As our lives, our businesses, and the world we live in change day by day, we’re all left wondering how long this will last. How long will we feel the effects of the coronavirus? How deep will the impact go? The human toll may forever change families, but the economic impact will rebound with a cycle of downturn followed by economic expansion like we’ve seen play out in the U.S. economy many times over.

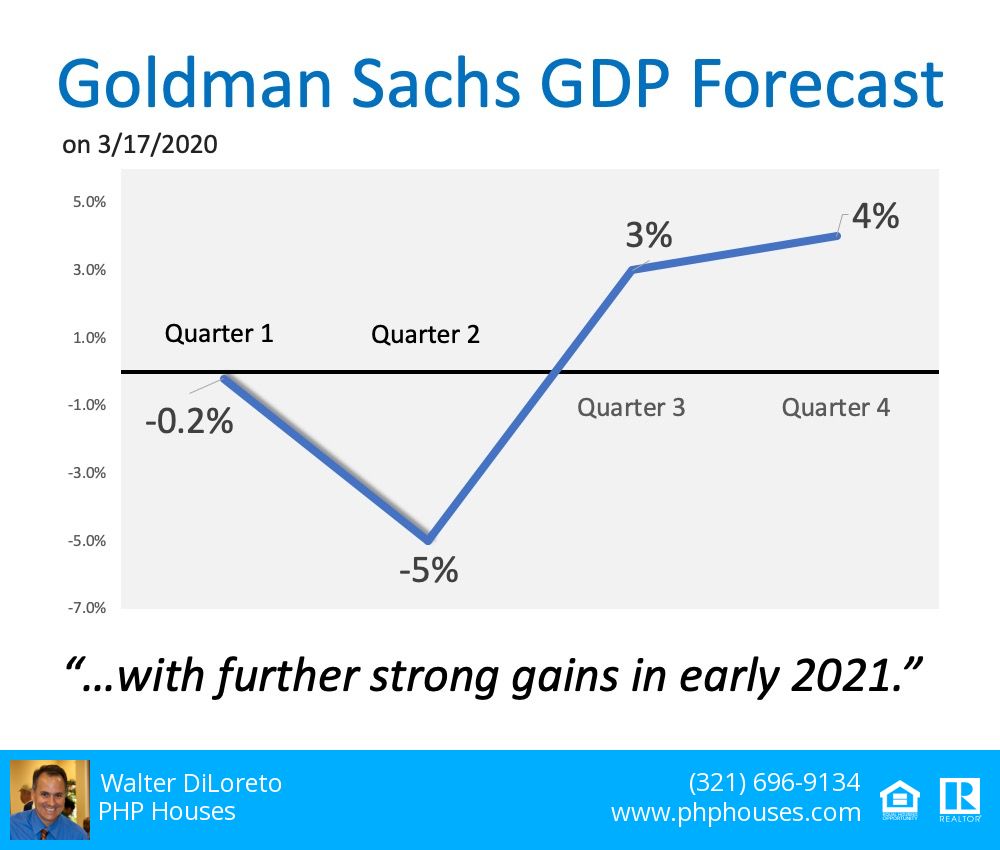

Here’s a look at what leading experts and current research indicate about the economic impact we’ll likely see as a result of the coronavirus. It starts with a forecast of U.S. Gross Domestic Product (GDP).

According to Investopedia:

“Gross Domestic Product (GDP) is the total monetary or market value of all the finished goods and services produced within a country’s borders in a specific time period. As a broad measure of overall domestic production, it functions as a comprehensive scorecard of the country’s economic health.”

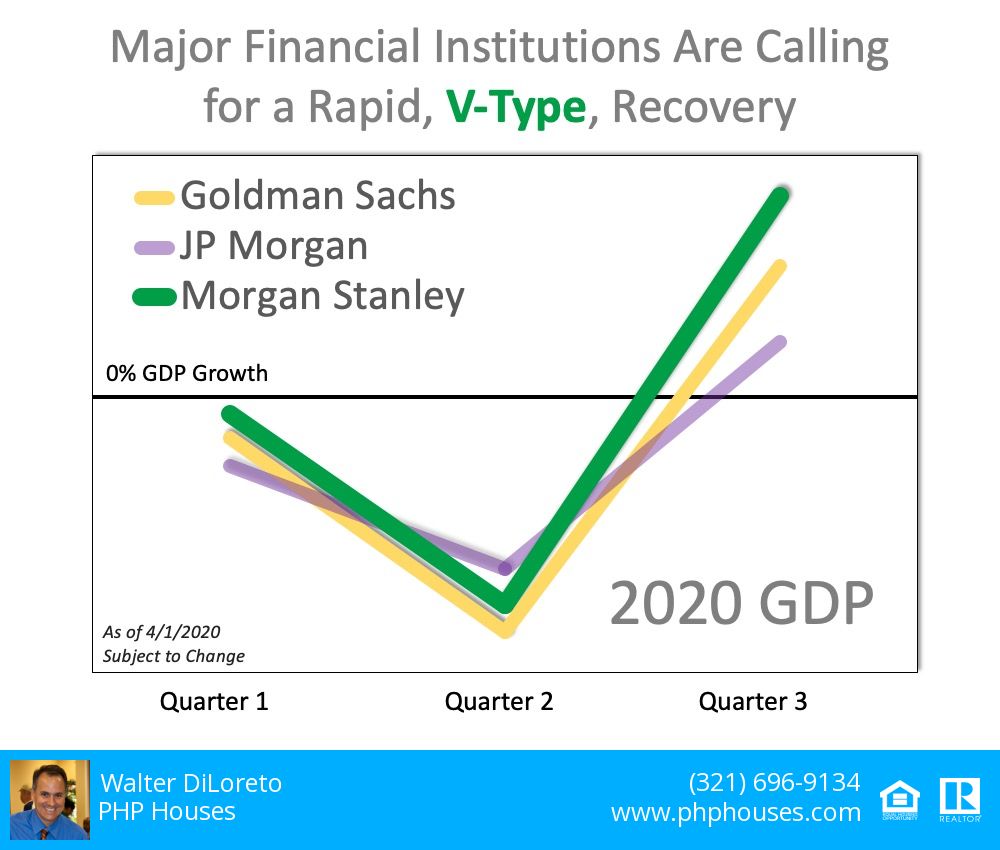

When looking at GDP (the measure of our country’s economic health), a survey of three leading financial institutions shows a projected sharp decline followed by a steep rebound in the second half of this year:

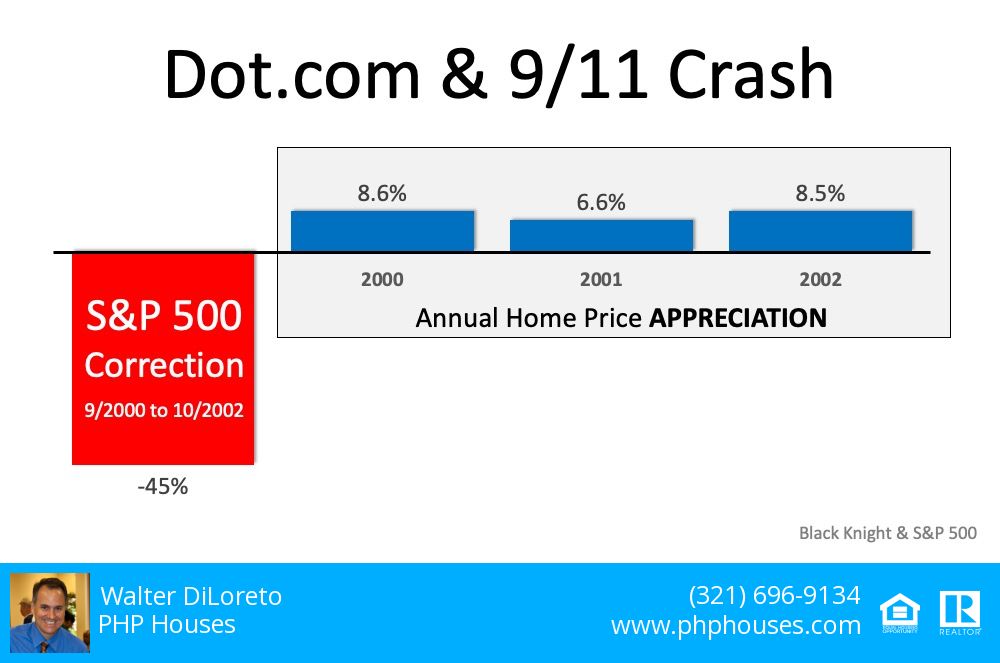

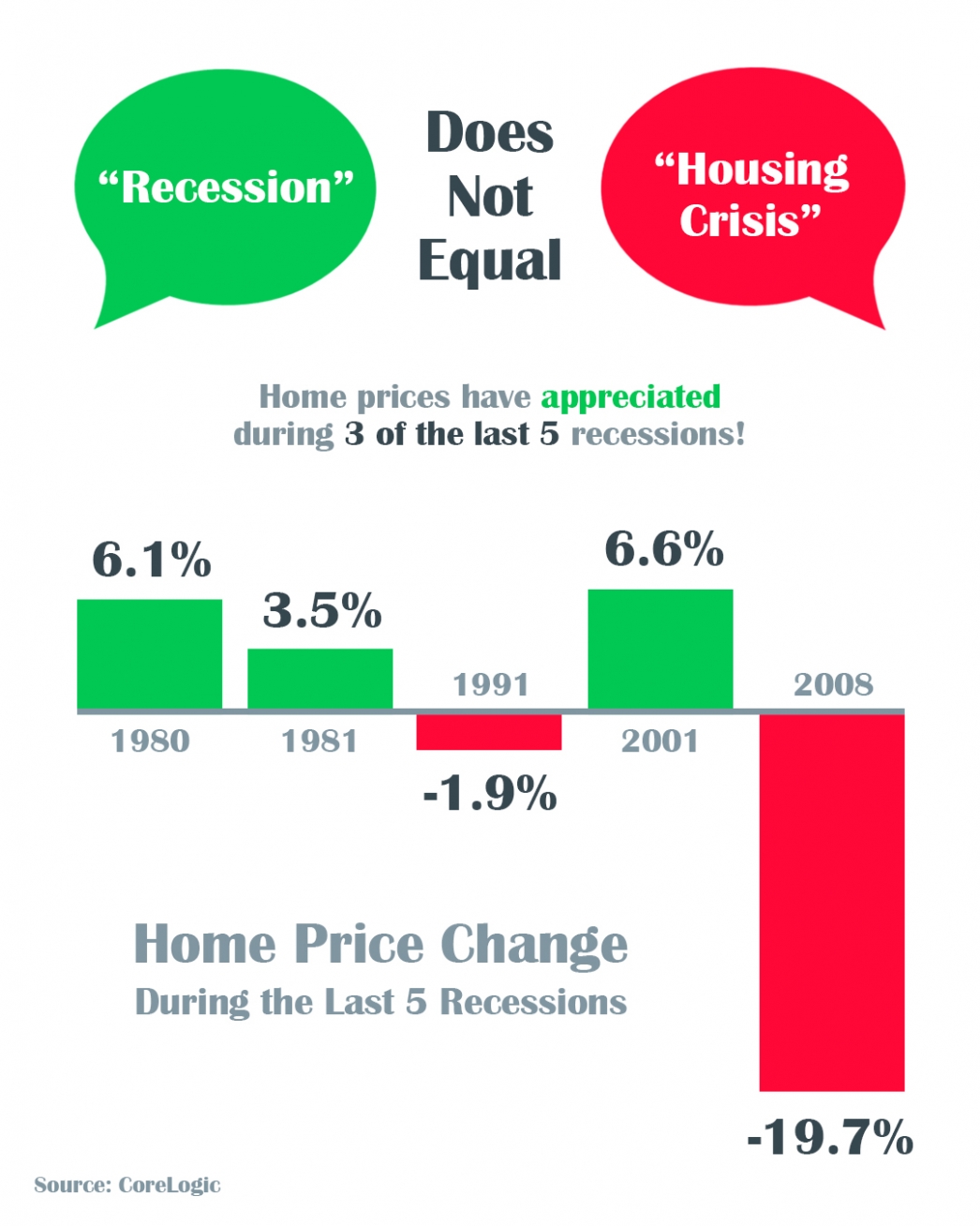

A recent study from John Burns Consulting also notes that past pandemics have also created V-Shaped Economic Recoveries like the ones noted above, and they had minimal impact on housing prices. This certainly gives hope and optimism for what is to come as the crisis passes.

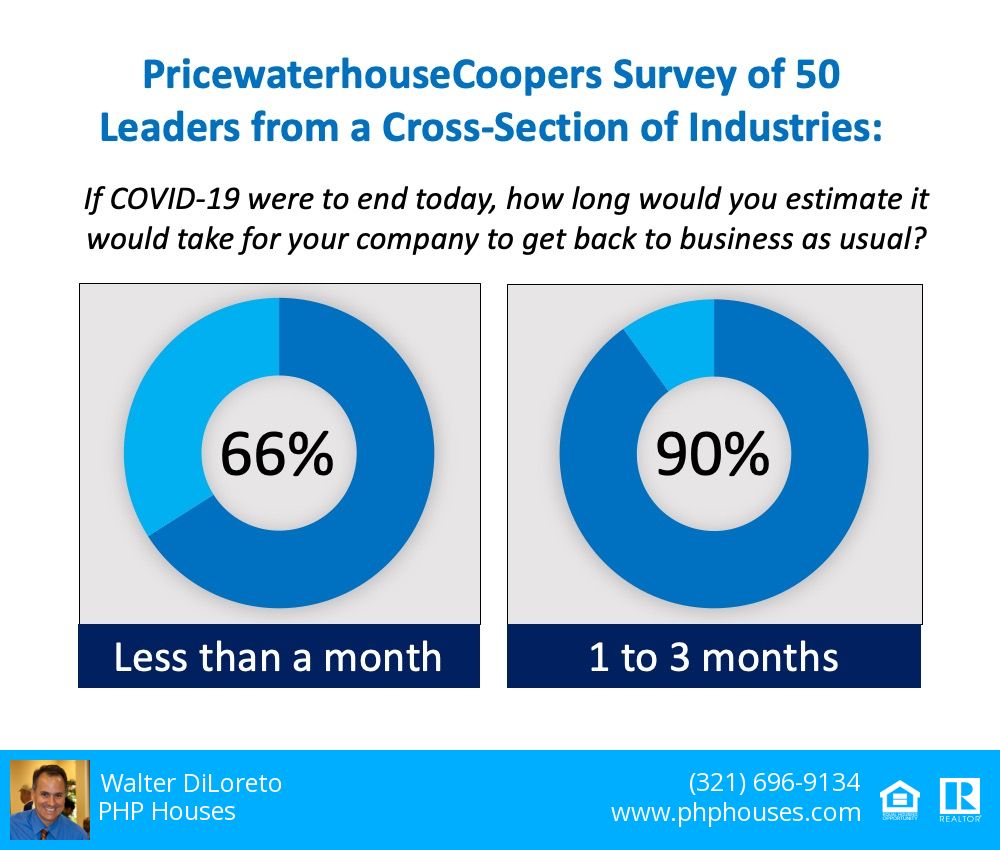

With this historical analysis in mind, many business owners are also optimistic for a bright economic return. A recent PricewaterhouseCoopers survey shows this confidence, noting 66% of surveyed business owners feel their companies will return to normal business rhythms within a month of the pandemic passing, and 90% feel they should be back to normal operation 1 to 3 months after:

From expert financial institutions to business leaders across the country, we can clearly see that the anticipation of a quick return to normal once the current crisis subsides is not too far away. In essence, this won’t last forever, and we will get back to growth-mode. We’ve got this.

Bottom Line

Lives and businesses are being impacted by the coronavirus, but experts do see a light at the end of the tunnel. As the economy slows down due to the health crisis, we can take guidance and advice from experts that this too will pass.

Contact us:

PHP Houses

142 W Lakeview Ave

Unit 1030

Lake Mary, FL 32746

Ph: (407) 519-0719

Fax: (407) 205-1951

email: info@phphouses.com

Let’s Connect:

Facebook

Linkedin

Twitter

Instagram