Home Price Deceleration Doesn’t Mean Home Price Depreciation

Home Price Deceleration Doesn’t Mean Home Price Depreciation

Experts in the real estate industry use a number of terms when they talk about what’s happening with home prices. And some of those words sound a bit similar but mean very different things. To help clarify what’s happening with home prices and where experts say they’re going, here’s a look at a few terms you may hear:

- Appreciation is when home prices increase.

- Depreciation is when home prices decrease.

- Deceleration is when home prices continue to appreciate, but at a slower pace.

Where Home Prices Have Been in Recent Years

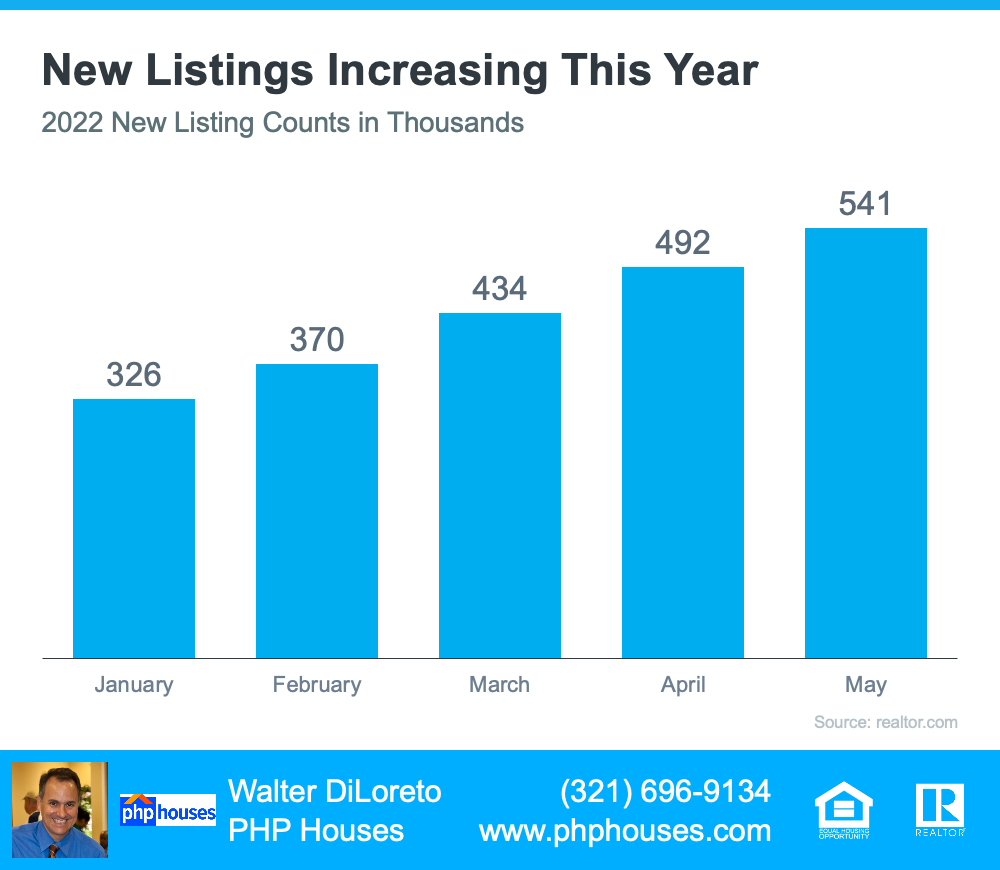

For starters, you’ve probably heard home prices have skyrocketed over the past two years, but homes were actually appreciating long before that. You might be surprised to learn that home prices have climbed for 122 consecutive months (see graph below):

Home Prices Have Appreciated Since 2012

As the graph shows, houses have gained value consistently over the past 10 consecutive years. But since 2020, the increase has been more dramatic as home price growth accelerated.

So why did home prices climb so much? It’s because there were more buyers than there were homes for sale. That imbalance put upward pressure on home prices because demand was high and supply was low.

Where Experts Say Home Prices Are Going

While this is helpful context, if you’re a buyer or seller in today’s market, you probably want to know what’s going to happen with home prices moving forward. Will they continue that same growth path or will home prices fall?

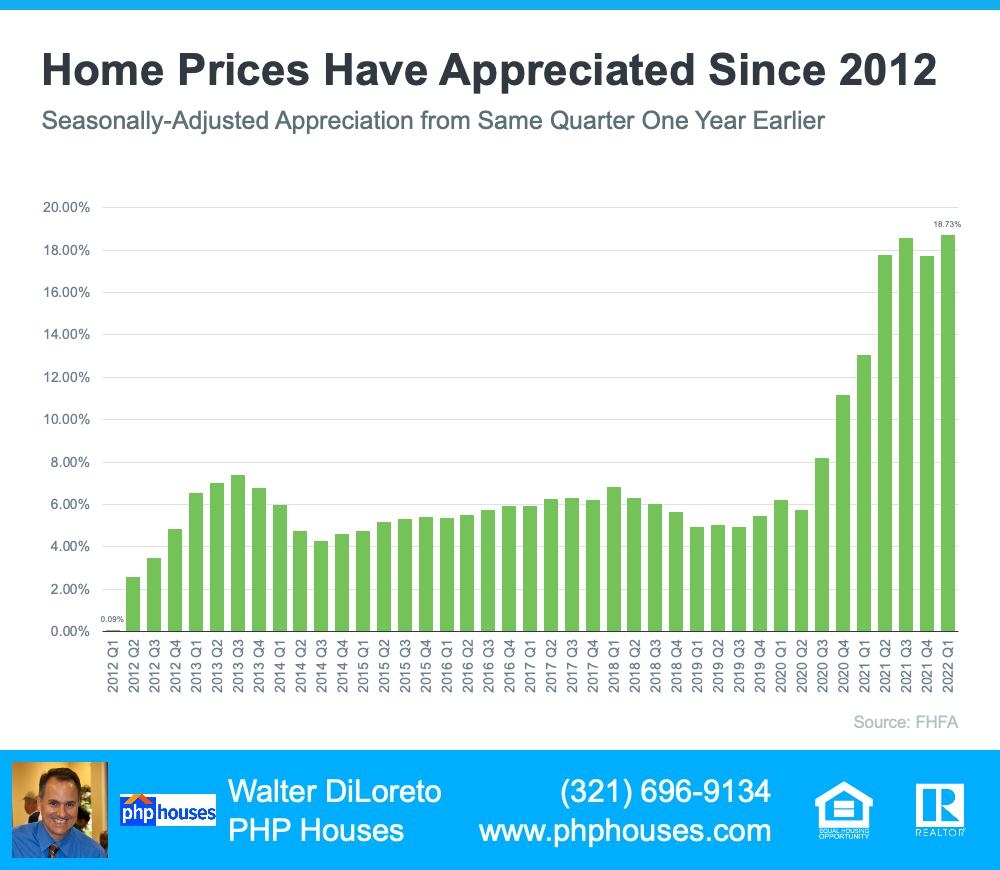

Experts are forecasting ongoing appreciation, just at a decelerated pace. In other words, prices will keep climbing, just not as fast as they have been. The graph below shows home price forecasts from seven industry leaders. None are calling for prices to fall (see graph below):

Home Price Forecasts for 2022

Mark Fleming, Chief Economist at First American, identifies a key reason why home prices won’t depreciate or drop:

“In today’s housing market, demand for homes continues to outpace supply, which is keeping the pressure on house prices, so don’t expect house prices to decline.”

And although housing supply is starting to tick up, it’s not enough to make home prices decline because there’s still a gap between the number of homes available for sale and the volume of buyers looking to make a purchase.

Terry Loebs, Founder of the research firm Pulsenomics, notes that most real estate experts and economists anticipate home prices will continue rising. As he puts it:

“With home values at record-high levels and a vast majority of experts projecting additional price increases this year and beyond, home prices and expectations remain buoyant.”

Bottom Line

Experts forecast price deceleration, not depreciation. That means home prices will continue to rise, just at a slower pace. Let’s connect so you can get the full picture of what’s happening with home prices in our local market and to discuss your buying and selling goals.

Contact us:

PHP Houses

142 W Lakeview Ave

Unit 1030

Lake Mary, FL 32746

Ph: (407) 519-0719

Fax: (407) 205-1951

email: info@phphouses.com

Let’s Connect:

Facebook

Linkedin

Twitter

Instagram

The information contained, and the opinions expressed, in this article are not intended to be construed as investment advice. The author does not guarantee or warrant the accuracy or completeness of the information or opinions contained herein. Nothing herein should be construed as investment advice. You should always conduct your own research and due diligence and obtain professional advice before making any investment decision. The author will not be liable for any loss or damage caused by your reliance on the information or opinions contained herein.