How to Make a Winning Offer on a Home

How to Make a Winning Offer on a Home

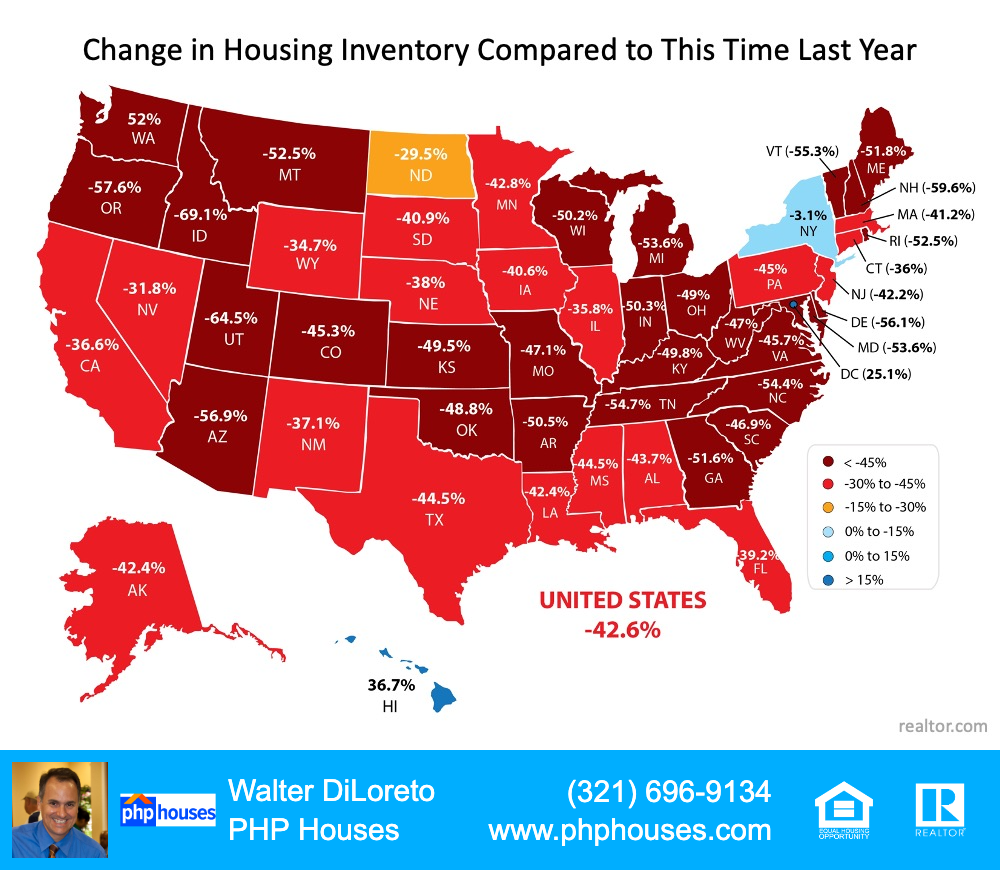

Today’s homebuyers are faced with a strong sellers’ market, which means there are a lot of active buyers competing for a relatively low number of available homes. As a result, it’s essential to understand how to make a confident and competitive offer on your dream home. Here are five tips for success in this critical stage of the homebuying process.

1. Listen to Your Real Estate Advisor

An article from Freddie Mac gives direction on making an offer on a home. From the start, it emphasizes how trusted professionals can help you stay focused on the most important things, especially at times when this process can get emotional for buyers:

“Remember to let your homebuying team guide you on your journey, not your emotions. Their support and expertise will keep you from compromising on your must-haves and future financial stability.”

A real estate professional should be the expert guide you lean on for advice when you’re ready to make an offer.

2. Understand Your Finances

Having a complete understanding of your budget and how much house you can afford is essential. The best way to know this is to get pre-approved for a loan early in the homebuying process. Only 44% of today’s prospective homebuyers are planning to apply for pre-approval, so be sure to take this step so you stand out from the crowd. Doing so make it clear to sellers you’re a serious and qualified buyer, and it can give you a competitive edge in a bidding war.

3. Be Prepared to Move Quickly

According to the latest Realtors Confidence Index from the National Association of Realtors (NAR), the average property sold today receives 3.7 offers and is on the market for just 21 days. These are both results of today’s competitive market, showing how important it is to stay agile and alert in your search. As soon as you find the right home for your needs, be prepared to submit an offer as quickly as possible.

4. Make a Fair Offer

It’s only natural to want the best deal you can get on a home. However, Freddie Mac also warns that submitting an offer that’s too low can lead sellers to doubt how serious you are as a buyer. Don’t make an offer that will be tossed out as soon as it’s received. The expertise your agent brings to this part of the process will help you stay competitive:

“Your agent will work with you to make an informed offer based on the market value of the home, the condition of the home and recent home sale prices in the area.”

5. Stay Flexible in Negotiations

After submitting an offer, the seller may accept it, reject it, or counter it with their own changes. In a competitive market, it’s important to stay nimble throughout the negotiation process. You can strengthen your position with an offer that includes flexible move-in dates, a higher price, or minimal contingencies (conditions you set that the seller must meet for the purchase to be finalized). Freddie Mac explains that there are, however, certain contingencies you don’t want to forego:

“Resist the temptation to waive the inspection contingency, especially in a hot market or if the home is being sold ‘as-is’, which means the seller won’t pay for repairs. Without an inspection contingency, you could be stuck with a contract on a house you can’t afford to fix.”

Bottom Line

Today’s competitive market makes it more important than ever to make a strong offer on a home. Let’s connect to make sure you rise to the top along the way.

Contact us:

PHP Houses

142 W Lakeview Ave

Unit 1030

Lake Mary, FL 32746

Ph: (407) 519-0719

Fax: (407) 205-1951

email: info@phphouses.com

Let’s Connect:

Facebook

Linkedin

Twitter

Instagram