Some Buyers Prefer Smaller Homes

Over the past year, we’ve had plenty of opportunities to reflect on what we consider most important in our lives. The place we call home is one of the biggest things many of us are reevaluating. George Ratiu, Senior Economist at realtor.com, shares:

“The very nature of the pandemic, through the health implications, social distancing, and need to isolate, has really brought a central focus on the importance of home for most Americans…In a sense, it has elevated real estate markets as a centerpiece of our lives.”

For some, this has spurred an interest in making a move to a home that better suits our changing needs. In a recent study on today’s homebuyer preferences, the National Association of Home Builders (NAHB) states:

“When asked more specifically how the pandemic may have impacted their preference for home size…21% or about 1 out of every 5 buyers, do want a larger home now as a direct result of the health crisis, while another segment – 12% – would prefer a smaller one instead.”

While you might expect more time at home to lead to a need for more space, it’s interesting that a significant portion of homeowners actually want less. For those who own larger homes right now and have a desire to move, today’s housing market is full of opportunities. Danielle Hale, Chief Economist at realtor.com, explains:

“In a real estate market that is tipped in the favor of sellers, boomers and older homeowners are really the ones holding the cards…Those who are selling homes can use the profits to help them buy new ones.”

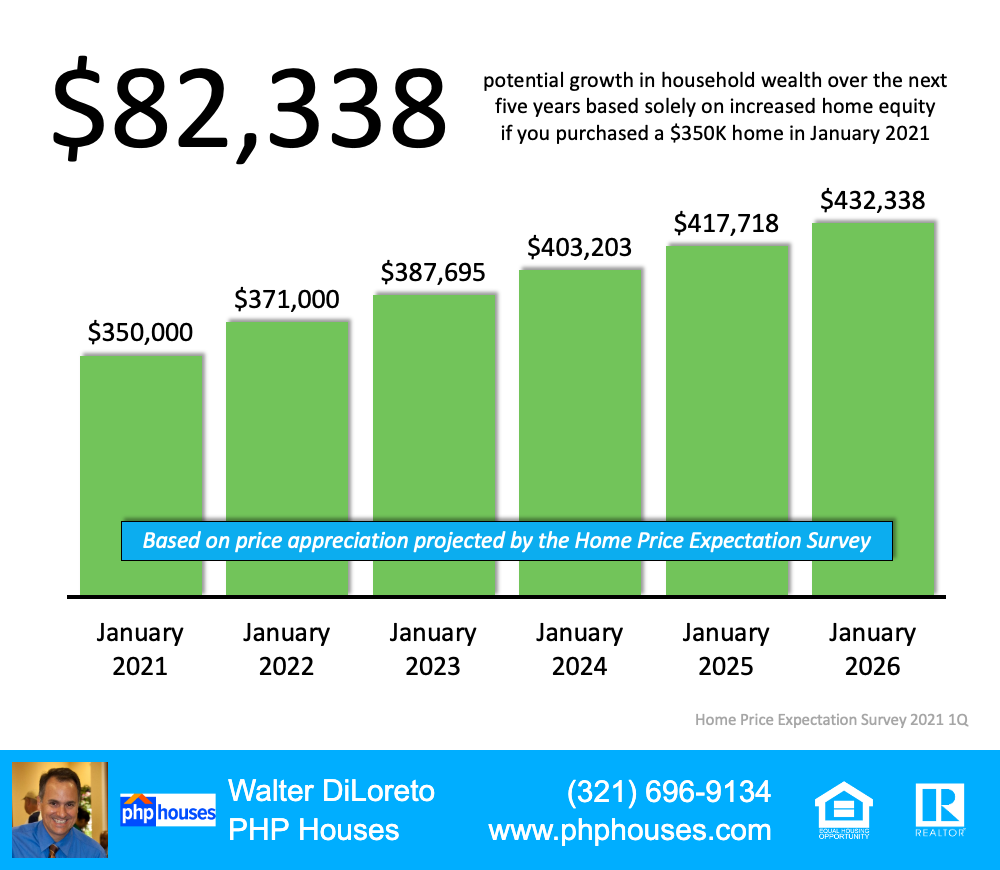

As a homeowner today, you likely have equity that can be put toward the purchase of your next home. With the equity growth homes have seen over the past year, you may have more than you think, which can help significantly as you make a move into your next home. According to a report from the National Association of Realtors (NAR):

“Home sellers cited that they sold their homes for a median of $66,000 more than they purchased it. Sellers 22 to 30 years gained the least at $33,400 in equity compared to sellers 66 to 74 years gained $100,000 in equity as they likely had lived in their homes for a longer period of time.”

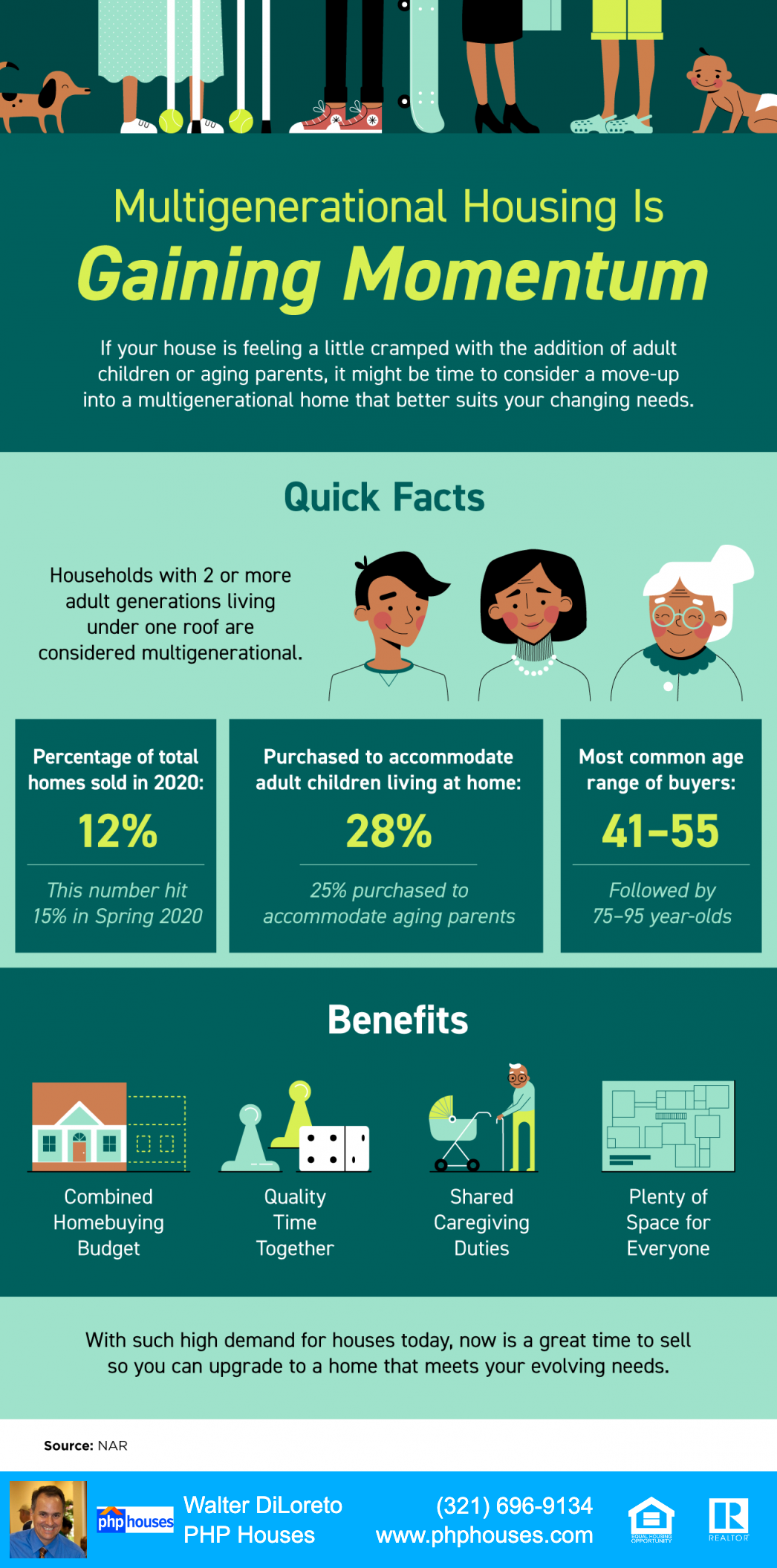

Despite the benefits of growing home equity, some homeowners are still hesitant to move and could be considering remodeling or making changes to their current space instead. However, if you’ve thought about aging in place rather than downsizing, you may want to reconsider. The U.S. Census Bureau points out:

“Of the nation’s 115 million housing units, only 10% are ready to accommodate older populations.”

If your house is no longer the best fit for your evolving needs, it may be time to put your equity to work for you and downsize to the home you really want.

Bottom Line

Today’s housing market favors homeowners who are ready to sell their houses and make a move. If you’re thinking about downsizing this year, let’s connect to discuss your options in our local market.

Contact us:

PHP Houses

142 W Lakeview Ave

Unit 1030

Lake Mary, FL 32746

Ph: (407) 519-0719

Fax: (407) 205-1951

email: info@phphouses.com

Let’s Connect:

Facebook

Linkedin

Twitter

Instagram

THE INFORMATION PRESENTED IN THIS ARTICLE IS FOR EDUCATIONAL PURPOSES ONLY AND SHOULD NOT BE CONSIDERED LEGAL, FINANCIAL, OR AS ANY OTHER TYPE.