Impact of the Coronavirus on the U.S. Housing Market

Impact of the Coronavirus on the U.S. Housing Market

The Coronavirus (COVID-19) has caused massive global uncertainty, including a U.S. stock market correction no one could have seen coming. While much of the news has been about the effect on various markets, let’s also acknowledge the true impact it continues to have on lives and families around the world.

With all this uncertainty, how do you make powerful and confident decisions in regard to your real estate plans?

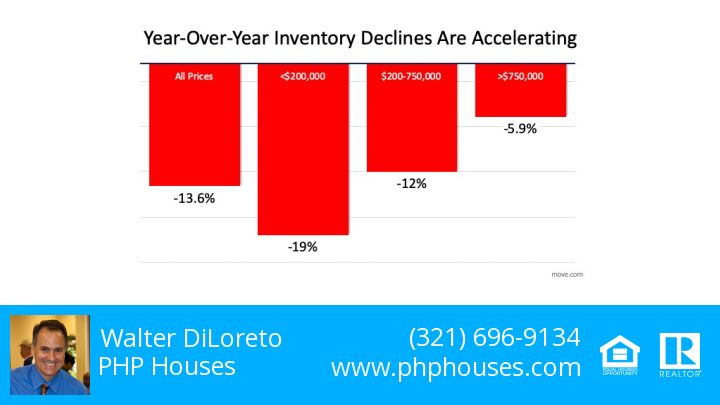

The National Association of Realtors (NAR) anticipates:

“At the very least, the coronavirus could cause some people to put home sales on hold.”

While this is an understandable approach, it is important to balance that with how it may end up costing you in the long run. If you’re considering buying or selling a home, it is key to educate yourself so that you can take thoughtful and intentional next steps for your future.

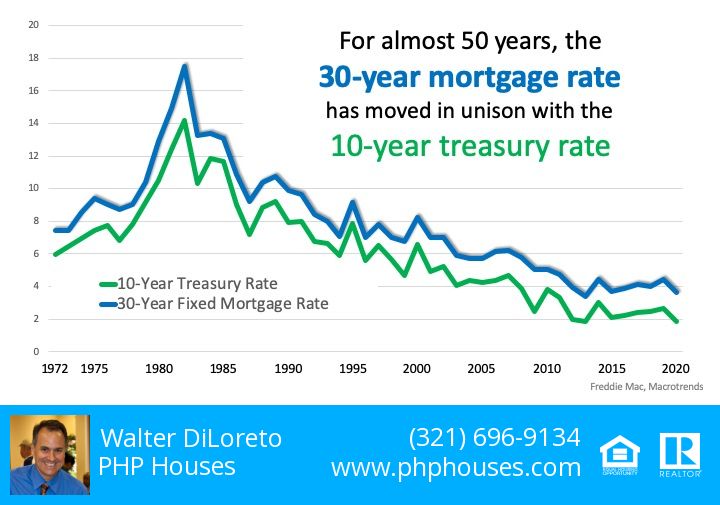

For example, when there’s fear in the world, we see lower mortgage interest rates as investors flee stocks for the safety of U.S. bonds. This connection should be considered when making real estate decisions.

According to the National Association of Home Builders (NAHB):

“The Fed’s action was expected but perhaps not to this degree and timing. And the policy change was consistent with recent declines for interest rates in the bond market. These declines should push mortgage interest rates closer to a low 3% average for the 30-year fixed rate mortgage.”

This is exactly what we’re experiencing right now as mortgage interest rates hover at the lowest levels in the history of the housing market.

Bottom Line

The full impact of the Coronavirus is still not yet known. It is in times like these that working with an informed and educated real estate professional can make all the difference in the world.

Contact us:

PHP Houses

142 W Lakeview Ave

Unit 1030

Lake Mary, FL 32746

Ph: (407) 519-0719

Fax: (407) 205-1951

email: info@phphouses.com