Today

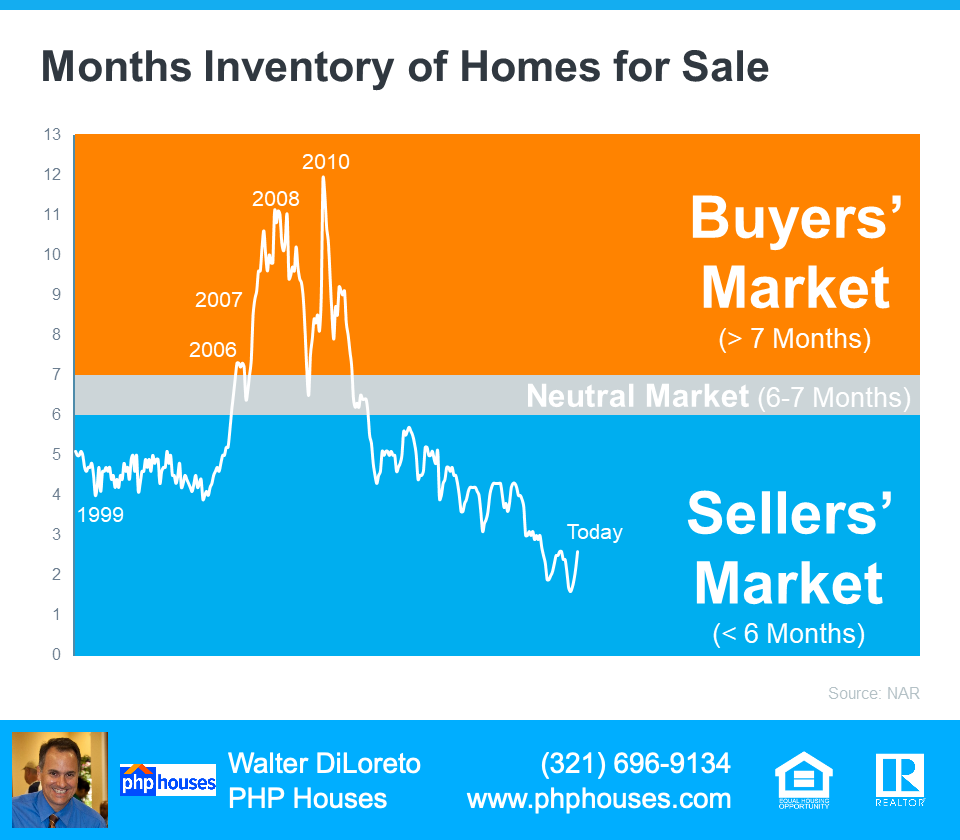

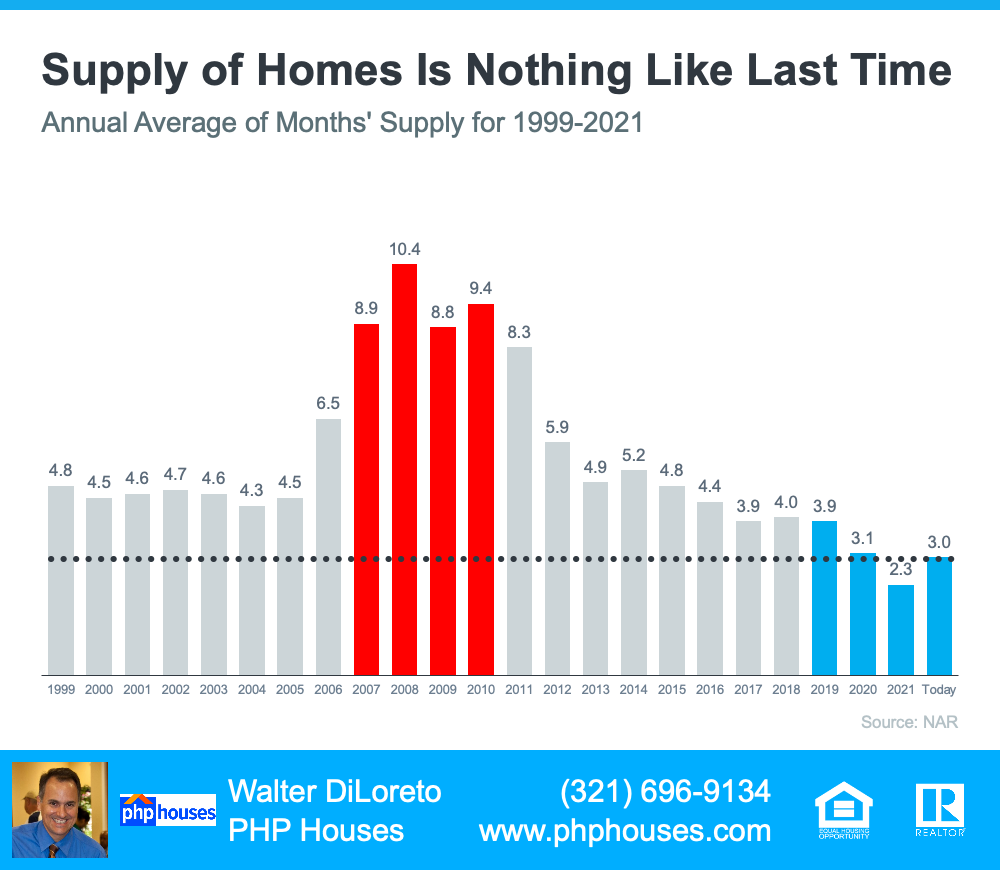

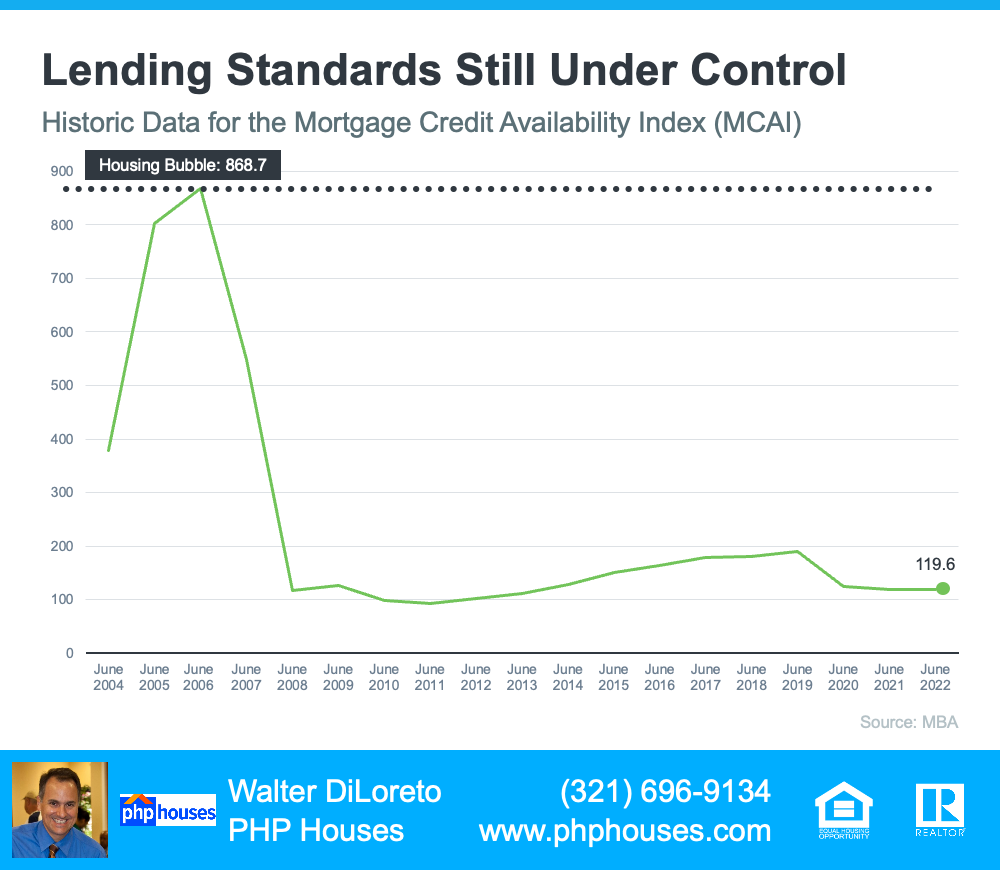

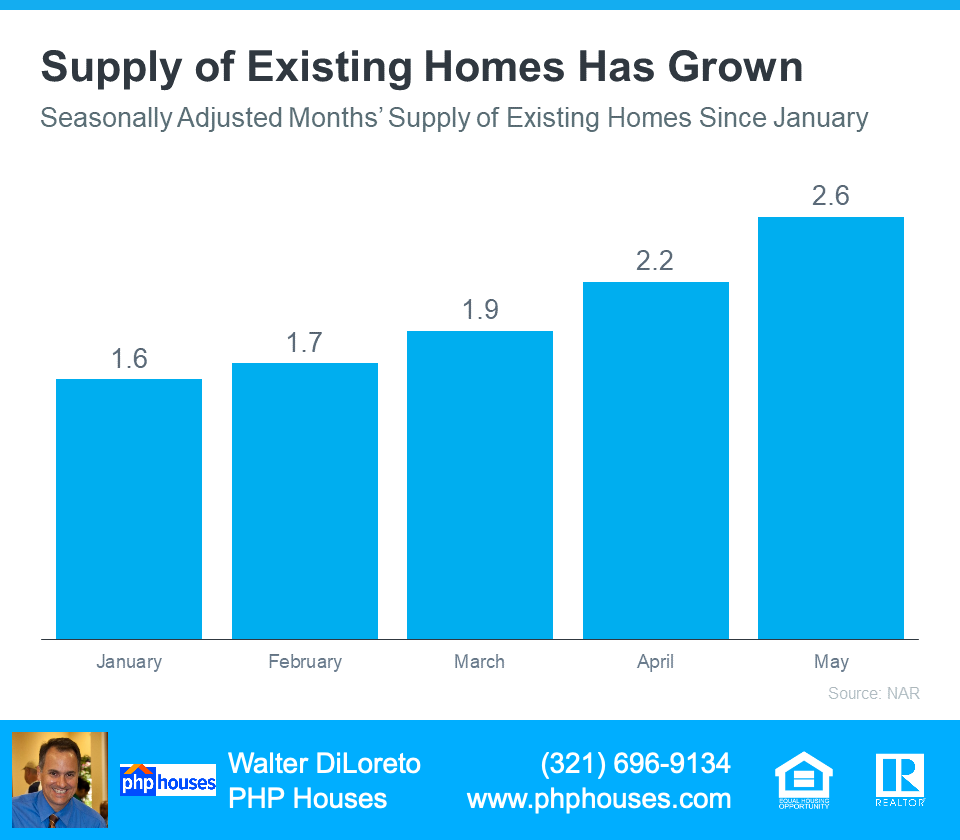

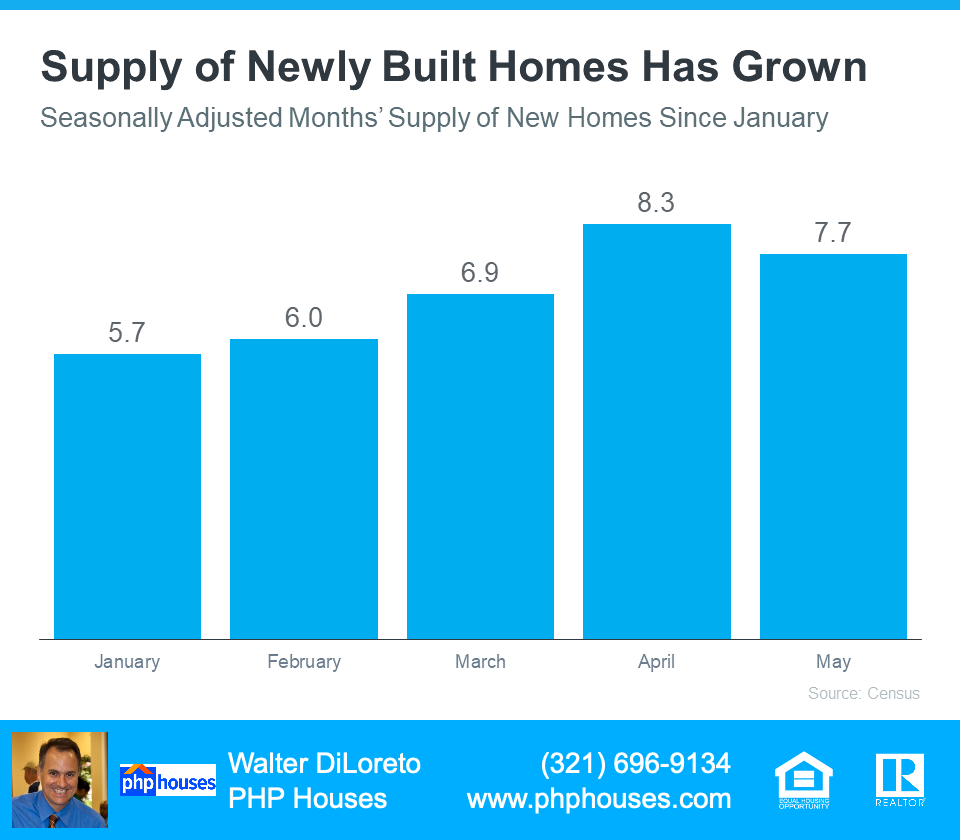

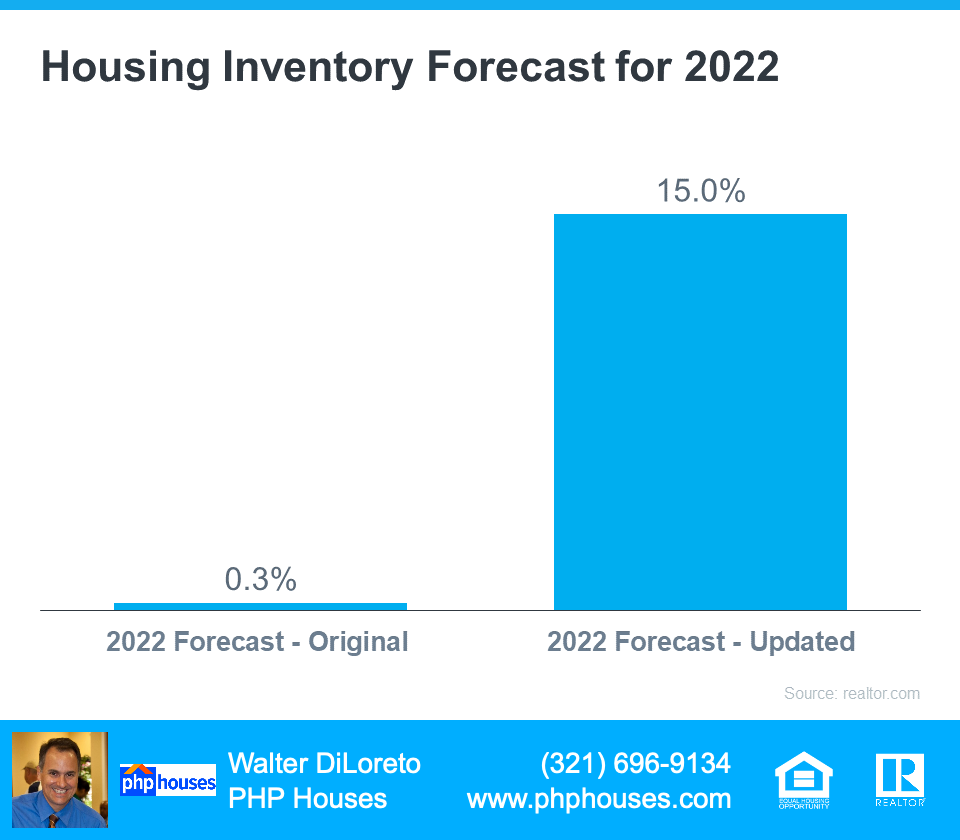

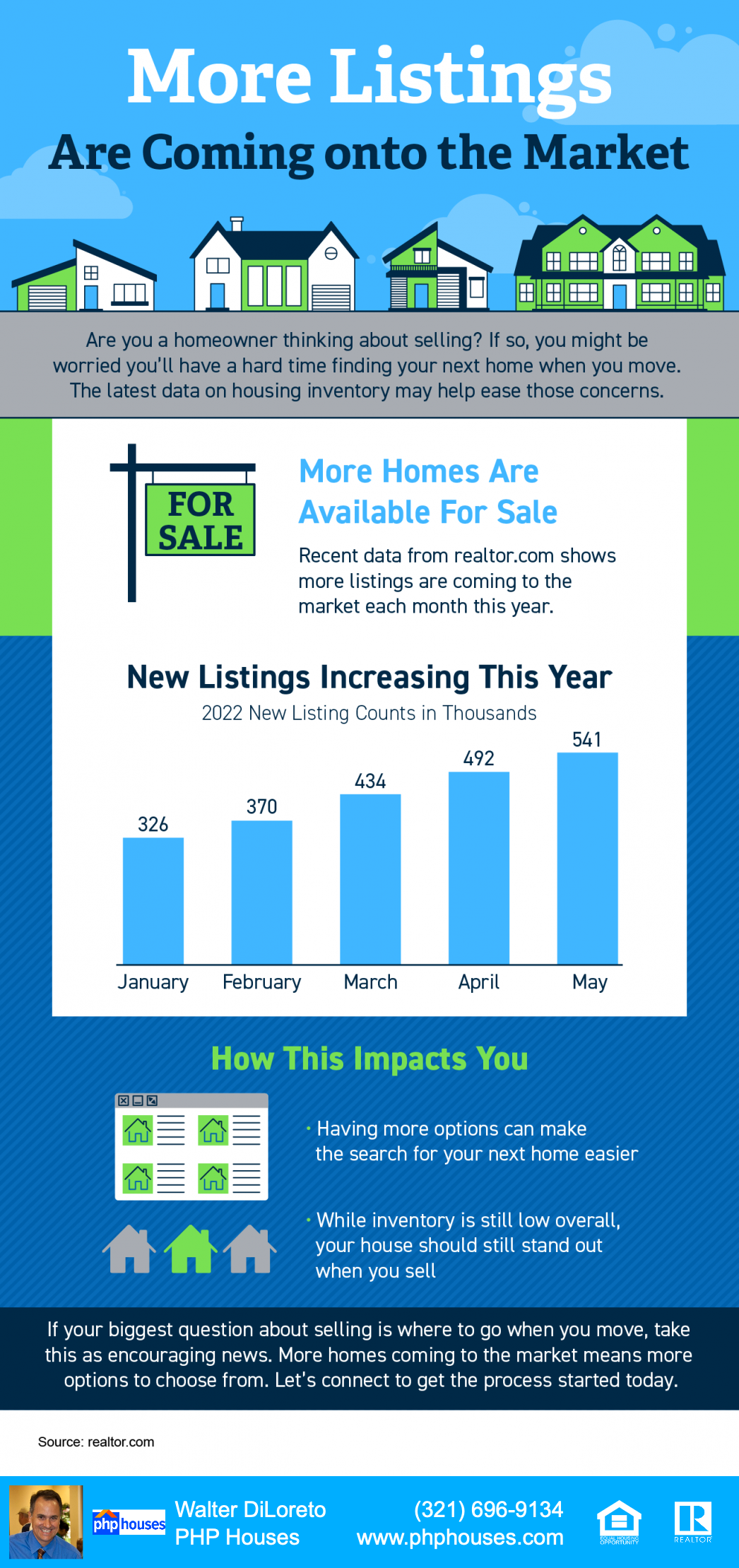

If you put off your home search at any point over the past two years, you may want to consider picking it back up based on today’s housing market conditions. Recent data shows the supply of homes for sale is increasing, giving buyers like you additional options.

But it’s important to keep in mind that while inventory is improving, it’s still a sellers’ market. And that means you need to be prepared as you set out on your home search. Here are three tips for buying the home of your dreams today.

1. Understand How Mortgage Rates Impact Your Homebuying Power

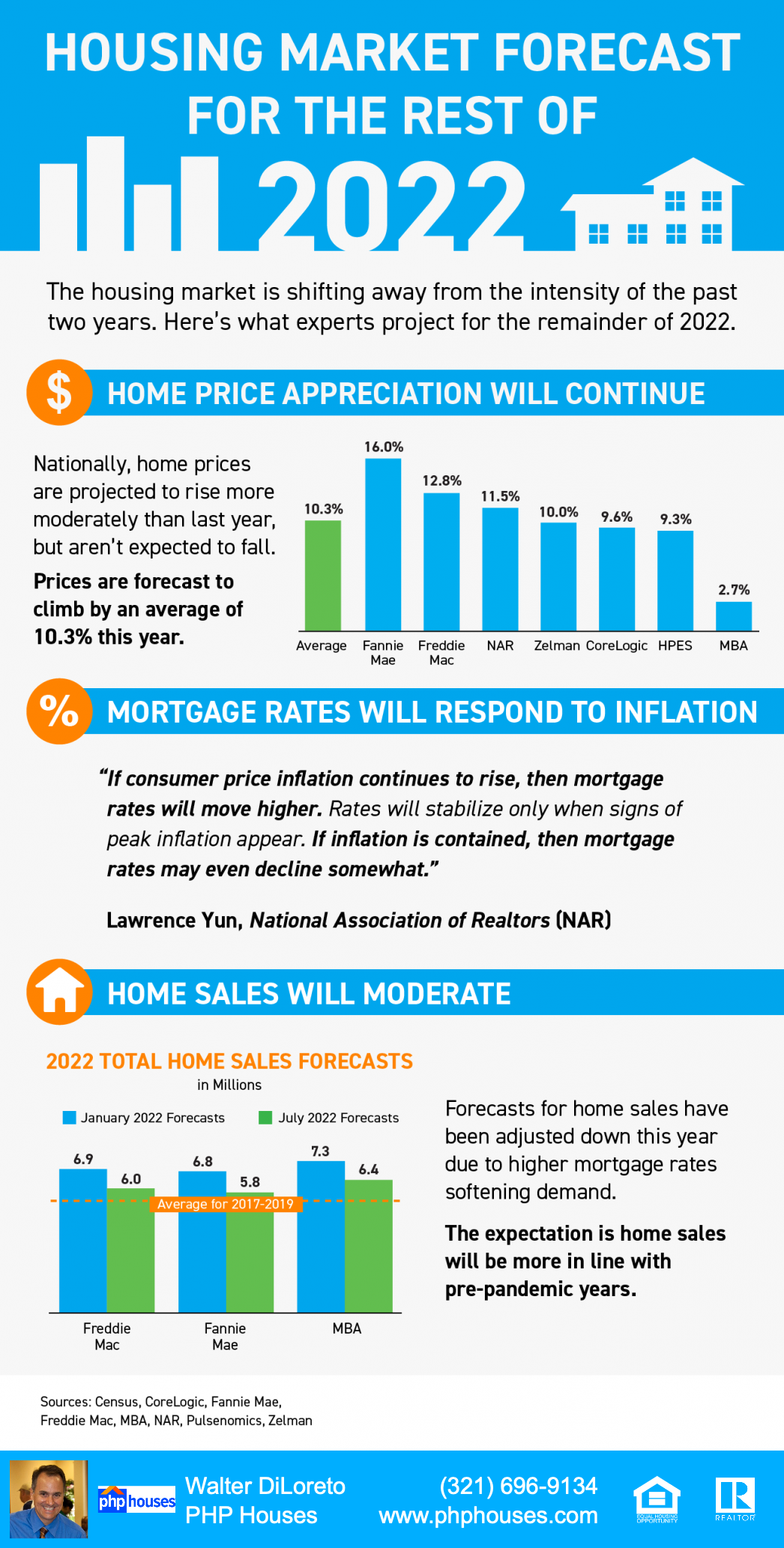

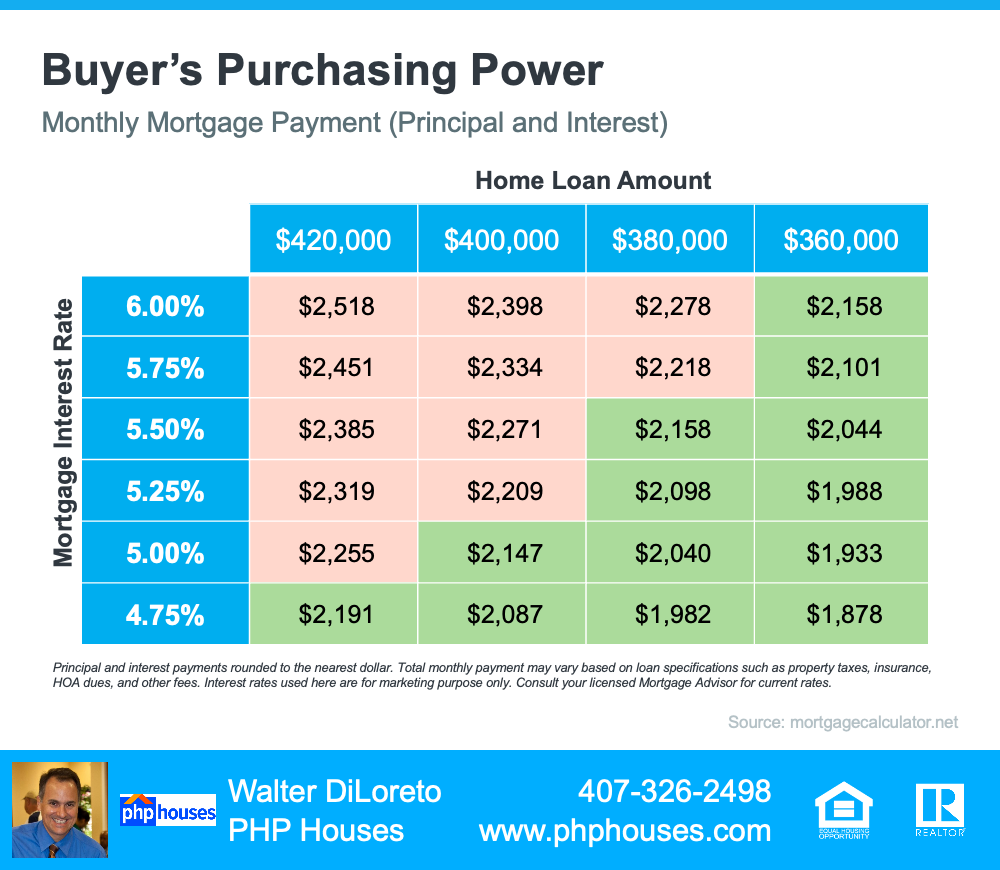

Mortgage rates have increased significantly this year, and over the past few weeks, they’ve been fluctuating quite a bit. It’s important to stay up to date on what’s happening with rates and understand how they can impact your purchasing power when you’re thinking of buying a home. The chart below can help.

Let’s say your budget allows for a monthly mortgage payment in the $2,100-$2,200 range. The green in the chart indicates a payment within or below that range, while the red is a payment that exceeds it.

Buyer’s Purchasing Power

As the chart shows, even a small change in mortgage rates can have a big impact on your monthly payments. If rates rise, you could exceed your budget unless you pursue a lower home loan amount. If rates fall, your purchasing power may increase, which could give you additional options for your search.

2. Be Open to Exploring Different Options During Your Search

The supply of homes for sale is improving, which gives you more homes to choose from. But historically, supply is still low. That means as you search for homes, if you still don’t find something that meets your needs, it may be worth expanding your search.

A recent article from the Washington Post highlights a few things buyers can consider today. It encourages opening yourself up to more areas. For example, if there’s a location you’ve previously ruled out (like a particular town, for example) it may be worth taking another look.

And if you’re able to, opening your search up to include other housing types, like newly built homes, condominiums, or townhomes can further increase your pool of options. Even as the inventory of homes for sale improves today, finding ways to cast a wider net during your search could help you find a hidden gem.

3. Work with a Local Real Estate Professional for Expert Guidance

Ultimately, you need to be prepared when you set out to buy a home. Jeff Ostrowski, Senior Mortgage Reporter for Bankrate, explains:

“Taking the leap to homeownership can provide a feeling of pride while boosting your long-term financial outlook, if you go in well-prepared and with your eyes open.”

No matter where you’re at in your homeownership journey, the best way to make sure you’re set up for success is to work with a real estate professional. If you’re just starting your search, a real estate professional can help you understand your local market and search for available homes. And when it’s time to make an offer, they’ll be an expert advisor and negotiator to help yours stand out above the rest.

Bottom Line

Strategically planning your home search by understanding today’s mortgage rates, casting a wide net, and building a team of experts can be the keys to finding the home of your dreams. To make sure you have expert advice each step of the way, let’s connect.

Contact us:

PHP Houses

142 W Lakeview Ave

Unit 1030

Lake Mary, FL 32746

Ph: (407) 641-1531

Fax: (407) 205-1951

email: info@phphouses.com

Let’s Connect:

Facebook

Linkedin

Twitter

Instagram

The information contained, and the opinions expressed, in this article are not intended to be construed as investment advice. The author does not guarantee or warrant the accuracy or completeness of the information or opinions contained herein. Nothing herein should be construed as investment advice. You should always conduct your own research and due diligence and obtain professional advice before making any investment decision. The author will not be liable for any loss or damage caused by your reliance on the information or opinions contained herein.