The Economic Impact of Buying a Home

The Economic Impact of Buying a Home

We’re in a changing real estate market, and life, in general, is changing too – from how we grocery shop and meal prep to the ways we can interact with our friends and neighbors. Even practices for engaging with agents, lenders, and all of the players involved in a real estate transaction are changing to a virtual format. What isn’t changing, however, is one key thing that can drive the local economy: buying a home.

We’re all being impacted in different ways by the effects of the coronavirus. If you’re in a position to buy a home today, know that you’re a major economic force in your neighborhood. And while we all wait patiently for the current pandemic to pass, there are a lot of things you can do in the meantime to keep your home search on track.

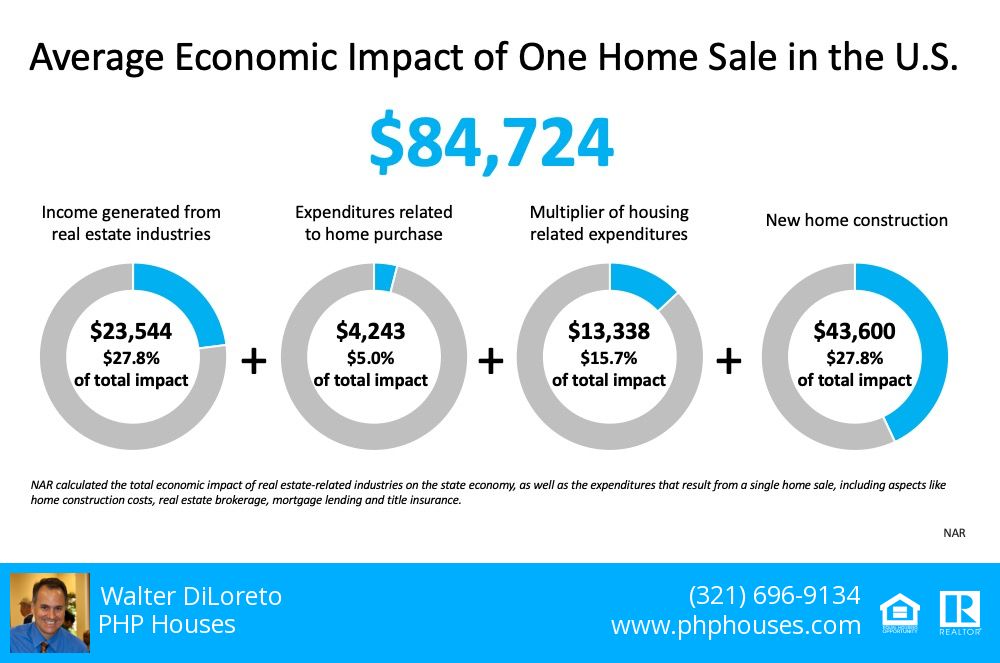

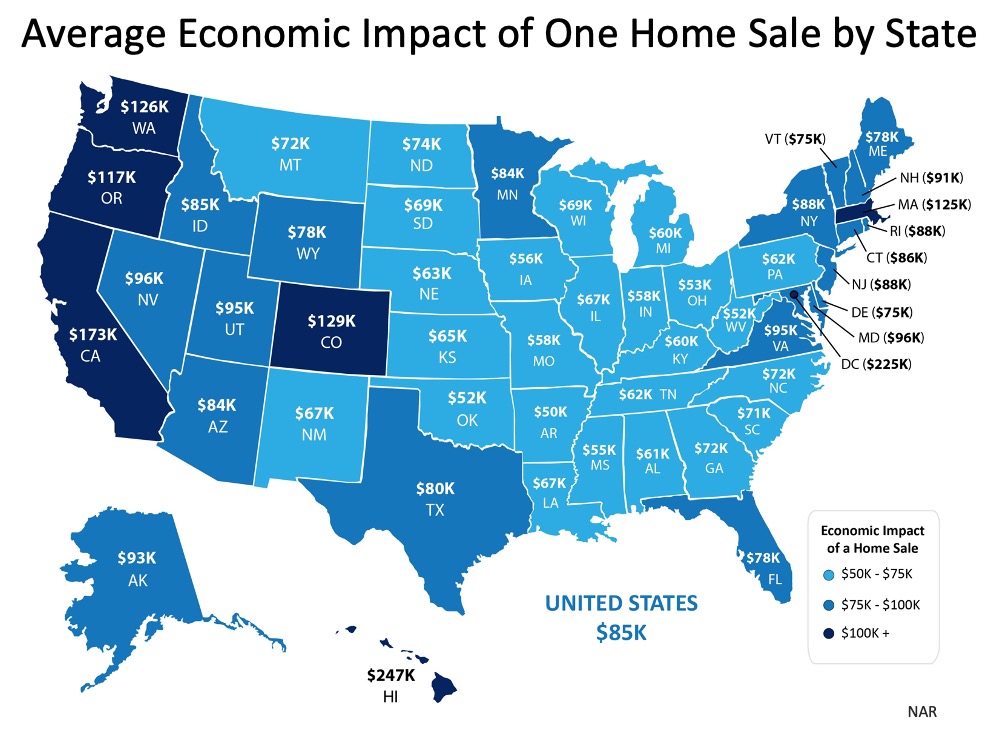

Every year the National Association of Realtors (NAR) shares a report that notes the full economic impact of home sales. This report summarizes:

“The total economic impact of real estate related industries on the state economy, as well as the expenditures that result from a single home sale, including aspects like home construction costs, real estate brokerage, mortgage lending and title insurance.”

Here’s the breakdown of how the average home sale boosts the economy:

Average Economic Impact of One Home Sale in the U.S.

When you buy a home, you’re making an impact. You’re fulfilling your need for shelter and a place to live, and you’re also generating jobs and income for the appraiser, the loan officer, the title company, the real estate agent, and many more contributors to the process. For every person or business that you work with throughout the transaction, there’s also likely a team behind the scenes making it all happen, so the effort multiplies substantially. As noted above in the circle on the right, the impact is almost double when you purchase new construction, given the extra labor it requires to build the home.

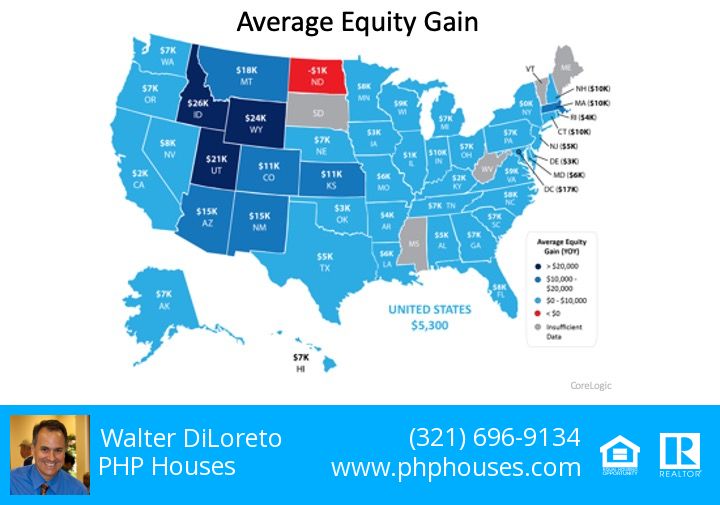

The report also breaks down the average economic impact by state:

Average Economic Impact of One House by State

As a buyer, you have an essential need for a home – and you can make an essential impact with homeownership, too. That need for shelter, comfort, and a safe place to live will always be alive and well. And whenever you’re able to act on that need, whether now or later, you’ll truly be creating gains for you, your family, local business professionals, and the overall economy.

Bottom Line

Whenever you purchase a home, you’re an economic driver. Even if you’re not ready or able to make a move now, there are things you can do to keep your own process moving forward so you’re set when the time is right for you. Let’s connect to keep your home search – and your local contributions – on track.

Contact us:

PHP Houses

142 W Lakeview Ave

Unit 1030

Lake Mary, FL 32746

Ph: (407) 519-0719

Fax: (407) 205-1951

email: info@phphouses.com

Let’s Connect:

Facebook

Linkedin

Twitter

Instagram

Seeking the help of third-parties is another way how to stop foreclosure in FL. Although homeowners have several options when stopping foreclosure, sometimes the process is too much for a single person. Enlisting the expertise of professionals will lessen your stress while providing a multitude of options for keeping your home. One option available to borrowers is contacting a foreclosure avoidance counselor. The

Seeking the help of third-parties is another way how to stop foreclosure in FL. Although homeowners have several options when stopping foreclosure, sometimes the process is too much for a single person. Enlisting the expertise of professionals will lessen your stress while providing a multitude of options for keeping your home. One option available to borrowers is contacting a foreclosure avoidance counselor. The  Many homeowners find themselves at risk for foreclosure after accruing a large amount of debt. They might think filing for bankruptcy is the simplest solution to escape their financial troubles. In some instances and with enormous debts, that can be true. However, if a homeowner isn’t keen on a lengthy litigation process and wants to halt the foreclosure process immediately, filing for bankruptcy might not be the best strategy for how to stop foreclosure in FL. Once an individual files the petition for bankruptcy, federal law prohibits debt collectors from seizing assets to pay off what’s owed. Since foreclosure is considered a collection activity, mortgage lenders must halt the foreclosure process. Once in court though, the bankruptcy trustee’s role is to play mediator between the filer and creditors, not absolve debt. Going through the courts will buy borrowers time to make past mortgage payments, but it won’t stop the foreclosure process completely. Filing for bankruptcy also has

Many homeowners find themselves at risk for foreclosure after accruing a large amount of debt. They might think filing for bankruptcy is the simplest solution to escape their financial troubles. In some instances and with enormous debts, that can be true. However, if a homeowner isn’t keen on a lengthy litigation process and wants to halt the foreclosure process immediately, filing for bankruptcy might not be the best strategy for how to stop foreclosure in FL. Once an individual files the petition for bankruptcy, federal law prohibits debt collectors from seizing assets to pay off what’s owed. Since foreclosure is considered a collection activity, mortgage lenders must halt the foreclosure process. Once in court though, the bankruptcy trustee’s role is to play mediator between the filer and creditors, not absolve debt. Going through the courts will buy borrowers time to make past mortgage payments, but it won’t stop the foreclosure process completely. Filing for bankruptcy also has  Although homeowners have several methods available to saving their property from repossession, some options are better than others.

Although homeowners have several methods available to saving their property from repossession, some options are better than others.