Buying a Home May Make More Financial Sense Than Renting One

Buying a Home May Make More Financial Sense Than Renting One

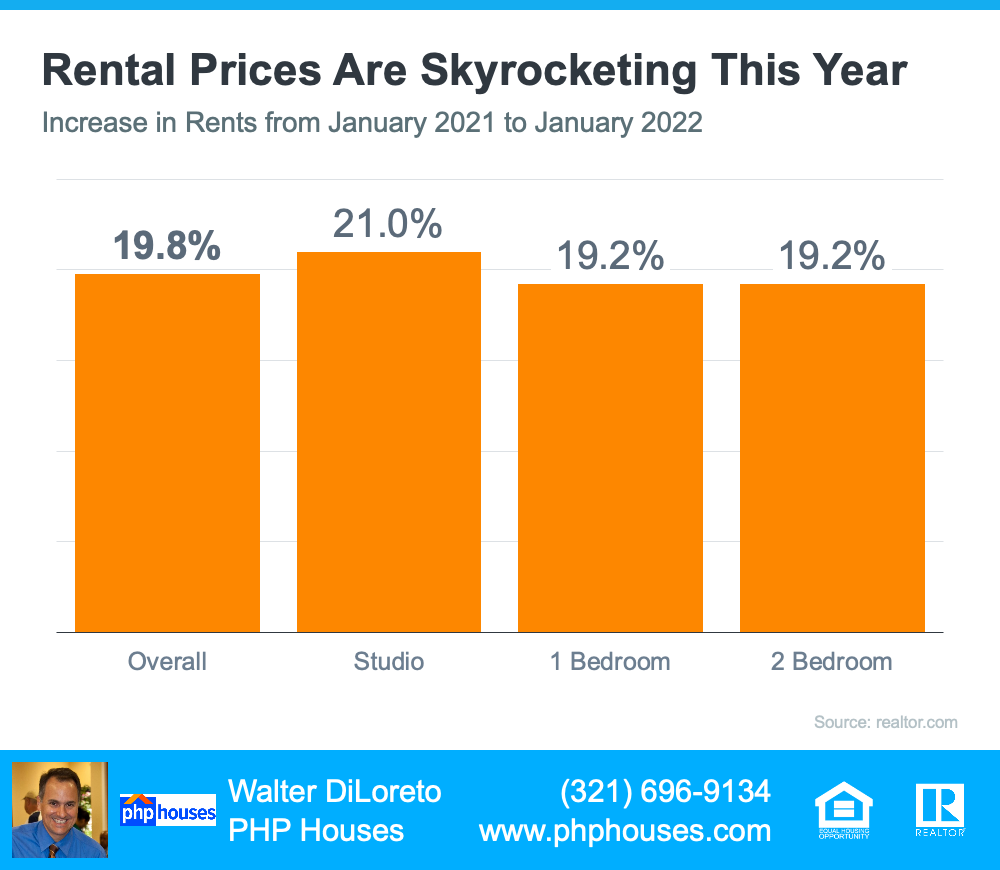

If rising home prices leave you wondering if it makes more sense to rent or buy a home in today’s housing market, consider this. It’s not just home prices that have risen in recent years – rental prices have skyrocketed as well. As a recent article from realtor.com says:

“The median rent across the 50 largest US metropolitan areas reached $1,876 in June, a new record level for Realtor.com data for the 16th consecutive month.”

That means rising prices will likely impact your housing plans either way. But there are a few key differences that could make buying a home a more worthwhile option for you.

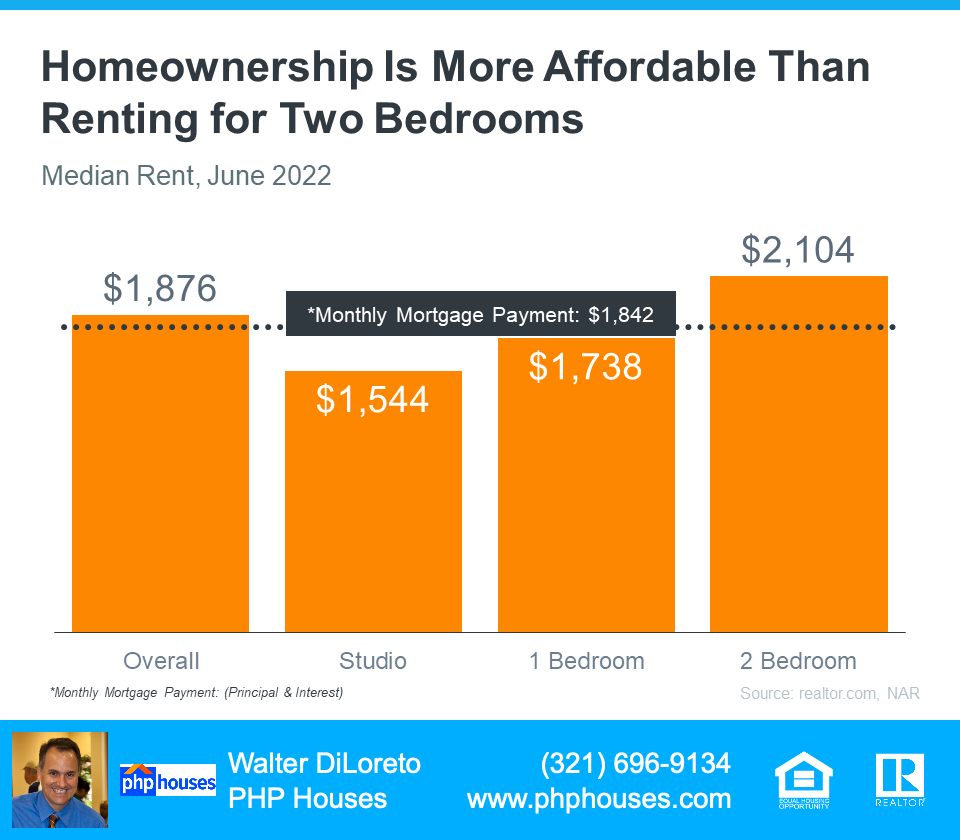

If You Need More Space, Buying a Home May Be More Affordable

What you may not realize is that, according to the latest data from realtor.com and the National Association of Realtors (NAR), it may actually be more affordable to buy than rent depending on how many bedrooms you need. The graph below uses the median rental payment and median mortgage payment across the country to show why.

Homeownership is More Affordable Than Renting or Two Bedrooms

As the graph conveys, if you need two or more bedrooms, it may actually be more affordable to buy a home even as prices rise. While this doesn’t take into consideration the interest deduction or other financial advantages that come with owning a home, it does help paint the picture that it may be more affordable to buy then rent for that unit size based on nationwide averages. So, if one of the factors motivating you to move is a desire for more space, this could be the added encouragement you need to consider homeownership.

Homeownership Also Provides Stability and a Chance To Grow Your Wealth

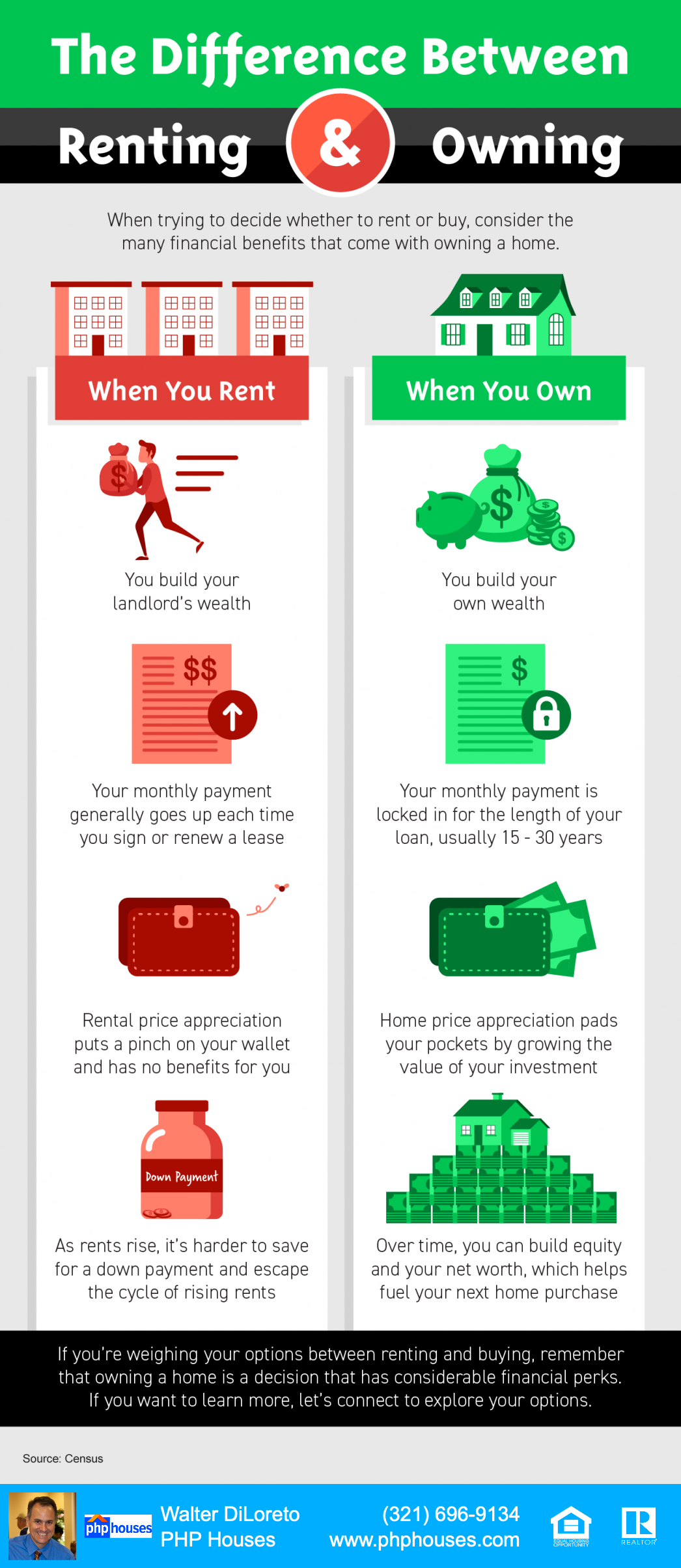

In addition to being more affordable depending on how many bedrooms you need, buying has two other key benefits: payment stability and equity.

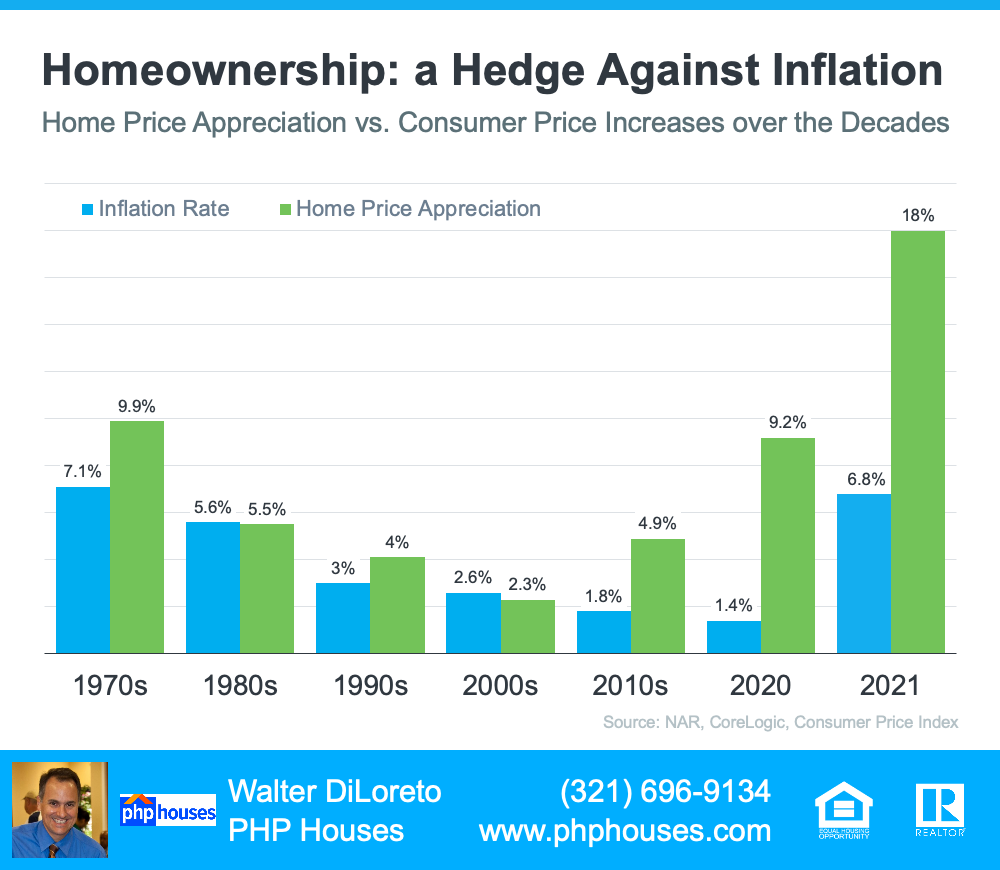

When you buy a home, you lock in your monthly payment with your fixed-rate mortgage. And that’s especially important in today’s inflationary economy. With inflation, prices rise across the board for things like gas, groceries, and more. Locking in your housing payment, which is likely your largest monthly expense, can provide greater long-term stability and help shield you from those rising expenses moving forward. Renting doesn’t provide that same predictability. A recent article from CNET explains it like this:

“…if you buy a house and secure a fixed-rate mortgage, that means that no matter how much prices or interest rates go up, your fixed payment will stay the same every month. That’s an advantage over renting since there’s a good chance your landlord will raise your rent to counter inflationary pressures.”

Not to mention, when you buy, you have the chance to build equity, which in turn grows your net worth. It works like this. As you pay down your home loan over time and as home values continue to appreciate, so does your equity. And that equity can make it easier to fuel a move into a future home if you decide you need a bigger home later on. Again, the CNET article mentioned above helps explain:

“Homeownership is still considered one of the most reliable ways to build wealth. When you make monthly mortgage payments, you’re building equity in your home that you can tap into later on. When you rent, you aren’t investing in your financial future the same way you are when you’re paying off a mortgage.”

Bottom Line

If you’re trying to decide whether to keep renting or buy a home, let’s connect to explore your options. With home equity and a shield against inflation on the line, it may make more sense to buy a home if you’re able to.

Contact us:

PHP Houses

142 W Lakeview Ave

Unit 1030

Lake Mary, FL 32746

Ph: (407) 519-0719

Fax: (407) 205-1951

email: info@phphouses.com

Let’s Connect:

Facebook

Linkedin

Twitter

Instagram

The information contained, and the opinions expressed, in this article are not intended to be construed as investment advice. The author does not guarantee or warrant the accuracy or completeness of the information or opinions contained herein. Nothing herein should be construed as investment advice. You should always conduct your own research and due diligence and obtain professional advice before making any investment decision. The author will not be liable for any loss or damage caused by your reliance on the information or opinions contained herein.