Latest Jobs Report: What Does It Mean for You & the Housing Market?

Latest Jobs Report: What Does It Mean for You & the Housing Market?

Last Friday, the Bureau of Labor Statistics released a very encouraging jobs report. The economy gained 916,000 jobs in March – well above expert projections of 650,000 to 675,000. The unemployment rate fell again and is now at 6%.

What does this mean for you?

Our lives are deeply impacted by our nation’s economy. The better the economy is doing overall, the better most individuals in the country will do as well. Here’s a look at what four experts told the Wall Street Journal after reviewing last week’s report.

Michael Feroli, JPMorgan Chase:

“The powerful tailwind of the reopening of economic activity appears to be gathering force; while the level of employment last month was still 8.4 million positions below that which prevailed before the pandemic, it is reasonable to expect that a majority of those lost jobs will be recouped in coming months.”

Mike Fratantoni, Mortgage Bankers Association:

“We fully expect that this pace of job gains will continue for months, and anticipate that the unemployment rate, now at 6%, will be well below 5% by the end of the year.”

Paul Ashworth, Capital Economics:

“With the vaccination program likely to reach critical mass within the next couple of months and the next round of fiscal stimulus providing a big boost, there is finally real light at the end of the tunnel.”

Jason Schenker, Prestige Economics:

“People are getting back to work and the vaccine isn’t just inoculating the population, it’s clearly inoculating the economy.”

What does this mean for residential real estate?

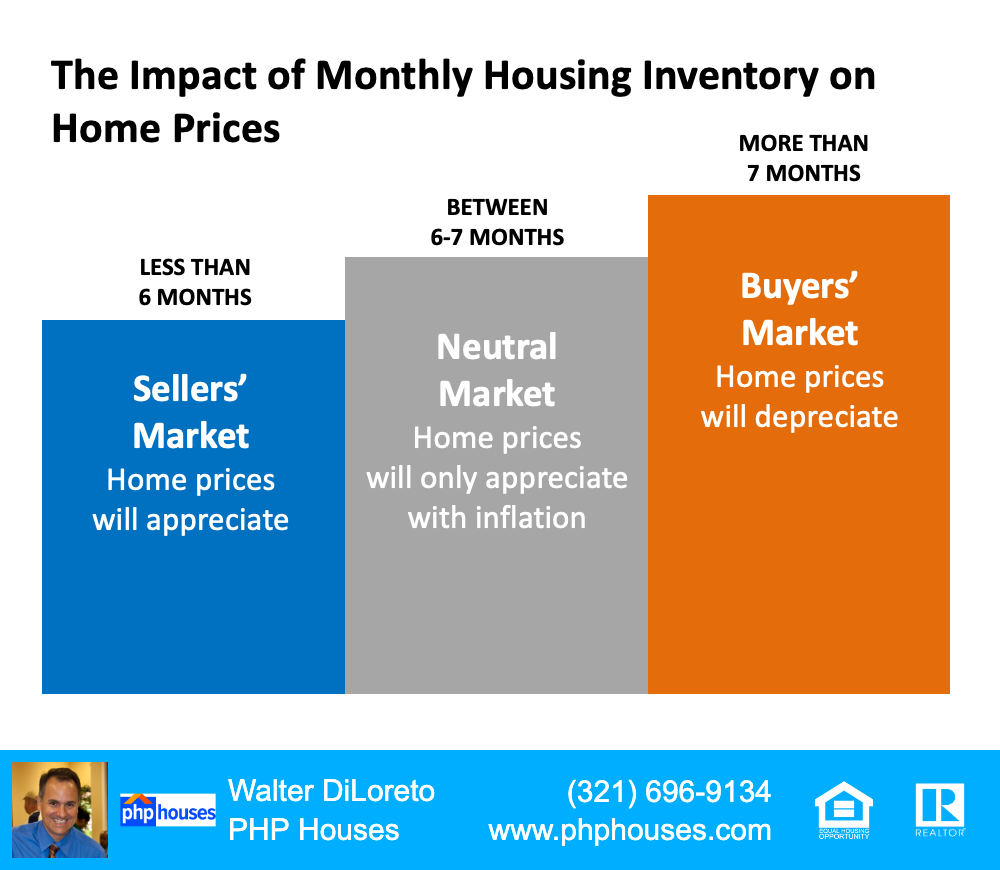

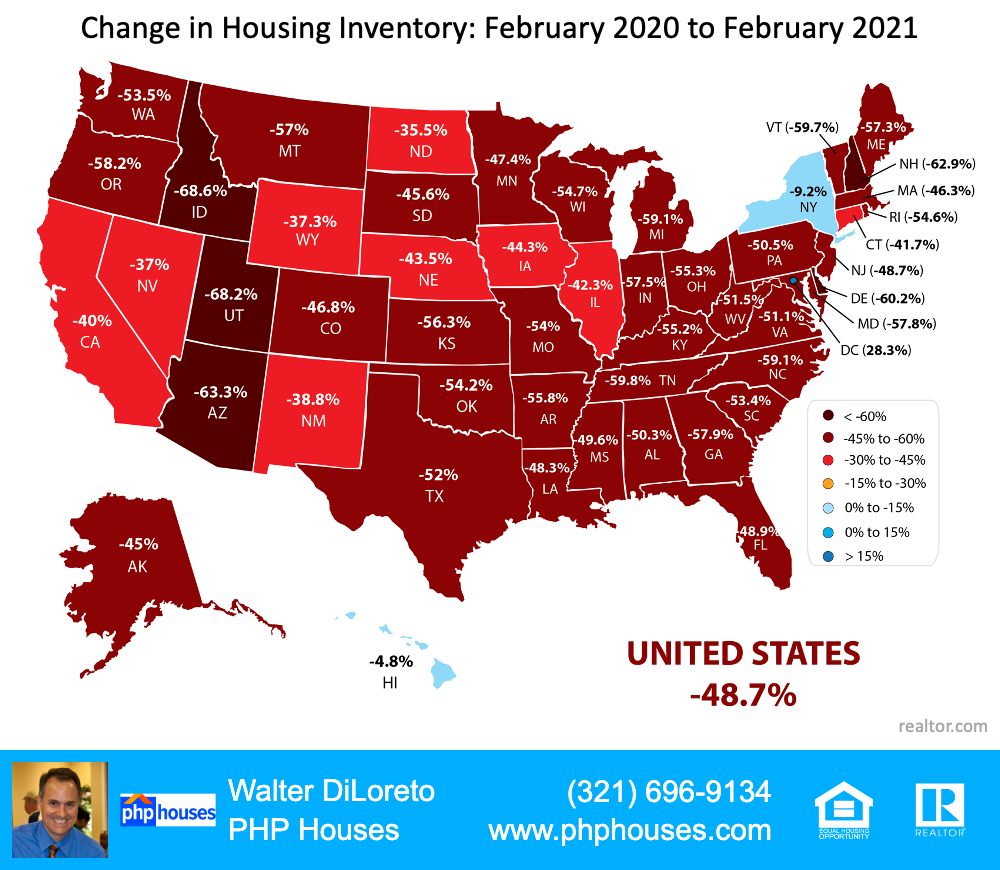

Today, the biggest challenge for homebuyers is the lack of homes currently for sale. With listing inventory down 52% from a year ago, bidding wars are skyrocketing. As a result, home prices are climbing.

One answer to this challenge is to build more homes to satisfy the demand. The latest jobs report gives hope for new housing construction, and therefore brings hope to buyers as well. Here’s what three industry economists said about the increase in construction jobs revealed in the report:

Lawrence Yun, Chief Economist, National Association of Realtors:

“Construction jobs boomed in March, one of the largest monthly gains ever. This raises the prospect for more home building and more inventory reaching the market in the upcoming months. The housing market has been hot with fast rising home prices but has been constrained by a lack of supply. By hiring more workers and building more homes, home prices will move to a manageable level to give more Americans a shot at ownership.”

Odeta Kushi, Deputy Chief Economist, First American:

“Great jobs report for a housing market in an inventory crisis. Residential construction building jobs increased 3.9% from pre-2020 recession peak in Feb. 2020. The construction industry remains a labor-intensive industry. We need more hammers at work to build more homes.”

Robert Dietz, Chief Economist, National Association of Home Builders:

“Good job numbers in March for residential construction. 37,000 gain from Feb to March. 3.03 million total employment for home builders and remodelers, and up 49,100 from Jan 2020.”

Bottom Line

An improving economy with a falling unemployment rate will benefit households across the country, as well as the overall housing market.

Contact us:

PHP Houses

142 W Lakeview Ave

Unit 1030

Lake Mary, FL 32746

Ph: (407) 519-0719

Fax: (407) 205-1951

email: info@phphouses.com

Let’s Connect:

Facebook

Linkedin

Twitter

Instagram

THE INFORMATION PRESENTED IN THIS ARTICLE IS FOR EDUCATIONAL PURPOSES ONLY AND SHOULD NOT BE CONSIDERED LEGAL, FINANCIAL, OR AS ANY OTHER TYPE.