Down Payment Assistance Programs Can Help You Achieve Homeownership

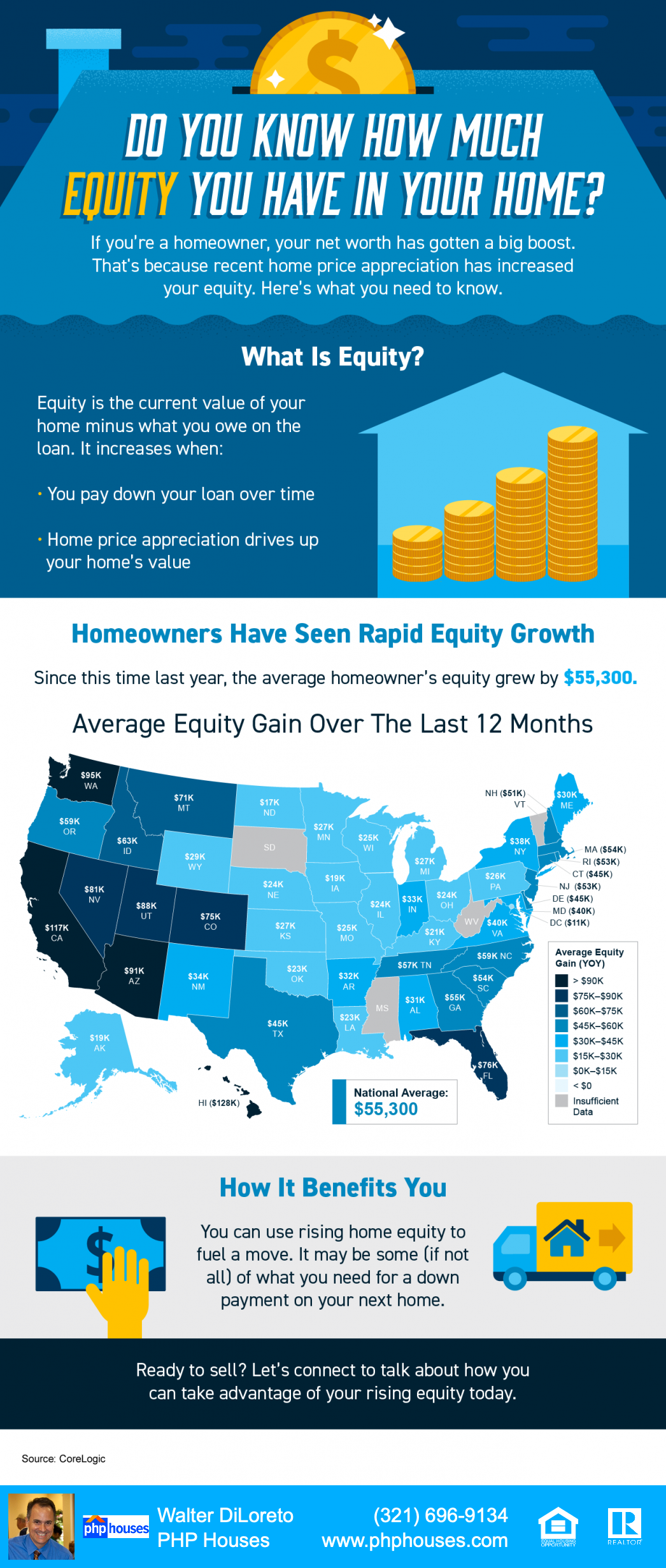

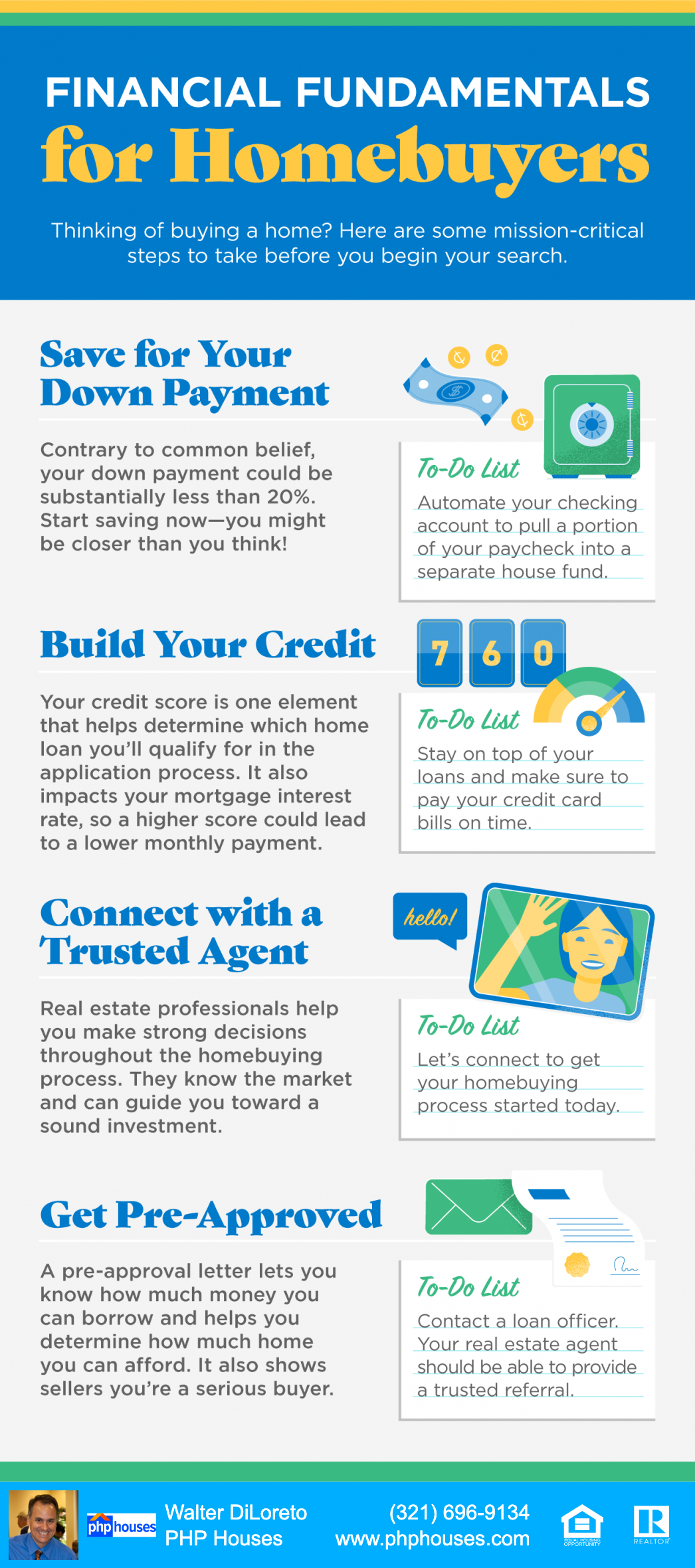

For many homebuyers, the thought of saving for a down payment can feel daunting, especially in today’s market. That’s why, when asked what they find most difficult in the homebuying process, some buyers say it’s one of the hardest steps on the path to homeownership. Data from the National Association of Realtors (NAR) shows:

“For first-time home buyers, 29 percent said saving for a downpayment [sic] was the most difficult step in the process.”

If you’re finding that your down payment is your biggest hurdle, the good news is there are many down payment assistance programs available that can help you achieve your goals. The key is understanding where to look and learning what options are available. Here’s some information that can help.

First-Time and Repeat Buyers Are Often Eligible

According to downpaymentresource.com, there are thousands of financial assistance programs available for homebuyers, like affordable mortgage options for first-time buyers. But, of the many programs that are available, down payment assistance options make up the large majority. They say 73% of the assistance available to homebuyers is there to help you with your down payment.

And it’s not just first-time homebuyers that are eligible for these programs. Downpaymentresource.com notes:

“You don’t have to be a first-time buyer. Over 38% of all programs are for repeat homebuyers who have owned a home in the last 3 years.”

That means no matter where you are in your homeownership journey, there could be an option available for you.

There Are Local Programs and Specialized Programs for Public Servants

There are also multiple down payment assistance resources designed to help those who serve our communities. Teacher Next Door is one of those programs:

“The Teacher Next Door Program was designed to increase home ownership among teachers and other public servants, support community development and increase access to affordable housing free from discrimination.”

Teacher Next Door is just one program that seeks to help teachers, first responders, health providers, government employees, active-duty military personnel, and veterans reach their down payment goals.

And, most importantly, even if you don’t qualify for these types of specialized programs, there are many federal, state, and local programs available for you to explore. And the best way to do that is to connect with a local real estate professional to learn more about what’s available in your area.

Bottom Line

If saving for a down payment seems daunting, there are programs available that can help. And if you work to serve our community, there may be even more opportunities available to you. To learn more about your options, let’s connect so you can start your homebuying journey today.

Contact us:

PHP Houses

142 W Lakeview Ave

Unit 1030

Lake Mary, FL 32746

Ph: (407) 519-0719

Fax: (407) 205-1951

email: info@phphouses.com

Let’s Connect:

Facebook

Linkedin

Twitter

Instagram

The information contained, and the opinions expressed, in this article are not intended to be construed as investment advice. The author does not guarantee or warrant the accuracy or completeness of the information or opinions contained herein. Nothing herein should be construed as investment advice. You should always conduct your own research and due diligence and obtain professional advice before making any investment decision. The author will not be liable for any loss or damage caused by your reliance on the information or opinions contained herein.