Are Home Prices Headed Toward Bubble Territory?

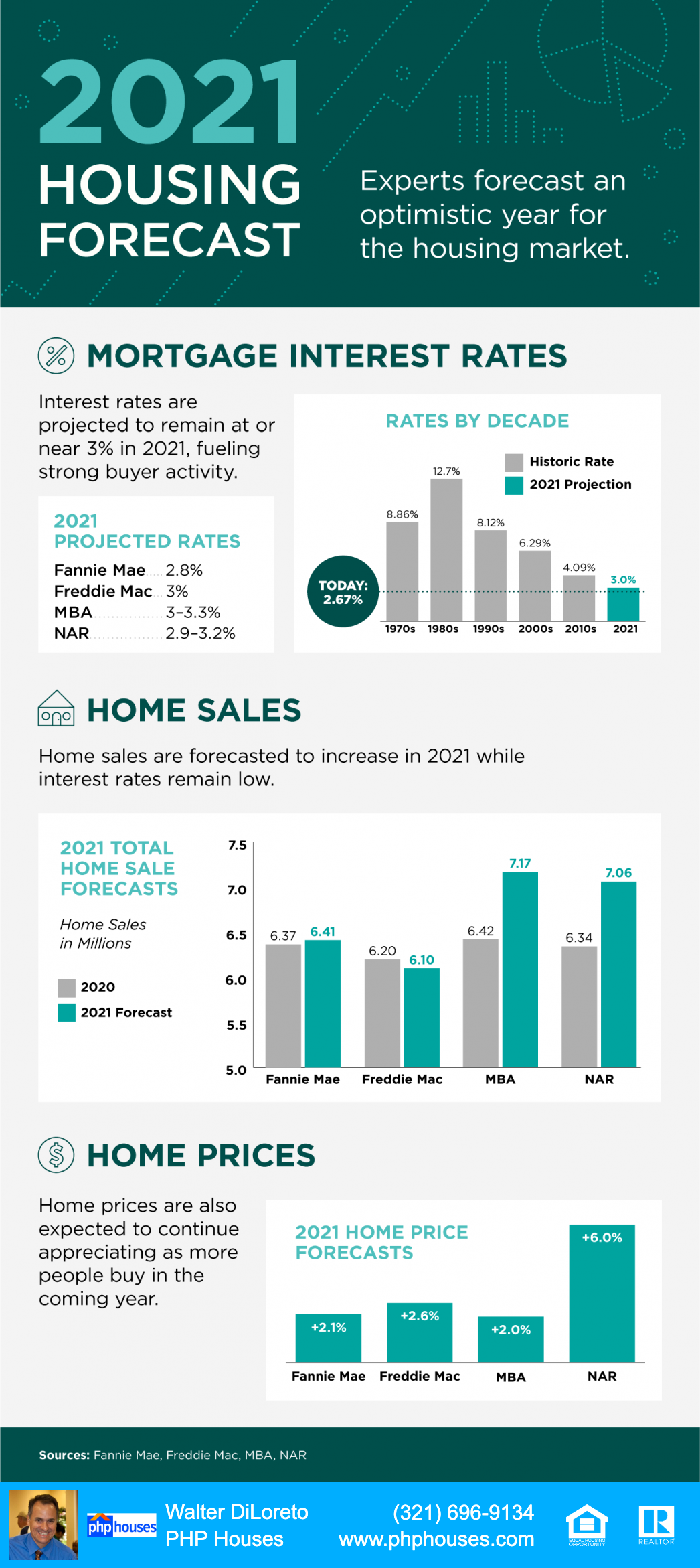

Talk of a housing bubble is beginning to crop up as home prices have appreciated at a rapid pace this year. This is understandable since the appreciation of residential real estate is well above historic annual averages. According to the Federal Housing Finance Agency (FHFA), annual appreciation since 1991 has averaged 3.8%. Here are the latest 2020 appreciation numbers from three reliable sources:

It’s easy to jump to the conclusion that house appreciation is out of control in today’s market. However, we need to put these numbers into context first.

Inflation and the Comeback from the Housing Crash

Following the housing crash, home values depreciated dramatically from 2007-2011. Values are still recovering from that unusually long period of falling prices. We must also realize that normal inflation has had an impact.

Bill McBride, the founder of the well-respected Calculated Risk blog, recently summed it up this way:

“It has been over fourteen years since the bubble peak. In the Case-Shiller release today, the seasonally adjusted National Index, was reported as being 22.2% above the previous bubble peak. However, in real terms (adjusted for inflation), the National index is still about 2% below the bubble peak…As an example, if a house price was $200,000 in January 2000, the price would be close to $291,000 today adjusted for inflation.”

The COVID Impact on Home Prices

The pandemic caused many households to reconsider whether their current home still fulfills their lifestyle. Many homeowners now want larger yards that are both separate and private.

Their needs on the inside of the home have changed too. People now want home offices, gyms, and living rooms well-suited for video conferencing. Barbara Ballinger, a freelance writer and the author of several books on real estate, recently wrote:

“While homeowners continue to want their outdoor spaces that offer a safe retreat, that appeal has shifted into other parts of the home, coupling comfort with function. In other words, homeowners want amenities for work and leisure, and they plan to enjoy them long after the pandemic.”

At the same time, concerns about the pandemic have caused many homeowners to put their plans to sell on hold. Realtor.com just released their November Monthly Housing Market Trends Report. It explains:

“Nationally, the inventory of homes for sale decreased 39.2% over the past year in November…This amounted to 490,000 fewer homes for sale compared to November of last year.”

More people buying and fewer people selling has caused home prices to escalate. However, with a vaccine on the horizon, more homeowners will be putting their houses on the market. This will better balance supply with demand and slow down the rapid appreciation.

That’s why major organizations in the housing industry are calling for much more moderate home appreciation next year. Here are the most recent forecasts for 2021:

This Is Nothing Like 2006

Finally, let’s put to rest some of the concerns that today’s scenario is anything like what led up to the last housing crash. Lawrence Yun, Chief Economist at the National Association of Realtors (NAR), explains why this is nothing like 2006:

“Such a frenzy of activity, reminiscent of 2006, raises questions about a bubble and the potential for a painful crash. The answer: There’s no comparison. Back in 2006, dubious adjustable-rate mortgages taxed many buyers’ budgets. Some loans didn’t even require income documentation. Today, buyers are taking out 30-year fixed-rate mortgages. Fourteen years ago, there were 3.8 million homes listed for sale, and home builders were putting up about 2 million new units. Now, inventory is only about 1.5 million homes, and home builders are underproducing relative to historical averages.”

Bottom Line

Most aspects of life have been anything but normal in 2020. That includes buying and selling real estate. High demand coupled with restricted supply has caused home prices to appreciate above historic levels. With the end of the health crisis in sight, we will see price appreciation return to more normal levels next year.

Contact us:

PHP Houses

142 W Lakeview Ave

Unit 1030

Lake Mary, FL 32746

Ph: (407) 519-0719

Fax: (407) 205-1951

email: info@phphouses.com

Let’s Connect:

Facebook

Linkedin

Twitter

Instagram

THE INFORMATION PRESENTED IN THIS ARTICLE IS FOR EDUCATIONAL PURPOSES ONLY AND SHOULD NOT BE CONSIDERED LEGAL, FINANCIAL, OR AS ANY OTHER TYPE OF ADVICE.